Good morning! Today we focus on the Trump administration and its various endeavors around the world - from Greenland to Iran.

Besides that we examine US GDP growth and take an industry specific case under consideration - it should be crucial to our sports betting fans.

Stay ahead of the game with out forward-looking morning brief!

Top Movers

#1 Arctic Escapades

As the pressure mounts on Denmark and Greenland, traders see a path forward, giving 34% chances of a del by the end of the quarter.

While we see end of March as a really tight deadline, in our opinion traders are on a right track - ultimately Denmark is a staunch ally of the US and will accommodate its wishes. But only after it takes something for itself; that's realpolitik.

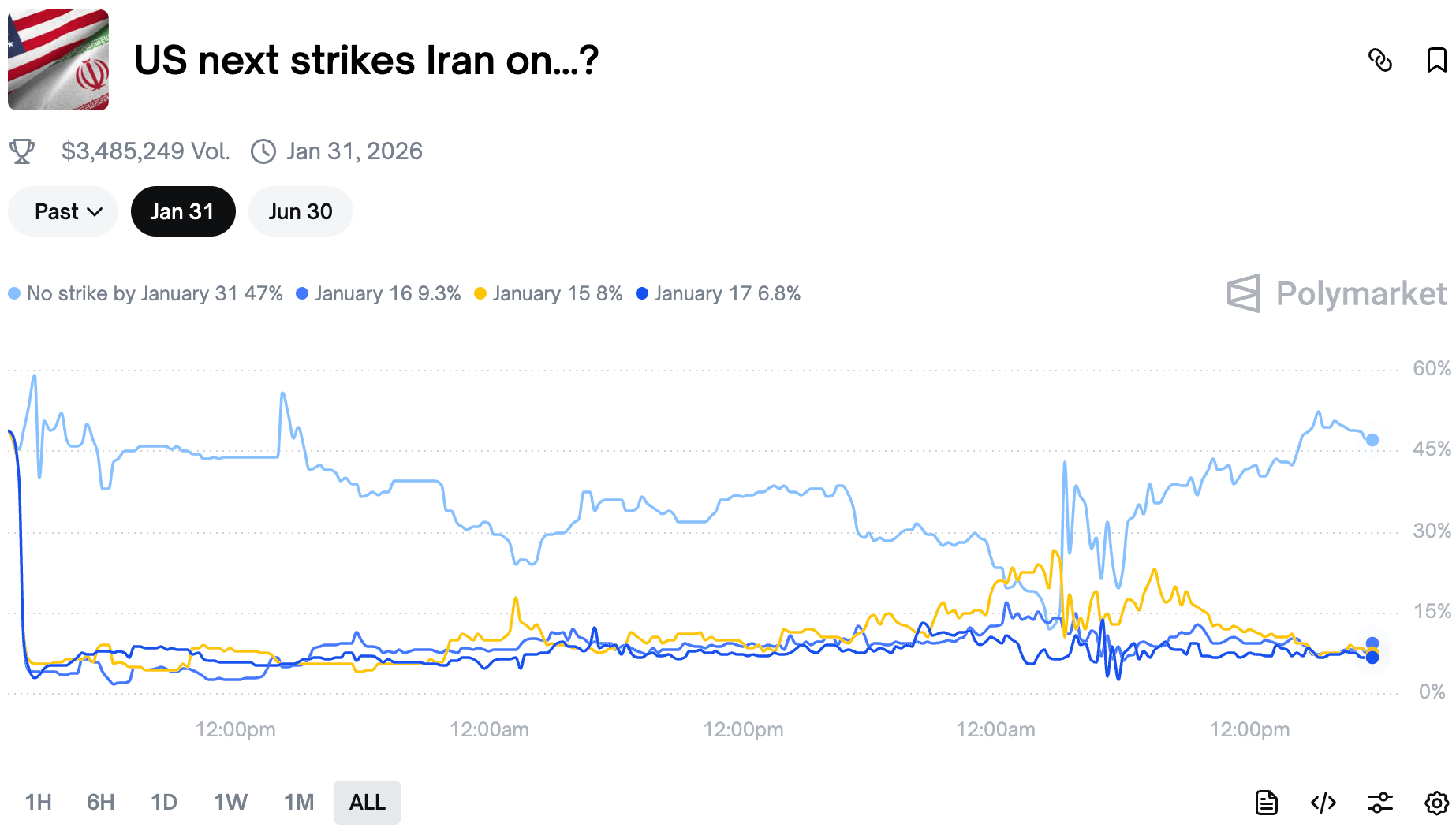

#2 Cold Feet

After an extremely bullish streak, traders are increasingly convinced there will be no US strikes on Iran by the end of the month.

The Trump administration has been threatening action for a while now, but all it managed to do is create an impressive confusion. Supposedly even senior European diplomats are confused.

We consider traders more sober than the masses, and now they are pulling back, inflating the no strike odds in the process - are they right? Or did they fall for the confusion tactic? We shall see soon enough.

#3 Truth vs Markets

Yesterday we learned that the Phase II of the Gaza ceasefire is live... or did we?

Traders initially sent the odds way higher, but then some sharps realized that the announcement doesn't meet the resolution criteria. It was not announced by both Israel and Hamas (yet). And it is not implemented, yet. Any of the two happen ,the market can resolve. But for now it seems that the Phase II of the Gaza ceasefire is a mirage ;)

#4 Moderately High

After a small bump, traders now expect to see the US GDP growth for 2025 at 2.0-2.5% range.

The highest bracket on the market started to rise after Atlanta Fed GDPNow estimate forecasted 5.3% GDP growth for Q4 2025. But the market is about the whole 2025, and estimation is more nuanced than taking an average of Q1-Q4 rates. We guess some traders are in for a surprise.

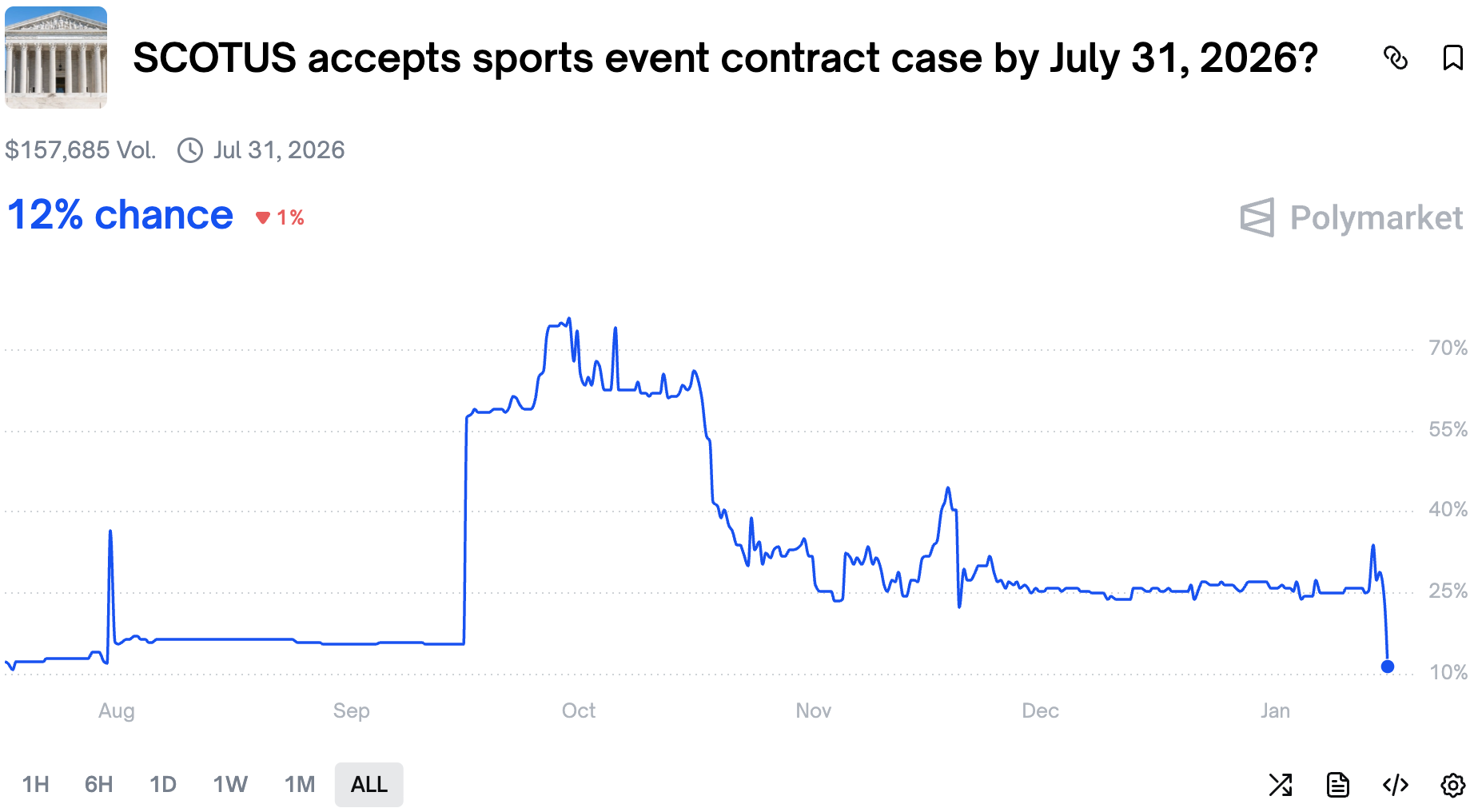

#5 Sports Event Contract Case Unclear

For some reason, the odds on SCOTUS accepting sports event contract case dropped significantly.

We didn't find any news that could explain the sudden odds movement - we will be on the lookout for any news around the topic as it is important for our industry!

Wrap up

That’s all for today - did you catch any of the moves? See you tomorrow for another Morning Brief!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.