Good morning! We are looking at a busy day as we are awaiting the new Fed chair announcement as well as news around government shutdown.

We showcase both markets while adding a commentary on Ukraine, TrumpRX as well as measles development in the US.

Stay ahead of the game with out forward-looking morning brief!

Top Movers

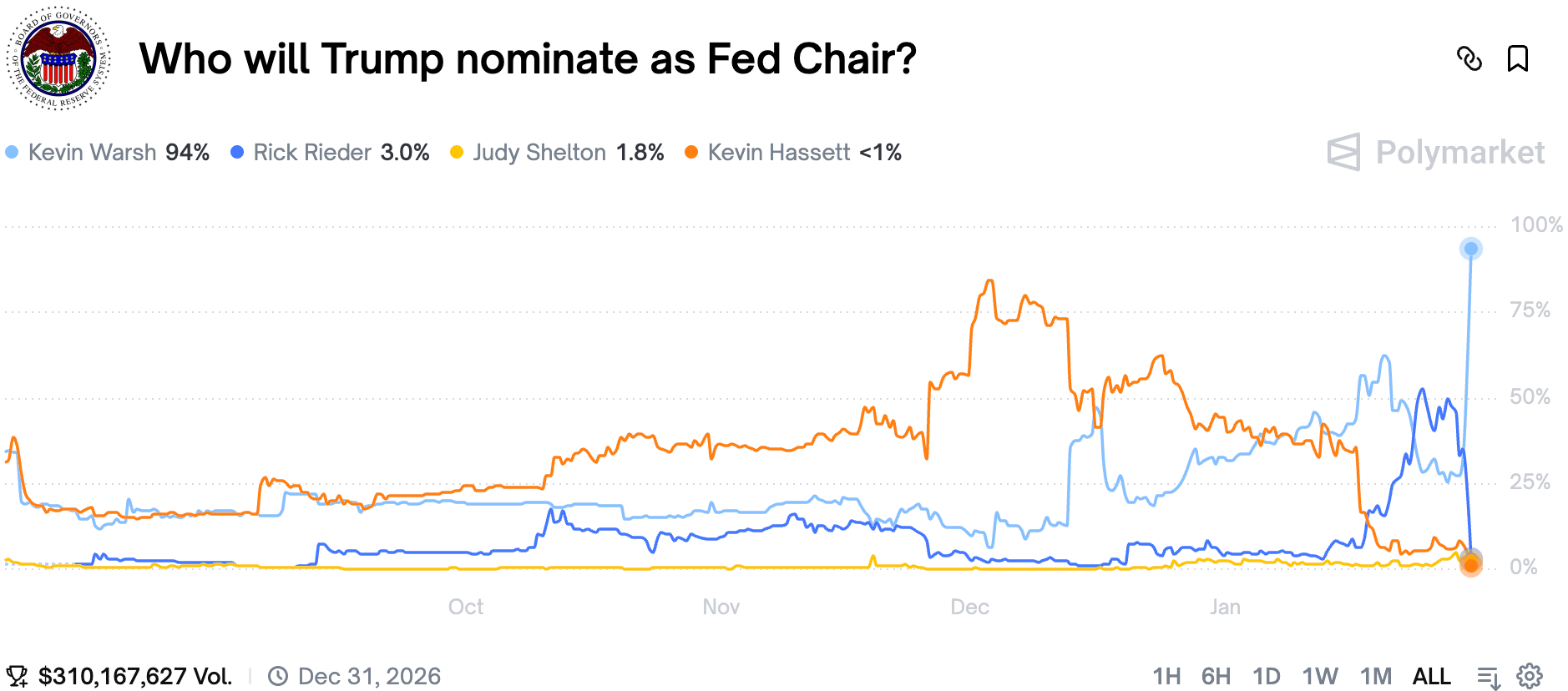

#1 Kevin Warsh Projected As The New Fed Chair

After months of keeping everyone on edge, Trump is apparently ready to announce his Fed chair pick.

Sharp traders started buying Warsh on the announcement, which was later followed by a flurry of reporting that Warsh is the apparent winner. While keen on cutting rates, Warsh didn't always see eye to eye with Trump when it comes to Fed actions. It is surely shaping up to be an interesting year at the Fed.

#2 Shutdown Thriller

The shutdown market has been a real roller-coaster as there was hope twice in a single day that a deal might be reached before the deadline.

But apparently the Senators refused to schedule the second vote early, paving a way for a short shutdown as Chuck Schumer said there is a bipartisan deal. If the situation continues without any major hiccups we can call it a "technical shutdown" rather than a real problem.

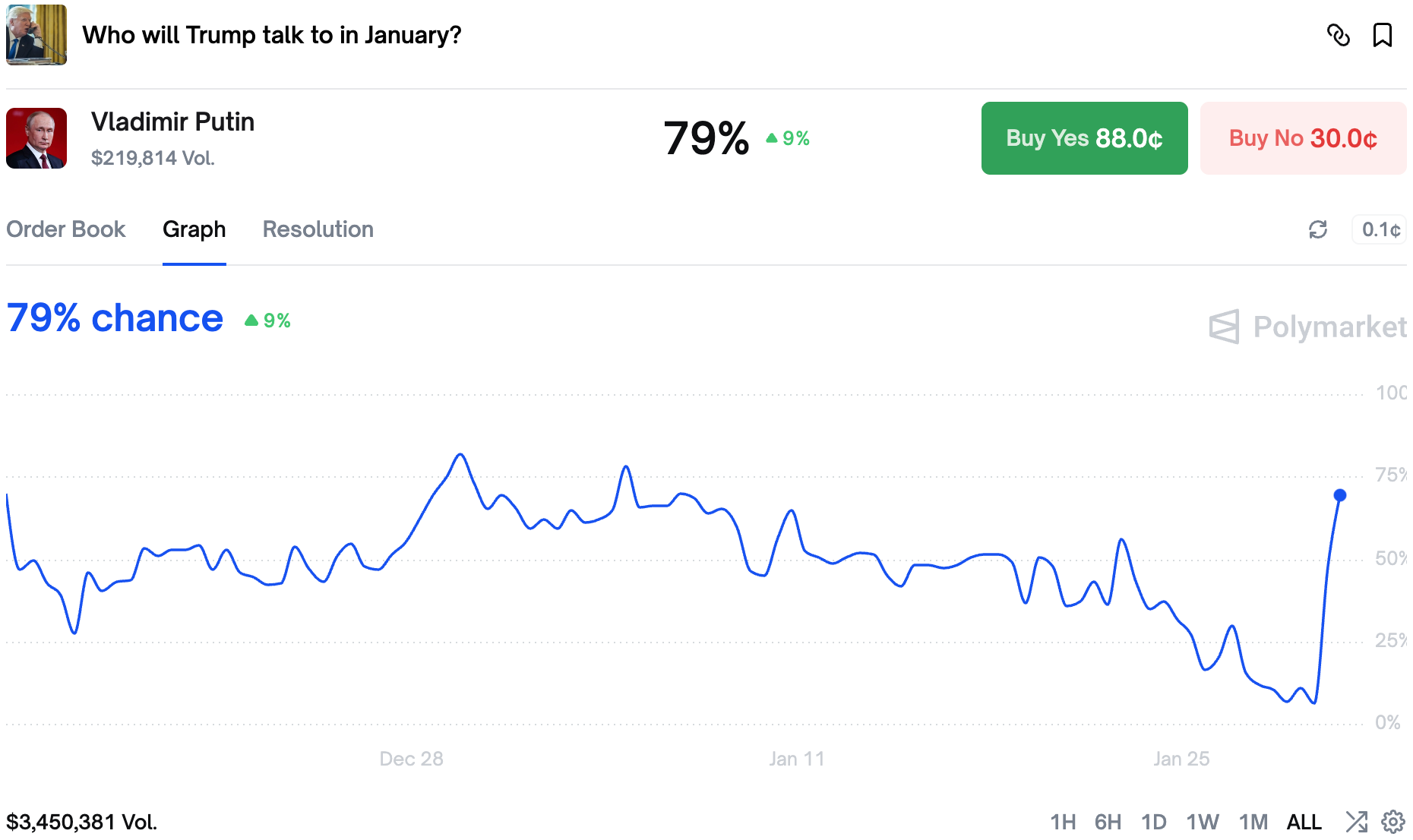

#3 Conversations Among Friends

It seems that Trump has indirectly admitted he recently talked with Putin.

During a press conference Trump mentioned that he personally asked Putin to stop the strikes on Ukraine due to cold. While it is short of an official conversation confirmation, the implication is clear.

Ukraine though remains skeptical the air ceasefire will hold (if we can even call it that).

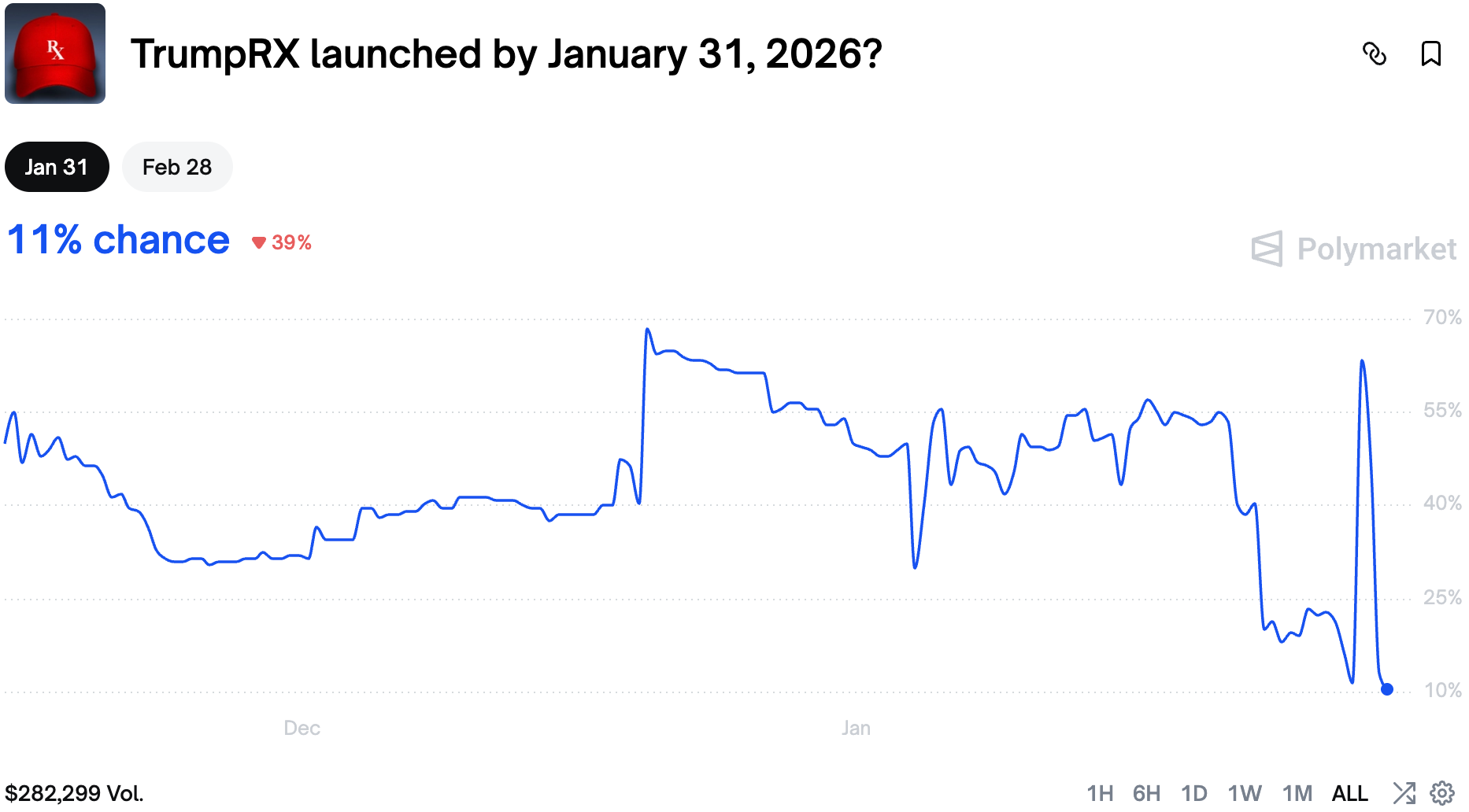

#4 TrumpRX Pump & Dump

Traders were anxious to hear about TrumpRX, perhaps too much so.

The market on the webpage going live this month pumped from 11% to almost 70% chance on the mystery Oval Office announcement yesterday. However it turned out Trump focused on other things and then ended the whole thing abruptly.

#5 Measles February Projections

Polymarket now expects just under 1,000 measles cases in February.

The new market for February was just launched and it already shows volatility. Initially traders expected over 1,000 cases, but there was a sharp downswing as some trader tempered market's expectations.

At the same time, Metaculus forecaster also adjusted their yearly forecast, now expecting only half the cases Polymarket is expecting for the year!

Wrap up

That’s all for today - did you catch any of the moves? See you tomorrow for another Morning Brief!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.