Good morning! Trump surprised us all (including Zelensky it seems) as we are learning about his 28-point peace plan for Ukraine. We are taking a short look to determine what we should expect in the next 2 days here.

Additionally we are taking a look at Gaza (literally!), stocks and crypto drawdowns, forecasts on an AI bubble and a new prediction market in the US.

Stay ahead of the game with out forward-looking morning brief!

Top Movers

#1 Ukraine Peace Is Back On The Menu

Amid a surprise announcement traders are trying to reprice Russia x Ukraine ceasefire odds.

After Axios dropped a story about a 28-point peace plan for Ukraine, the whole world seems to be scrambling to respond to it. The plan has some interesting points as well as ones that would be difficult for both sides to accept. Today we are awaiting some comments from European leaders that will take part in a call with Zelensky. For now we only know that they were surprised to learn about the plan.

#2 A Peek Inside Gaza

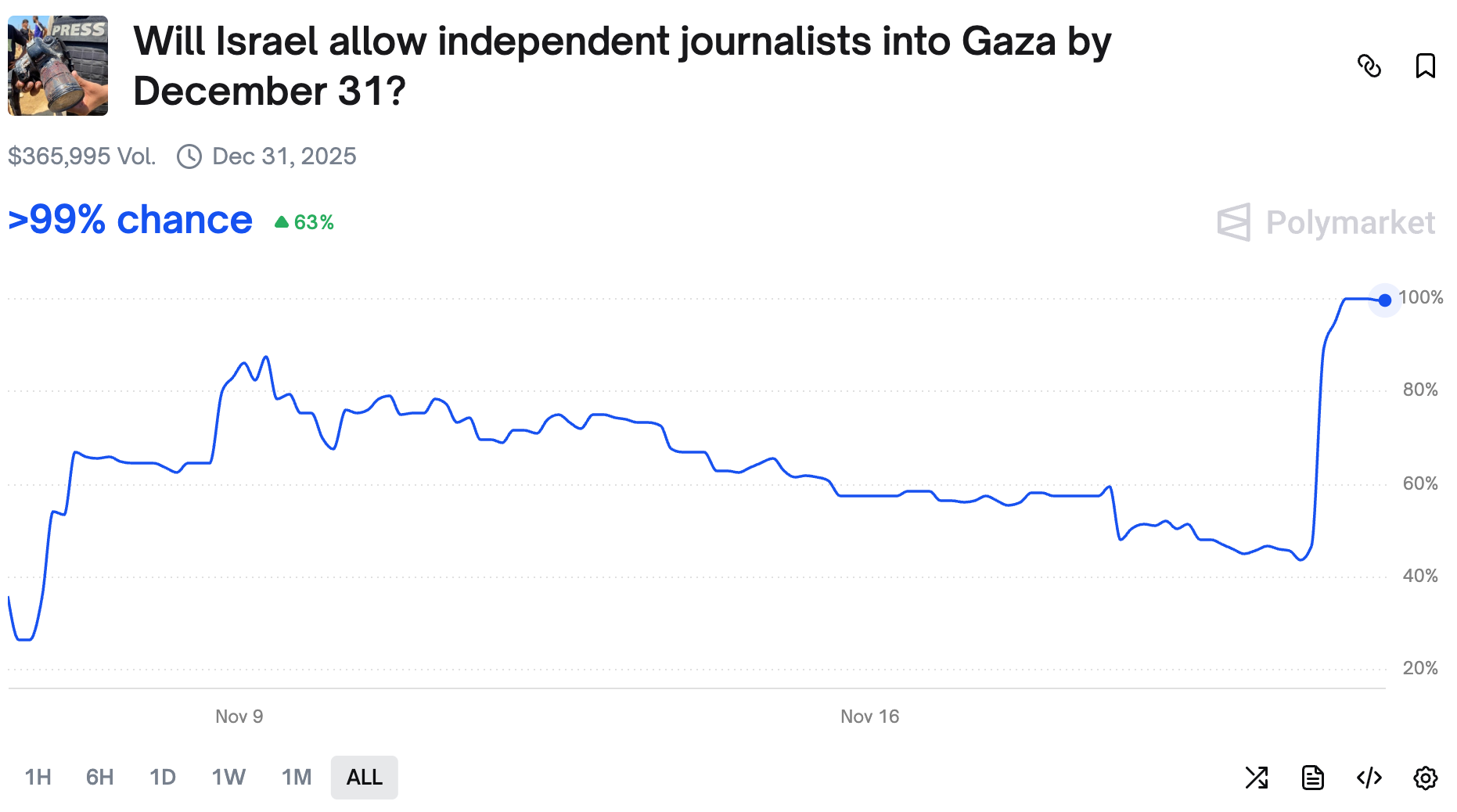

We had a surprise movement on Israel allowing independent journalists into Gaza by the end of the year market.

Traders noticed that 10 French journalists were able to enter Gaza to report on current situation there. Despite being escorted by the IDF and having essentially no freedom of movement, the action sufficed to satisfy the rules. You can read the report here.

#3 Traders Expect A Sustained Drawdown On The Stock Market

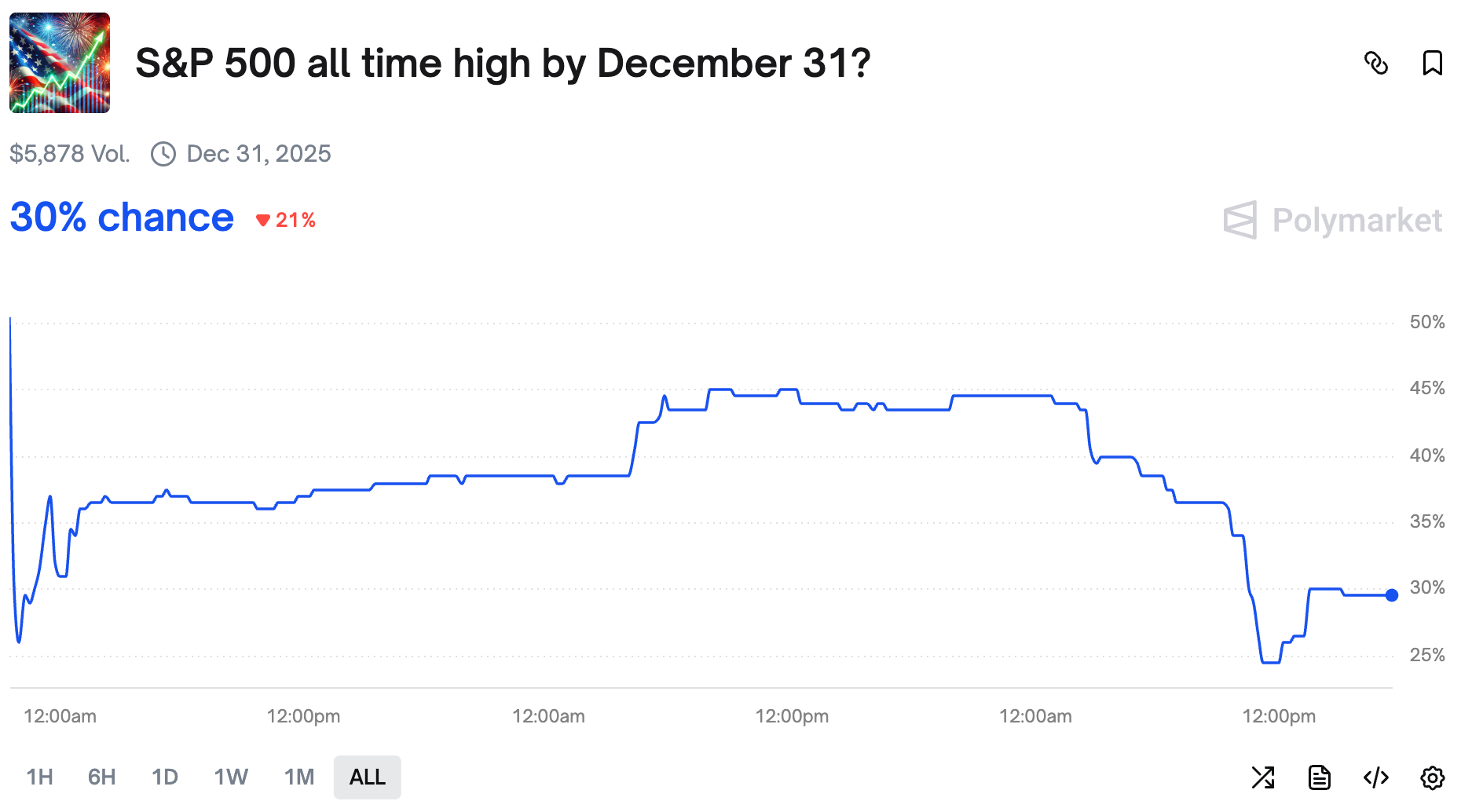

As S&P500 continues its plunge, traders are no longer confident we will see another ATH this year.

For a few days now, all kinds of assets, from crypto to stocks, are massively in the red. Fueled by AI bubble worries, no Fed rate cut rumors and Japanese Yen situation, it seems that we have a strong combination of downward forces to prevent new highs this year.

Oh and we even had Michael Burry present a new big short.

#4 AI Bubble And A New Type Of Market

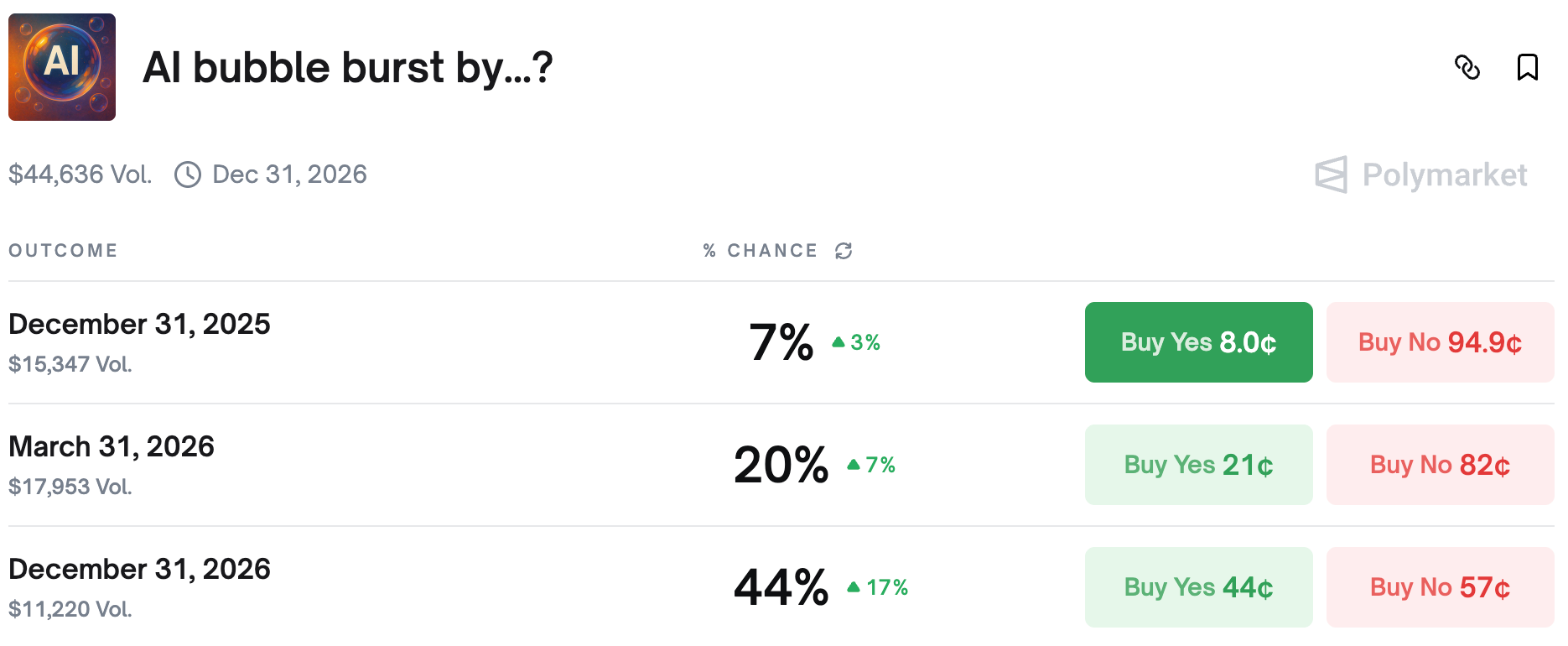

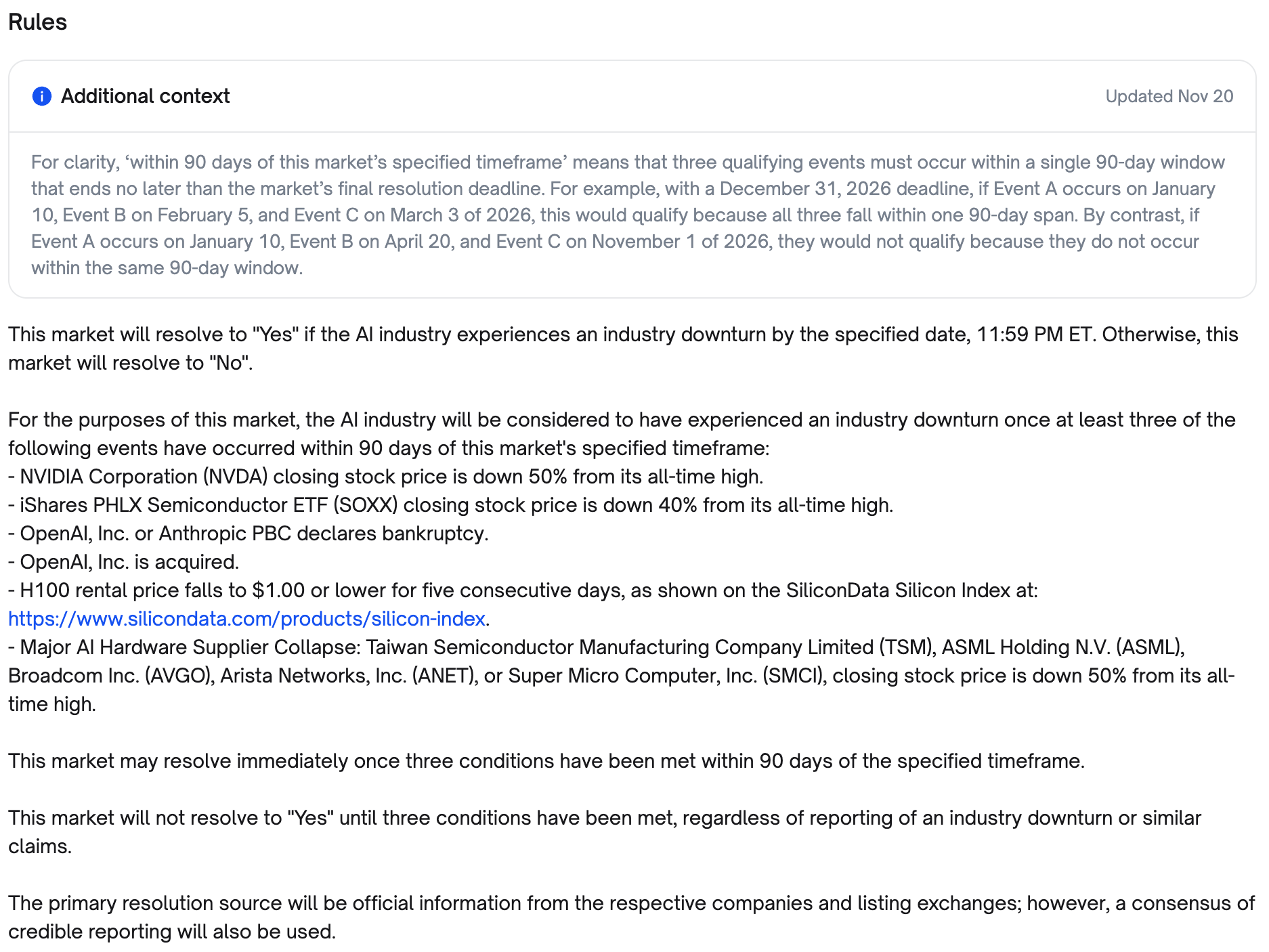

Speaking of bubbles, we now have the market with odds of a bubble bursting.

This new type of market has interesting rules. They require that at least 3 out of listed events must happen in a 90-day window to satisfy conditions for a Yes resolution. We hope to see more "conditional markets" in the future as they present a unique way to forecast and have exposure to more complex events.

Maybe ceasefire markets should also be structured in such a way...

#5 All In On Prediction Markets

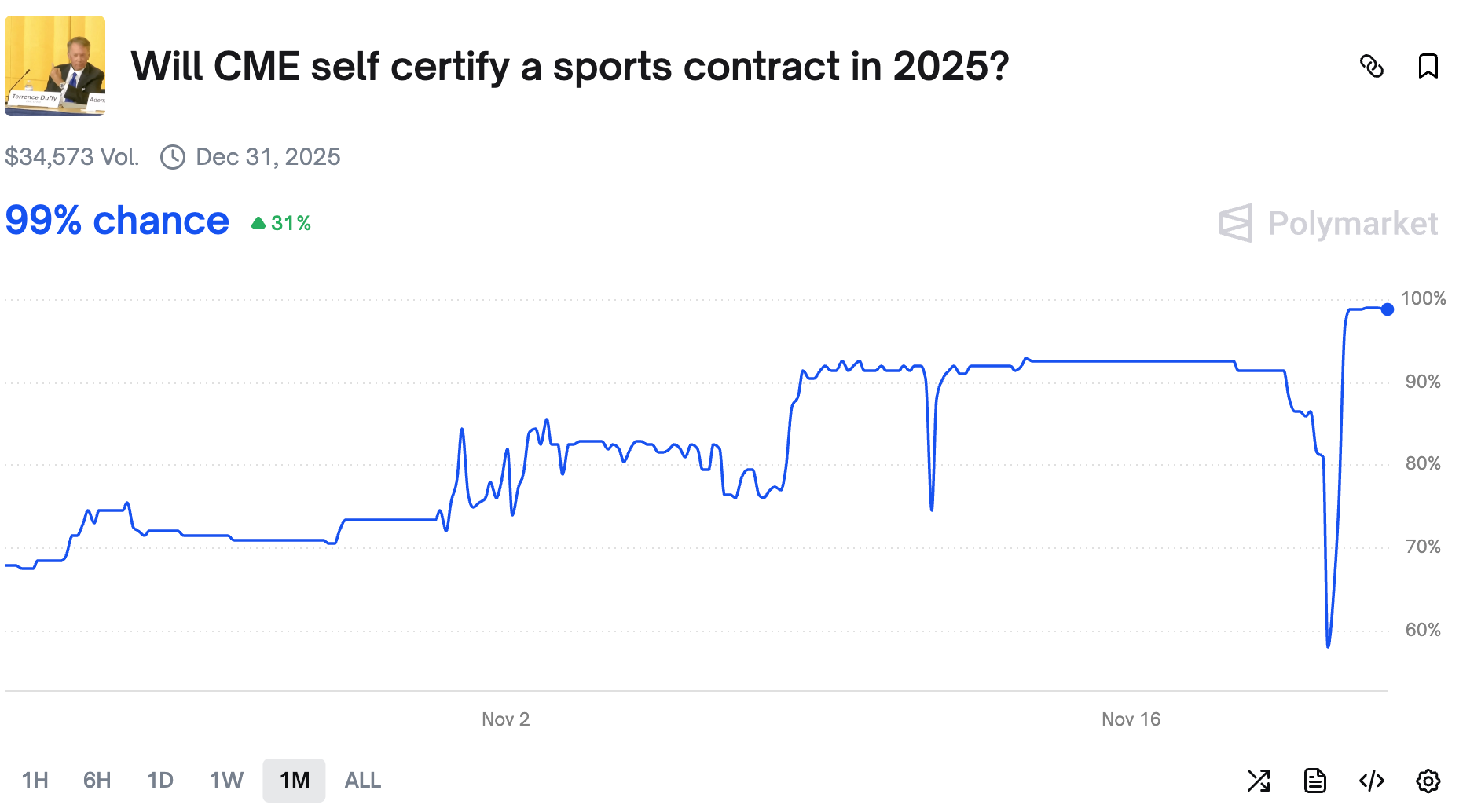

After Polymarket and Kalshi had enormous success with prediction markets, more players are entering the space.

We've already mentioned that DraftKings is looking to launch their own prediction market this year. Now it seems that FanDuel along with CME Group have already launched their product. And what is especially interesting about this market is that we had a price drop below 60c for Yes, after CME self certified first markets!

Additionally both DraftKings and FanDuel officially left American Gaming Association, showing that they aim to bet on prediction markets trumping the original sportsbook model in the US.

Wrap up

That’s all for today - did you catch any of the moves? See you tomorrow for another Morning Brief!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.