Good morning! For some time now Trump isn't doing great - now his flagship trials against Letitia James and James Comey are in danger. But between all the foreign affairs developments, no one might notice.

Outside of domestic politics, we are looking at an information drought regarding Venezuela, developments in Ukraine and the Fed, which finally is giving us some directions regarding the next decision.

Stay ahead of the game with out forward-looking morning brief!

Top Movers

#1 Failed Revenge

Traders were wise to expect the Comey trial to never happen.

It's not only Comey - Letitia James is also spared trial (for now). The judge dismissed both cases due to the prosecutor being illegally appointed. A cunning catch, but something tells us it might not be the last chapter in this story.

#2 Venezuela Strikes - Signal vs Noise

Traders anxiously await any news on Venezuela as a single Trump post swings the odds dramatically.

After the official designation of Cartel de los Soles as a terrorist organization, Axios reported that Trump might be ready to talk to Maduro, and that the phone conversation "is in the planning stages". What we see here is that traders must be starved for information if such a poor leak forces the Yes price 30c down.

FYI: Phone calls are easy to schedule, an average assistant schedules several on a daily basis. "Planning stages" means that backdoor communication channels are open, but failed to produce any tangible results.

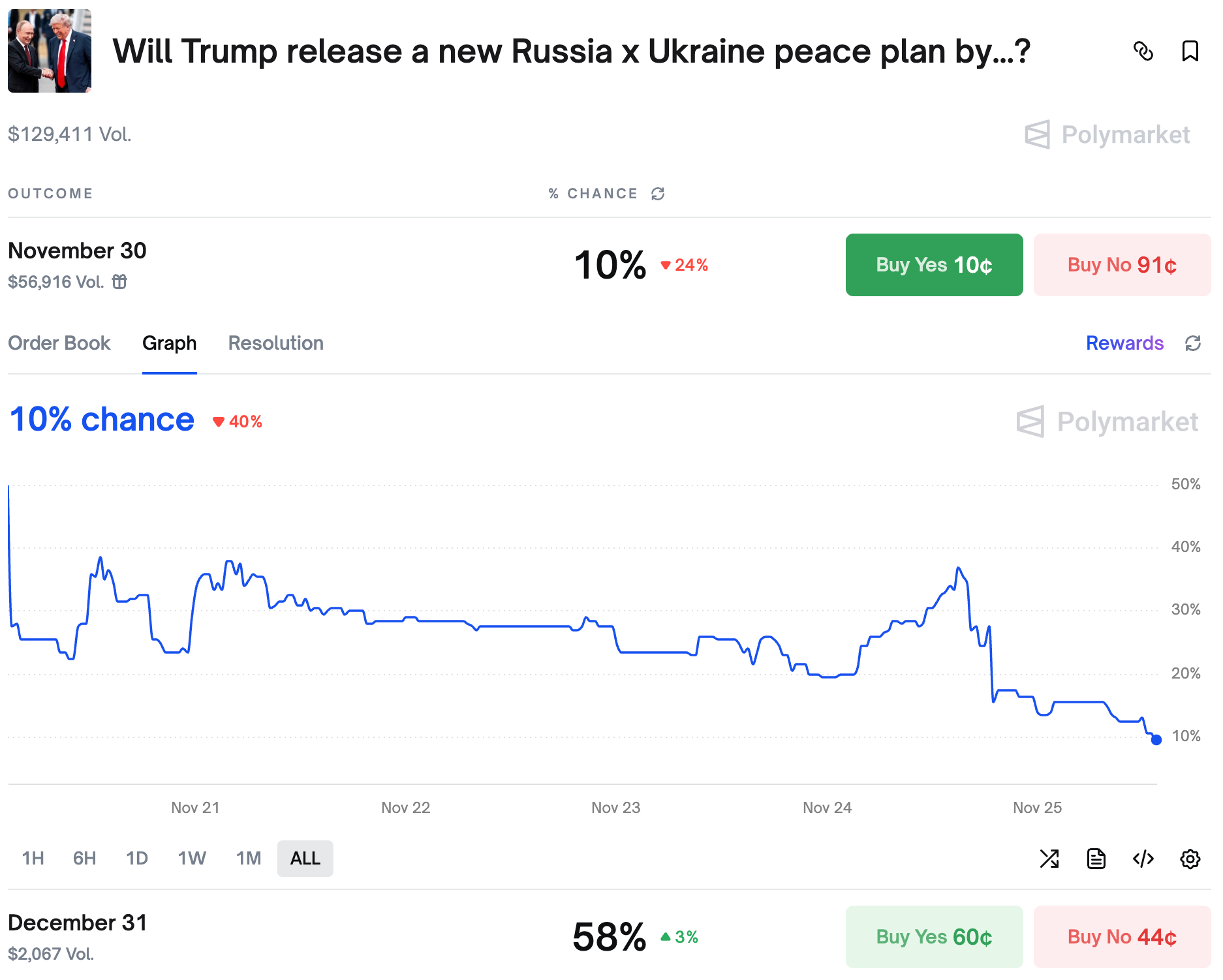

#3 New Peace Plan For Ukraine?

Not only backdoor diplomacy fails - the one out in the open doesn't seem to work either.

Traders are increasingly bearish on a new Ukraine peace plan being presented this month, and put only 58% chance to see it by the end of the year. After the 28-point plan drama, the US and Ukrainian delegations started to work on a new framework and all signs point to it being another nothingburger.

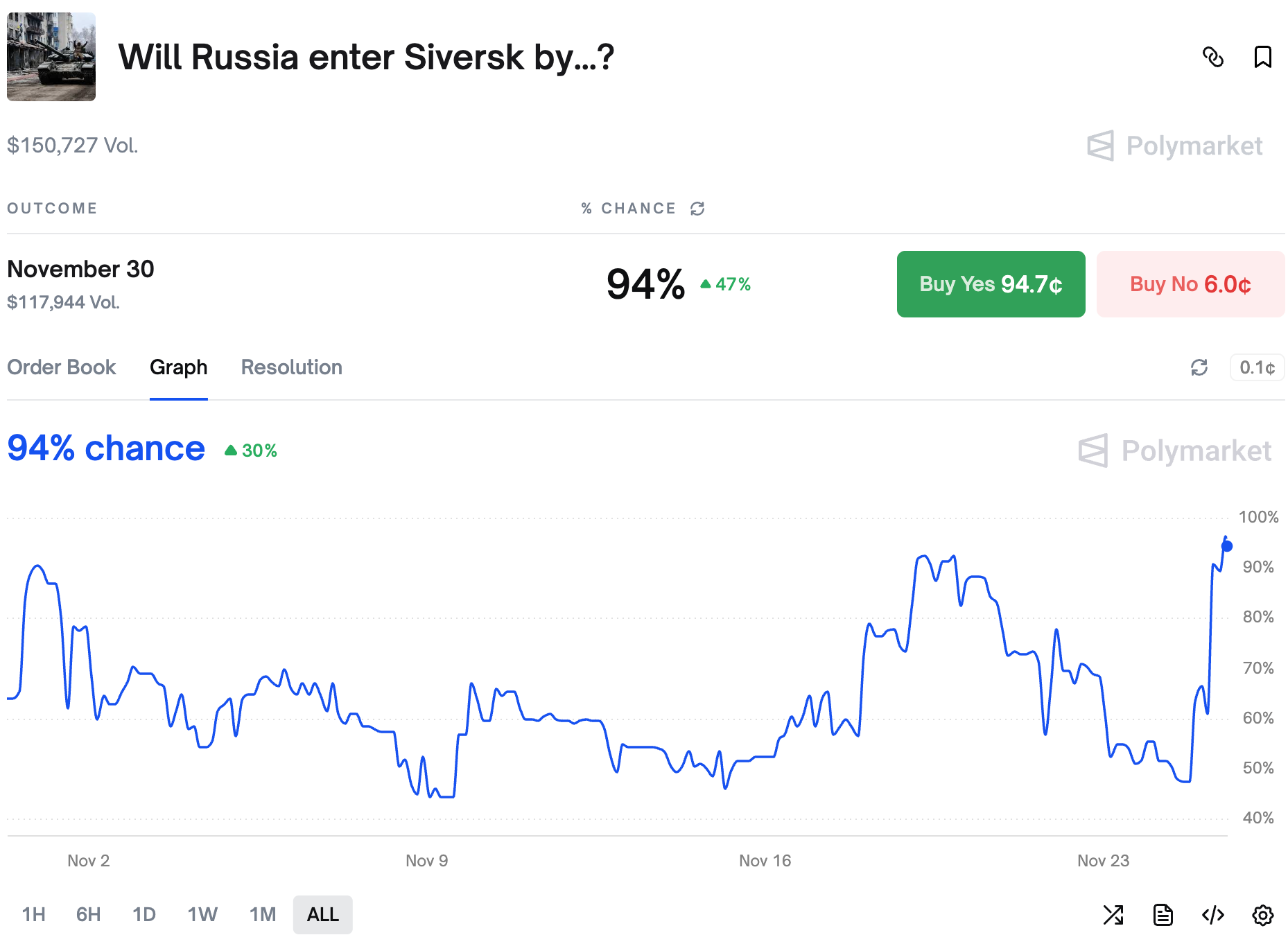

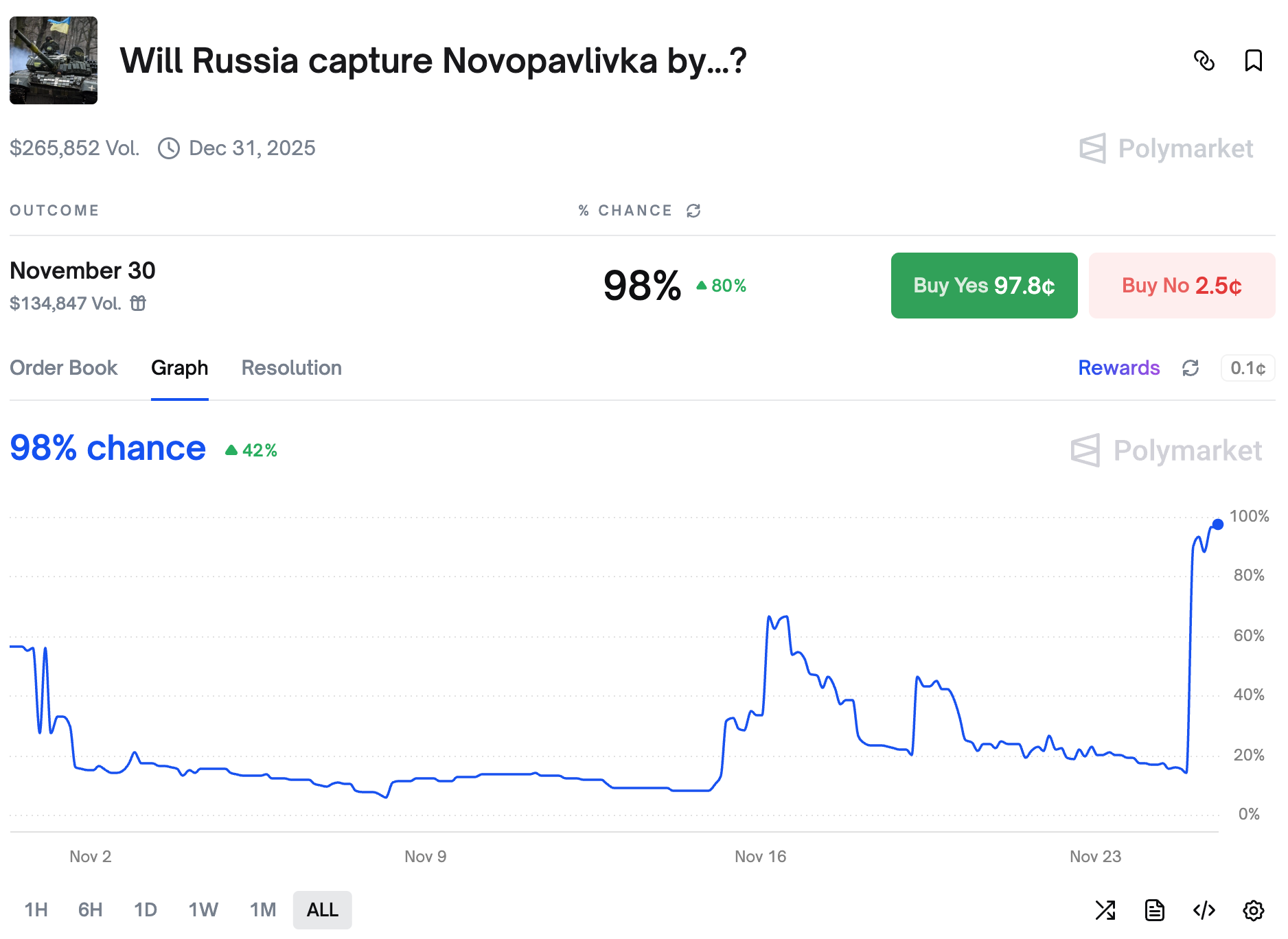

#4 Russia Gains Ground In Ukraine

Especially since we are seeing Russian gains.

Traders got surprised twice as Russia is looking to enter Siversk and capture Novopavlivka by the end of the month now:

Looking at first breakthroughs in a while, combined with an anticipated harsh winter, Russia should be inclined to continue at least till March to see how much pressure it can actually apply now that the conditions are turning in their favor.

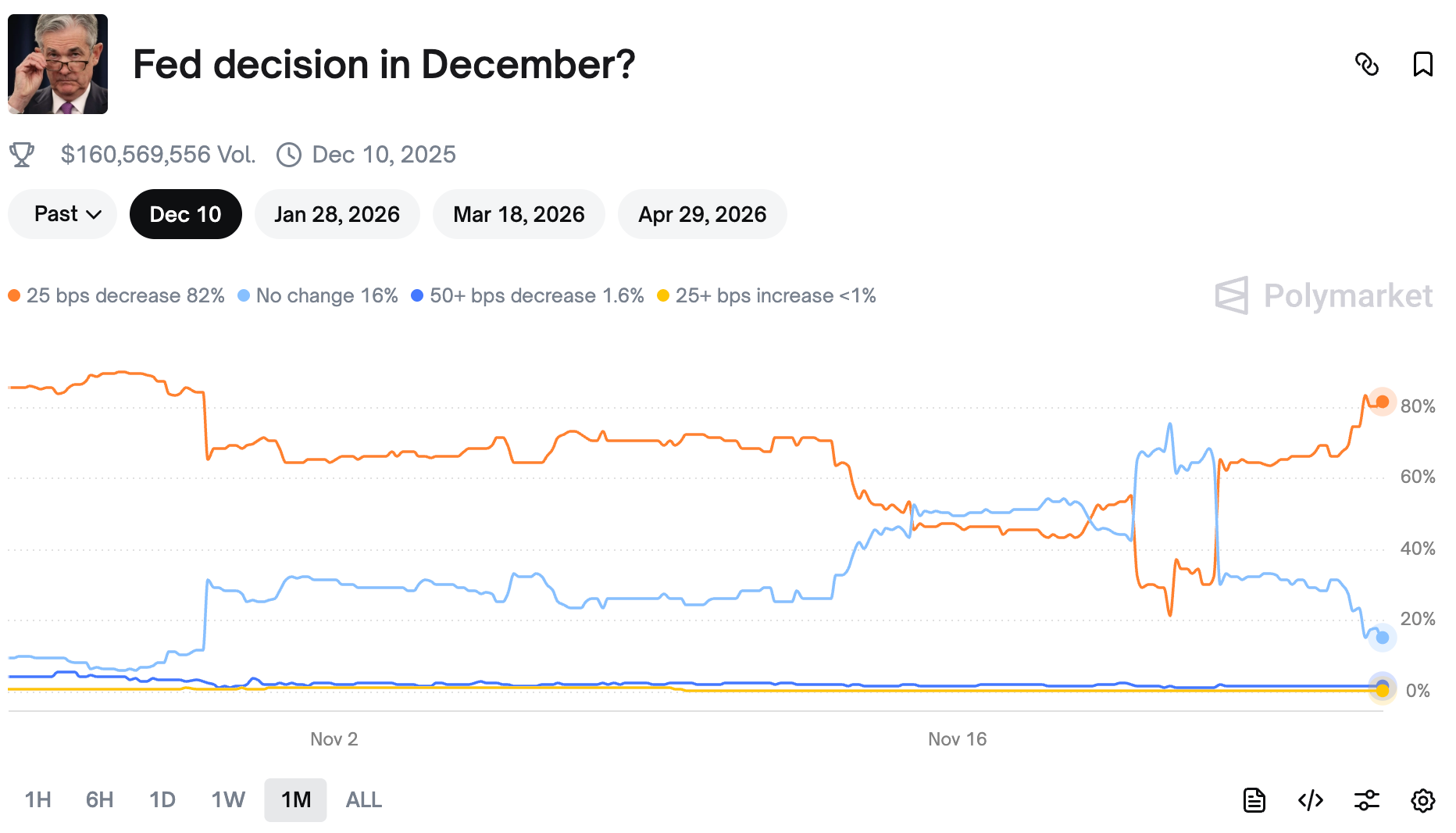

#5 Fed Rate Cut Is Back On Track

The Fed rate markets are recently extremely volatile, with the December rate cut resembling September uncertainty.

However traders now feel more and more comfortable with a 25 bps cut. Our Fed oracle delivered two articles (here and here) strongly suggesting that the Fed will go the cut way. When faced with a potential recession, seemingly no one really cares about inflation.

Wrap up

That’s all for today - did you catch any of the moves? See you tomorrow for another Morning Brief!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.