Good morning! Whatever moves the world, moves prediction markets, so our top topic today focuses on Ukraine. In foreign affairs we also take a look at the dire situation in Gaza as it struggles in a fragile peace.

Domestically we focus on the race for the next Fed Chair as the Trump administration is starting the usual public contest. We also present a new derivative market on the Fed rate decision.

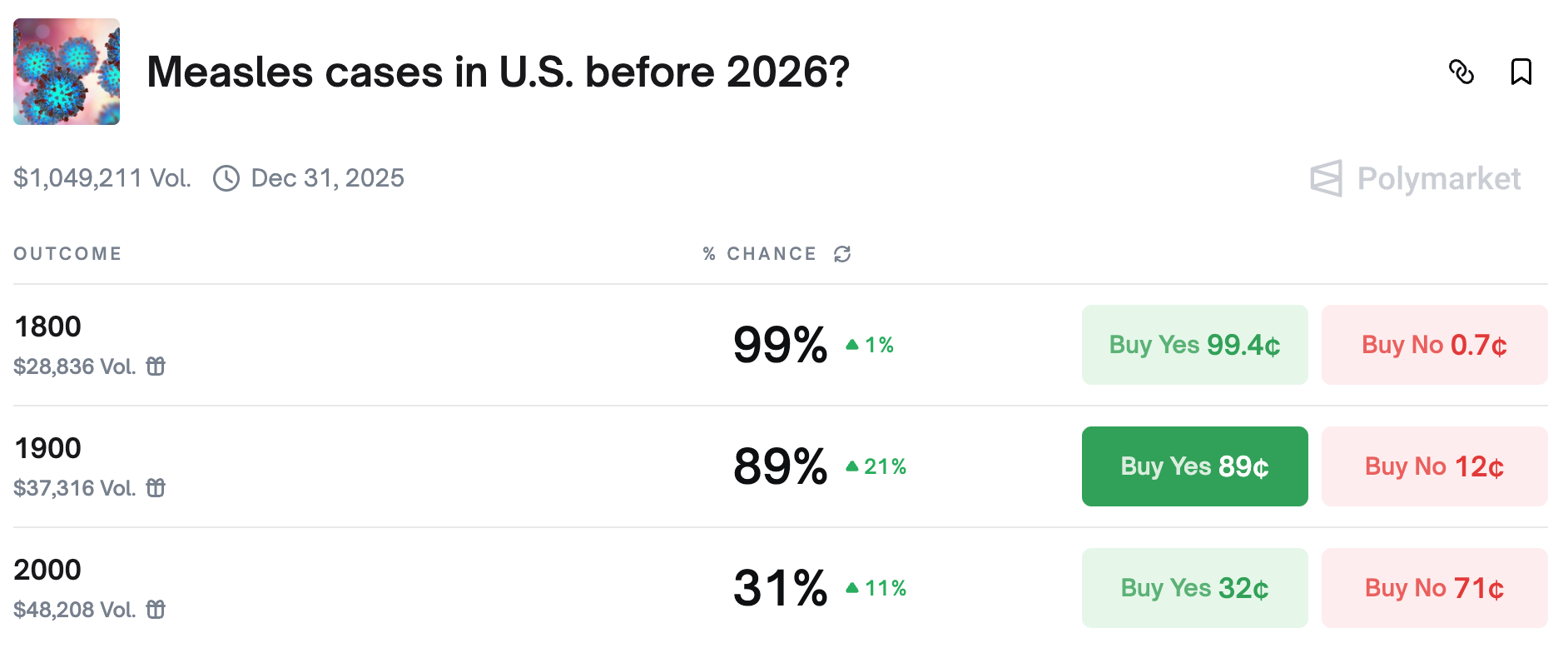

Lastly we come back to Measles as both traders and forecasters are moving their predictions above a key threshold.

Stay ahead of the game with out forward-looking morning brief!

Top Movers

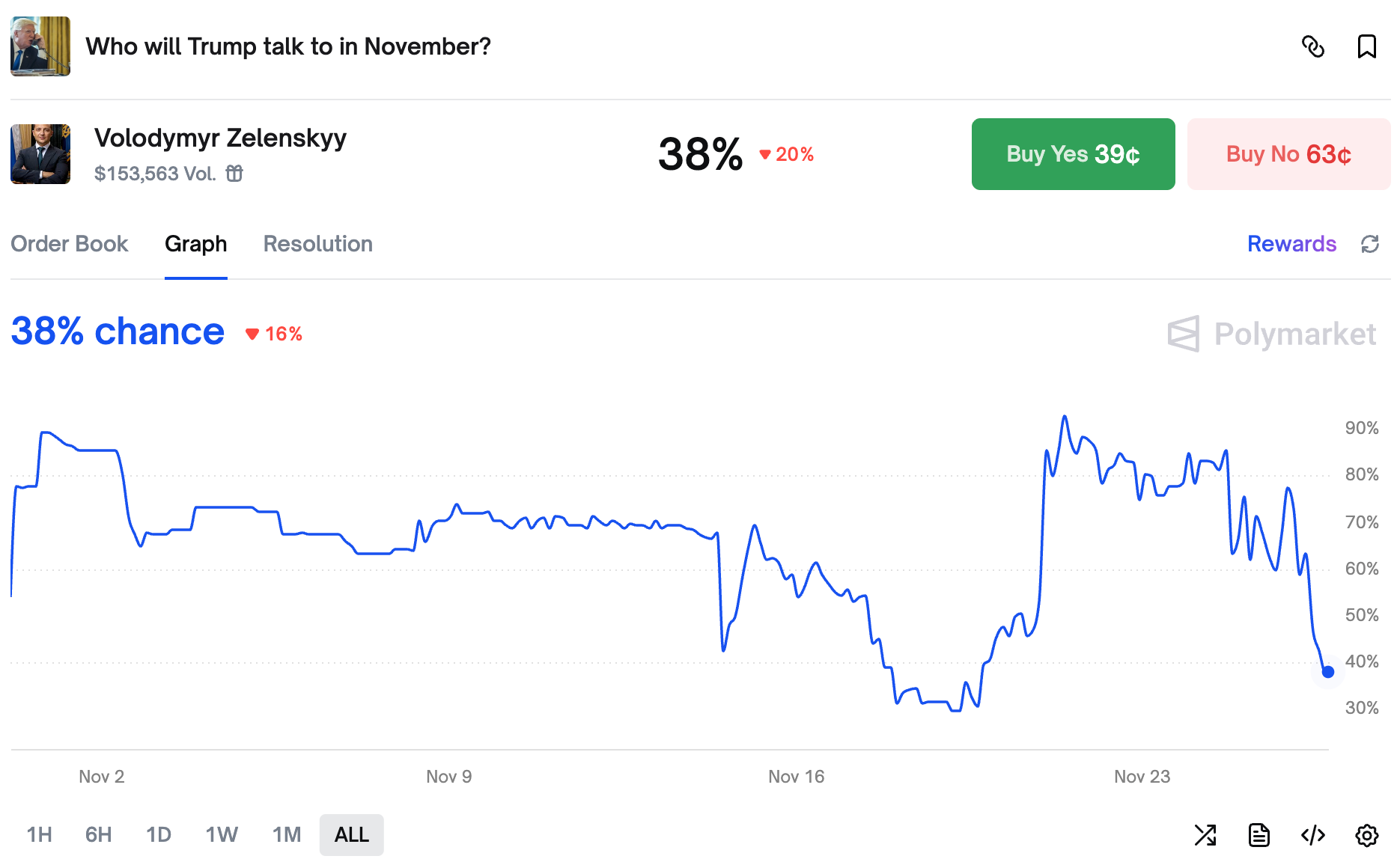

#1 Zelensky Is Not Welcome

Just a couple of days ago traders were sure Zelensky will meet and talk with Trump.

The momentum was building as the peace plan was moving ahead - the Geneva talks, Zelensky's willingness to come to Washington to sign the deal, all looked great. However Trump ended the party when he said he will meet with Zelensky or Putin only if there is a strong chance the peace will go through.

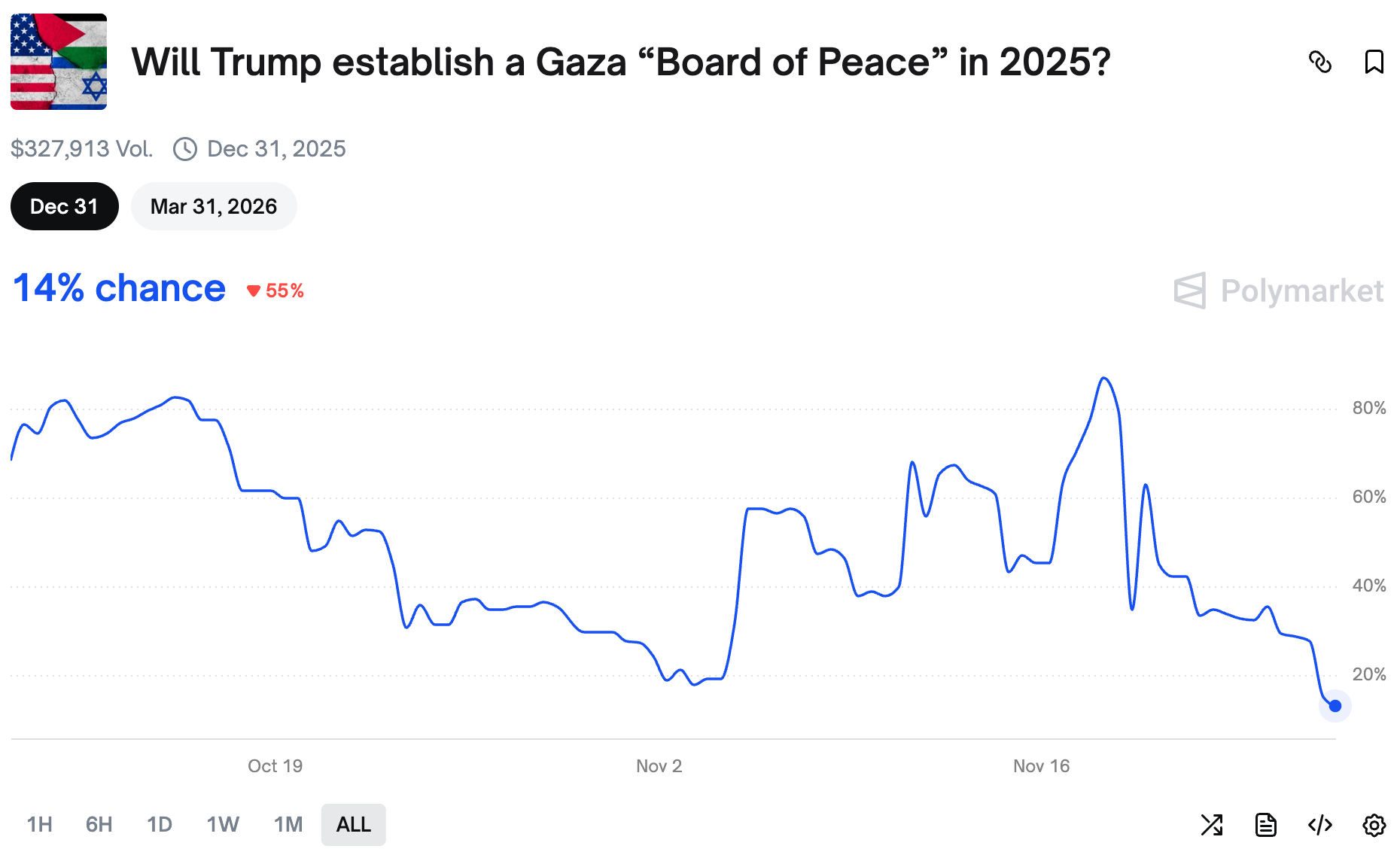

#2 Middle East Woes

Looks like Trump's plan of establishing a Board of Peace is not going very well.

After the UN resolution passed, traders realized a lot must happen before the market can resolve to Yes. And it will be a difficult process as Hamas and Israel still can't come to an understanding of how the post-war Gaza will look like.

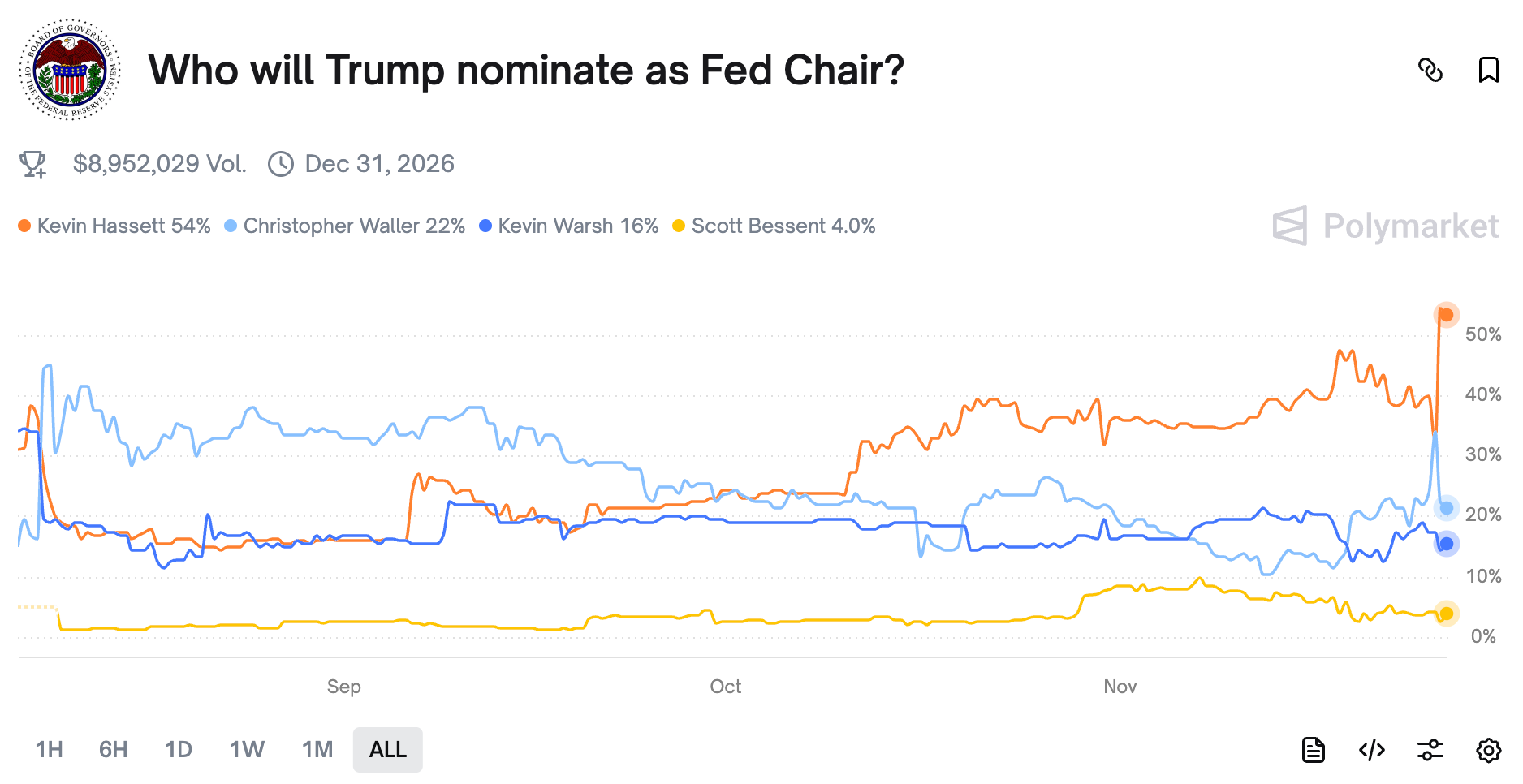

#3 The Race For The Fed Chair

Kevin Hassett emerged as a top contender for the Fed Chair position on Polymarket.

The move comes after Trump allies and advisors seem to float his name after interview process with Bessent ended. However, we are still a long way from the process being over - not only does Trump love to make a show out of everything, but also the Fed board nomination spot opens only in February. Up until then, anyone named will be just a candidate-elect. And even after February, Powell's term ends only in May.

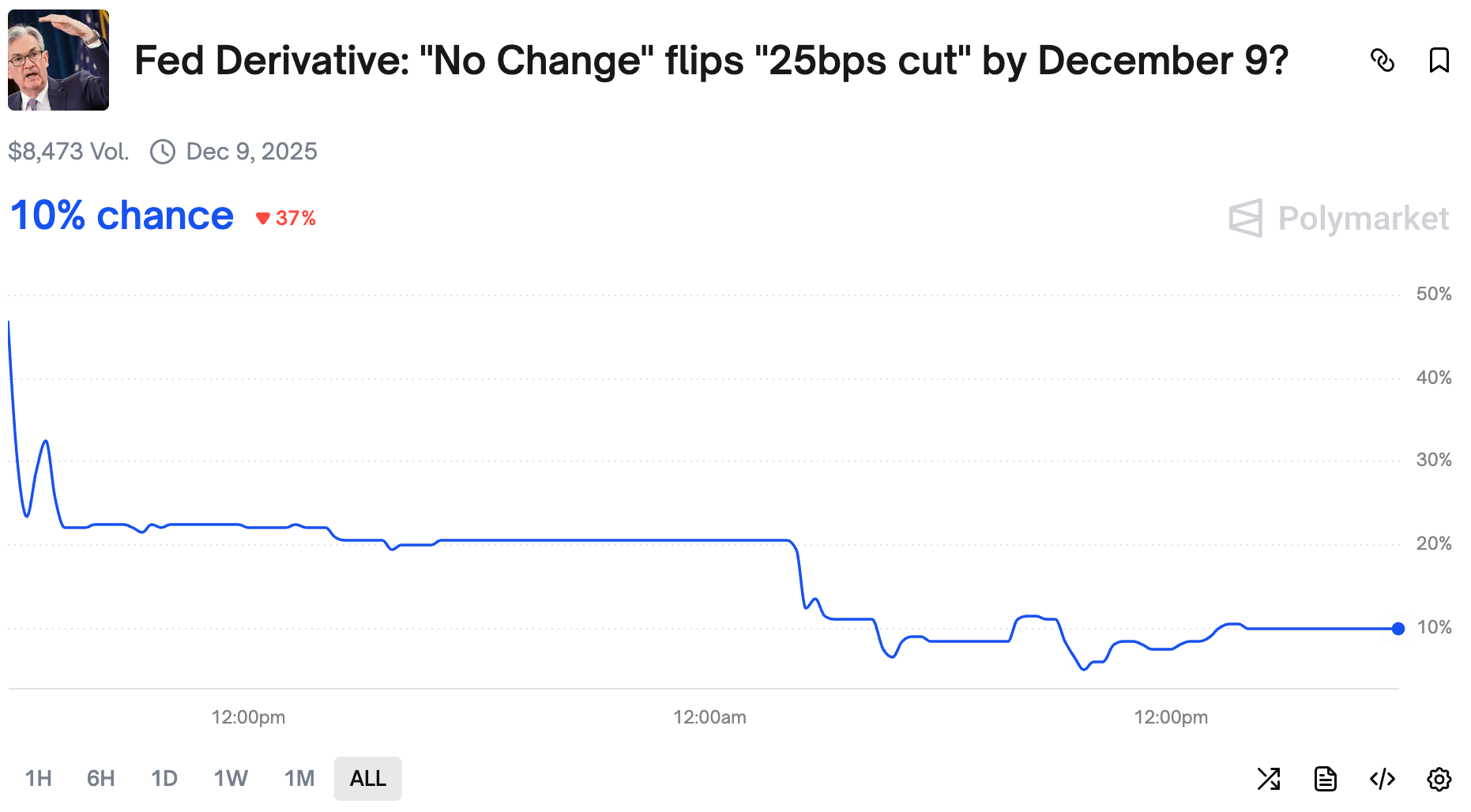

#4 New Derivative Market

Polymarket is recently experimenting with different market types to attract liquidity.

The newest addition is a derivative market on the Fed interest rate market, in which you can bet on directional moves of the two most probable scenarios: no cut and a 25 bps cut.

It's hardly strange - derivatives markets are bigger than traditional financial markets and by a lot. Polymarket bets on the relation holding in prediction markets.

#5 Measles Makes A Comeback

Measles markets are once again making big moves as traders price in the increase in new cases.

Ever since September forecasts on total cases in 2025 keep rising. Metaculus forecasters predicted just over 1,800 cases only 2 months ago. Now they see over 2,000 cases and Polymarket traders are also starting to update their positions. We just might have showed you great alpha ;)

You can read more about measles recent developments here.

Wrap up

That’s all for today - did you catch any of the moves? See you tomorrow for another Morning Brief!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.