Good morning! It's a one packed with geopolitics as we saw moves in the Middle East as well as Venezuela.

Additionally we focus today on a potential new prediction market platform and a possible rate cut in England.

Stay ahead of the game with our forward-looking morning brief.

Top Movers

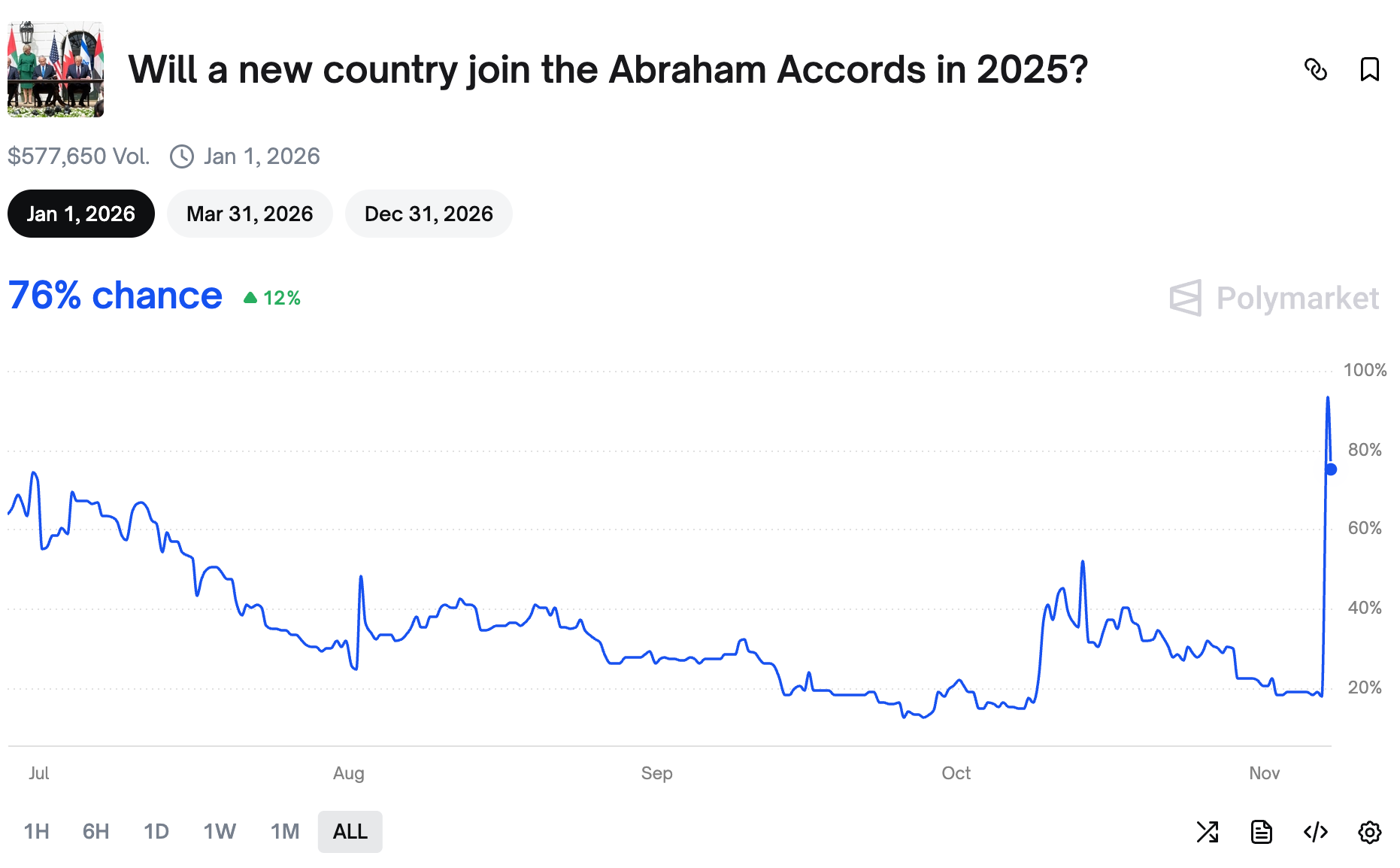

#1 Abraham Accords Revival

It looks like a new country is joining Abraham Accords after the chances spiked to almost 100% on the market.

Traders got a rare case of a shocker as the country signing the Accords is Kazakhstan, which has had diplomatic relations with Israel for 33 years. It's mostly a symbolic event, aimed at keeping the Accords alive amid Saudi refusal to sign them.

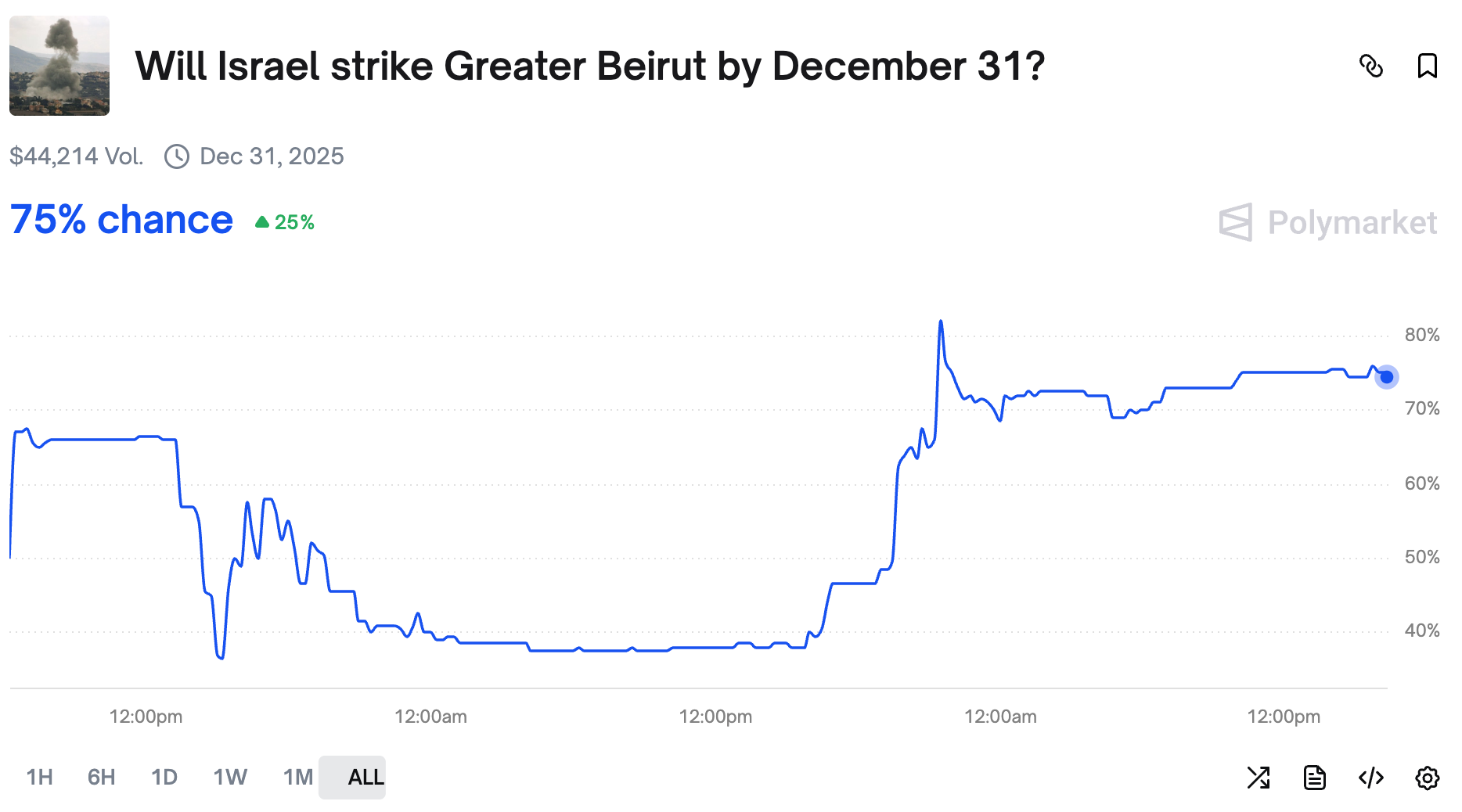

#2 Israel Escalates in Lebanon?

The situation in the Middle East continues to be tense, with traders pricing in an Israeli strike on Greater Beirut by the end of the year.

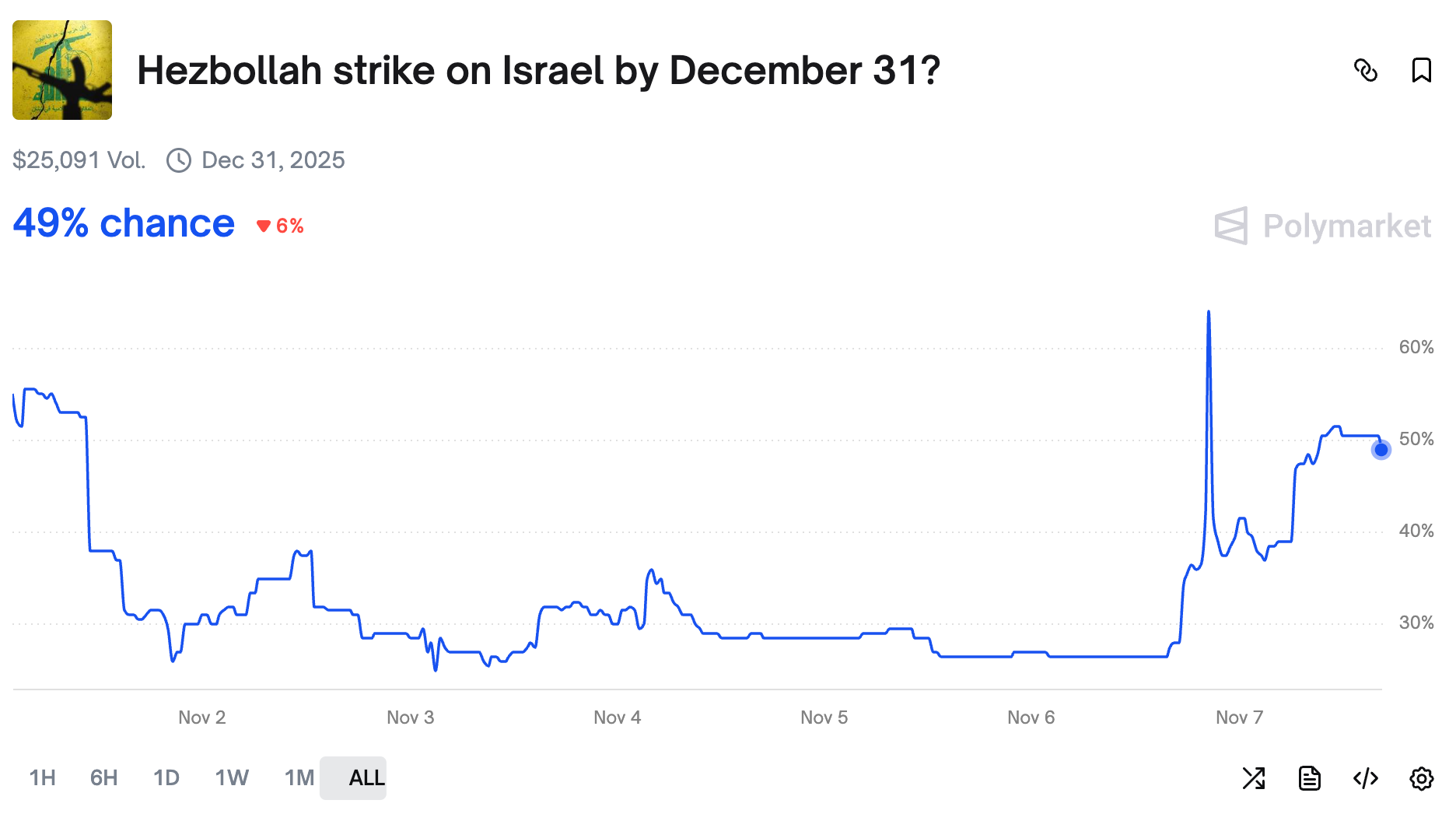

Tensions have been high for a few weeks now with almost daily strikes on Lebanon. However now Hezbollah is establishing a stronger posture, refusing to disarm and vowing to defend itself as long as Israeli strikes continue. Traders are now pricing in a high chance of retaliation:

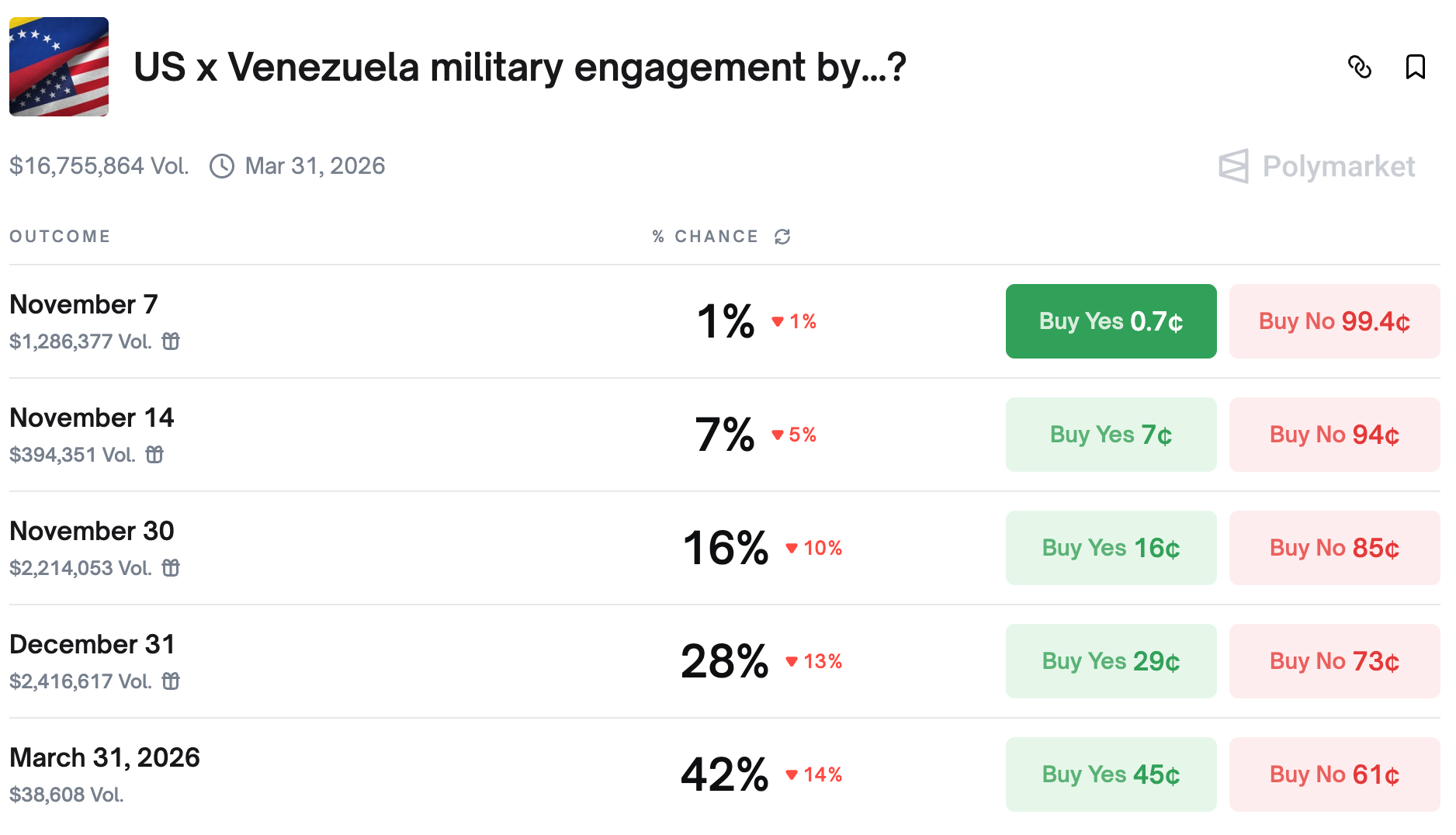

#3 A Venezuelan Dilemma

Chances of the US striking Venezuela dropped across the board.

Despite Congress refusing to block Trump, one trader bet almost $300,000 on No, moving the odds significantly in the process. Their comments suggest that they are betting on Trump being the president of peace. From our perspective the trader has the vibes of other peace trader, SatoshiAncap - be your own judge when it comes to determining whether it is signal or noise.

#4 New Prediction Market Platform?

After a bit of a slump, traders are now once again leaning towards DraftKings launching a prediction market this year.

The October spike you see was related to DraftKings acquiring RailBrid, a niche prediction market platform. Now the company lowered it's end of year financial outlook citing costs associated with launching a prediction market platform as key reason. However the government shutdown is surely making it difficult to coordinate with CFTC and is one of the reasons behind the odds not surging higher as the end of the year looms closer.

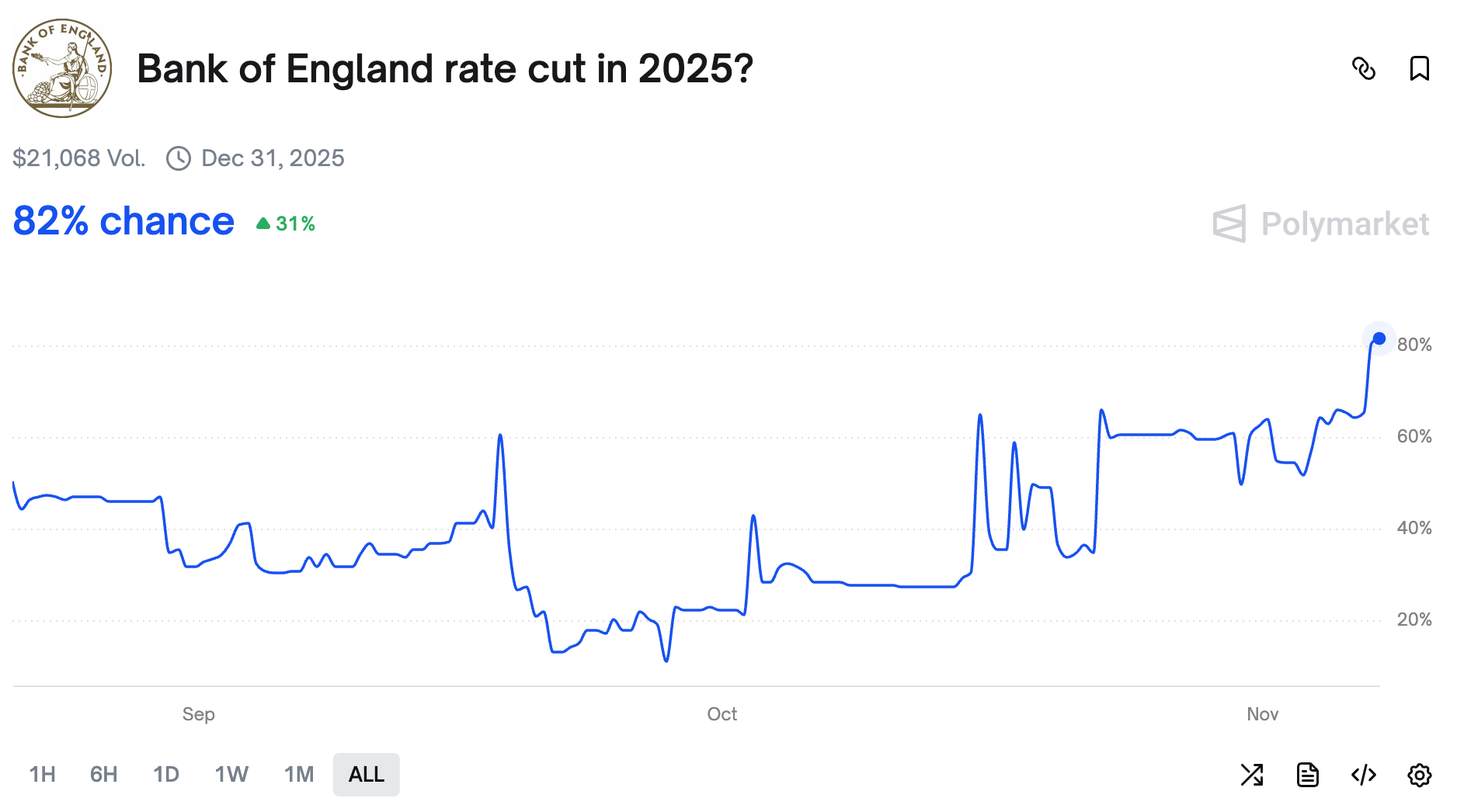

#5 Bank of England To Cut Rates?

Traders now expect the Bank of England to cut rates this year after having the chances at 20% only a month ago.

The bank held the rates steady on the last meeting yesterday. However it suggested that it might cut next time as it sees inflation as having peaked. The announcement comes while inflation is at 3.8%

Wrap up

That’s all for today - did you catch any of the moves? See you tomorrow for another Morning Brief!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.