Good morning! From Epstein to tropical wars, every day brings novelty on prediction markets.

Beyond the above, we touch on Warner Bros. acquisition news and look briefly on the Middle East.

Oh and we reevaluate the "prediction market supercycle" claims - who knows, maybe this is it?

Stay ahead of the game with out forward-looking morning brief!

Top Movers

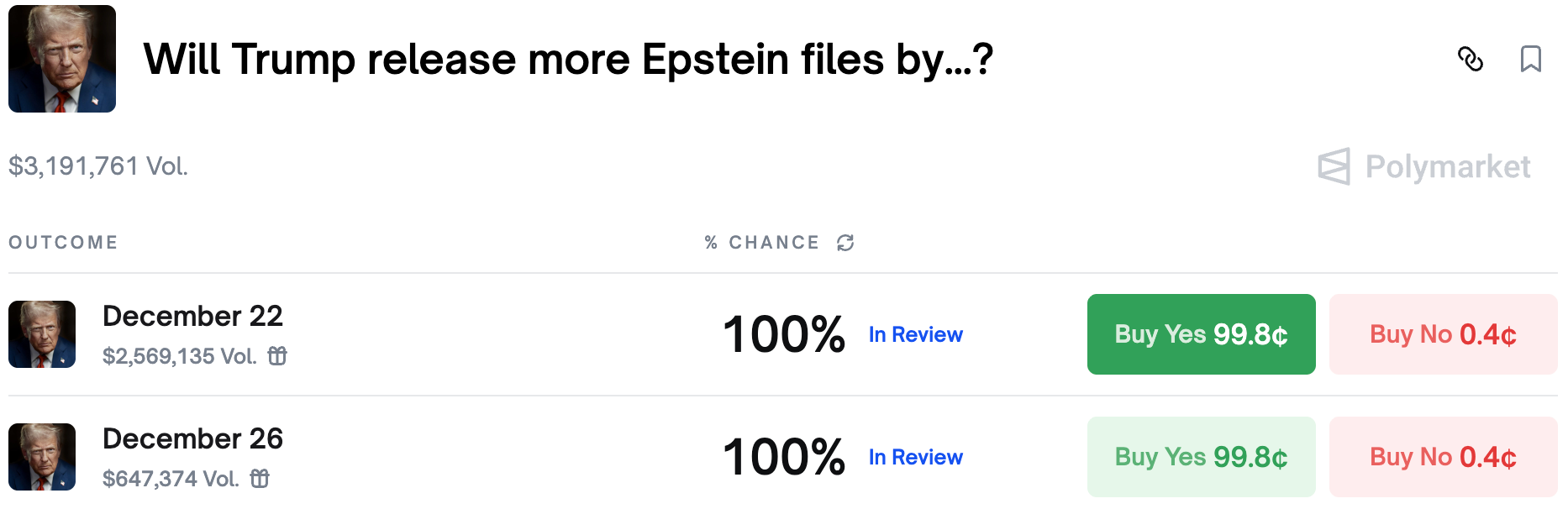

#1 Moar Files

Turns out the Trump admin is faster than anticipated.

Only yesterday we highlighted these markets, only to show them resolved today. The DOJ published a second drop of the files, pushing a flurry of markets to resolve as several prominent people are named there, Elon Musk, Barack Obama and Alec Baldwin among them.

This drop reportedly features more mentions of Trump.

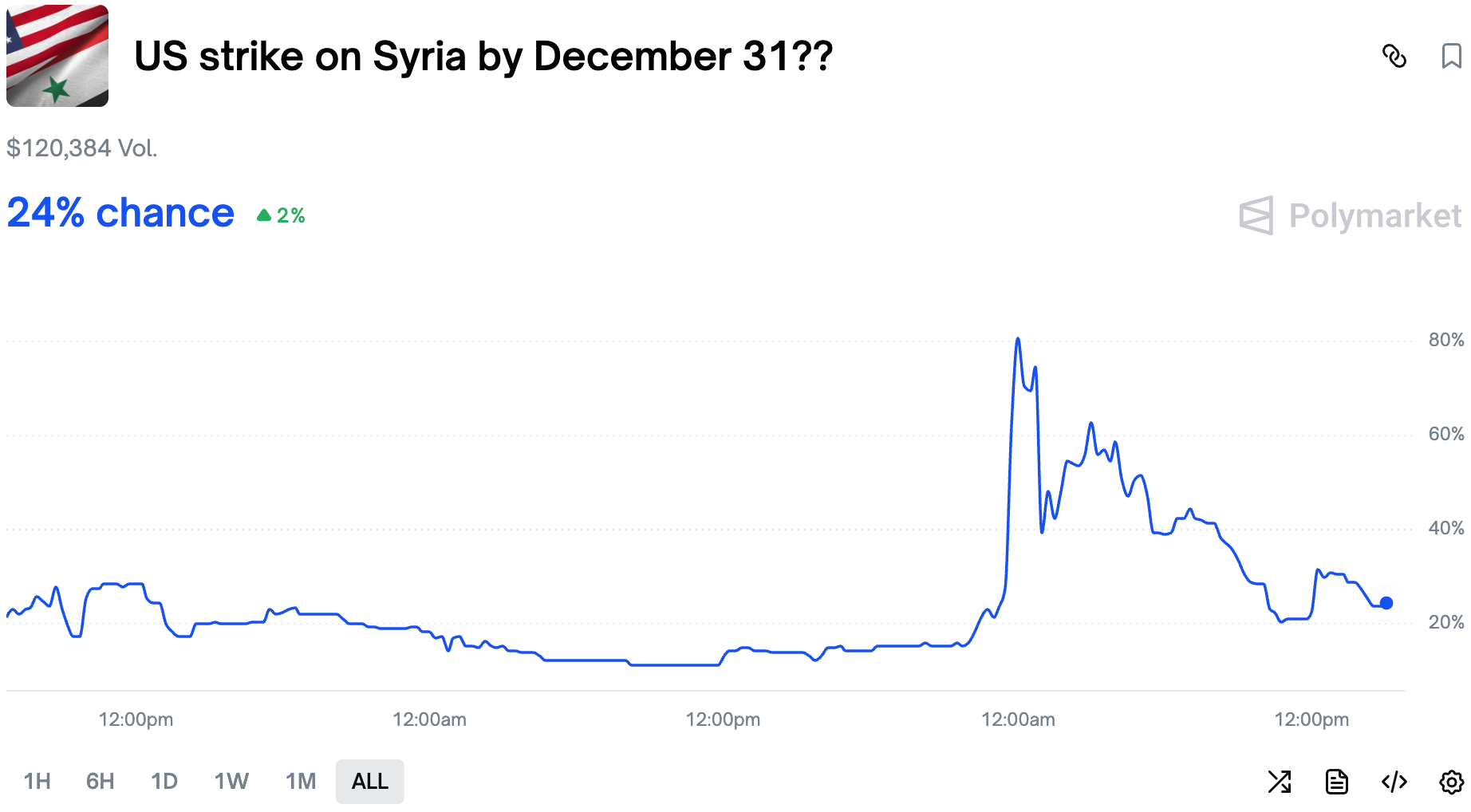

#2 No Part 2 In Syria

Traders seem to be unsure on how to price the next US strike on Syria.

After unconfirmed reports of new strikes, traders once again are bearish on renewed bombing in the country. After Friday's strikes the situation quieted down a bit, however Pete Hegseth vowed this is not the end of action.

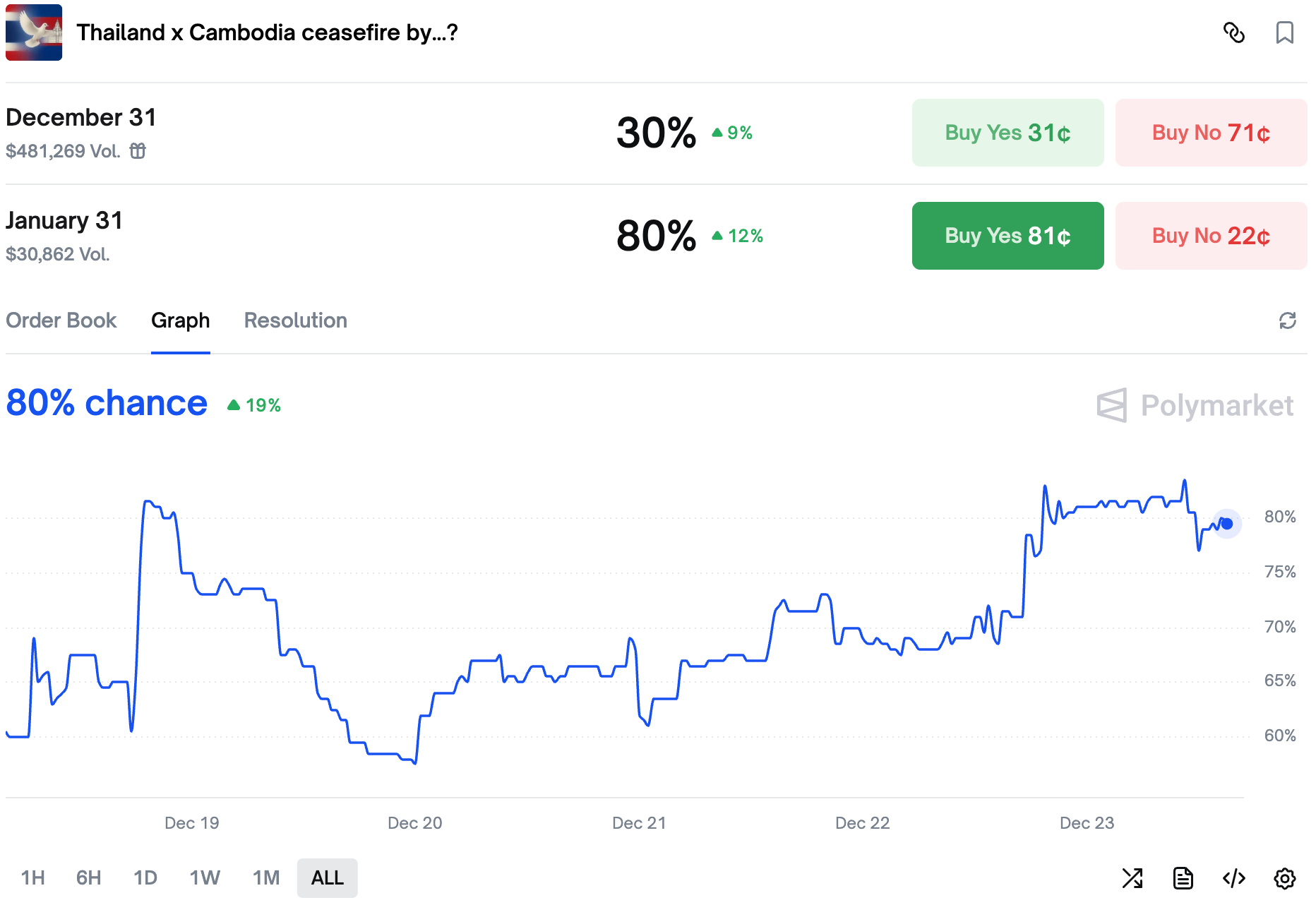

#3 Thailand Is Not Backing Down

Traders are still optimistic about a ceasefire by the end of January, but they tempered their expectations vis a vis Thai posture.

Despite tomorrow's ceasefire negotiations, traders see small chances it will lead to a quick end of hostilities. Thailand remains keen on recognizing new realities on the ground, while Cambodia is not exactly looking to capitulate. And this time, we don't have Trump using coercive diplomacy to force the resolution.

Not that it was effective beyond a short-term photo-op.

#4 Warner Bros. Saga Continues

Traders are once again optimistic about Paramount chances of acquiring Warner Bros. after Larry Ellison personally guaranteed $40.4 billion for the deal.

Additionally Paramount upped the break fee to $5.8 billion. All in an effort to prevent Netflix from gaining near-monopoly on streaming market. Warner Bros. is the owner of HBO MAX service. If Netflix manages to close the deal, it will be the biggest streaming service provider, having close to 50% of global market share.

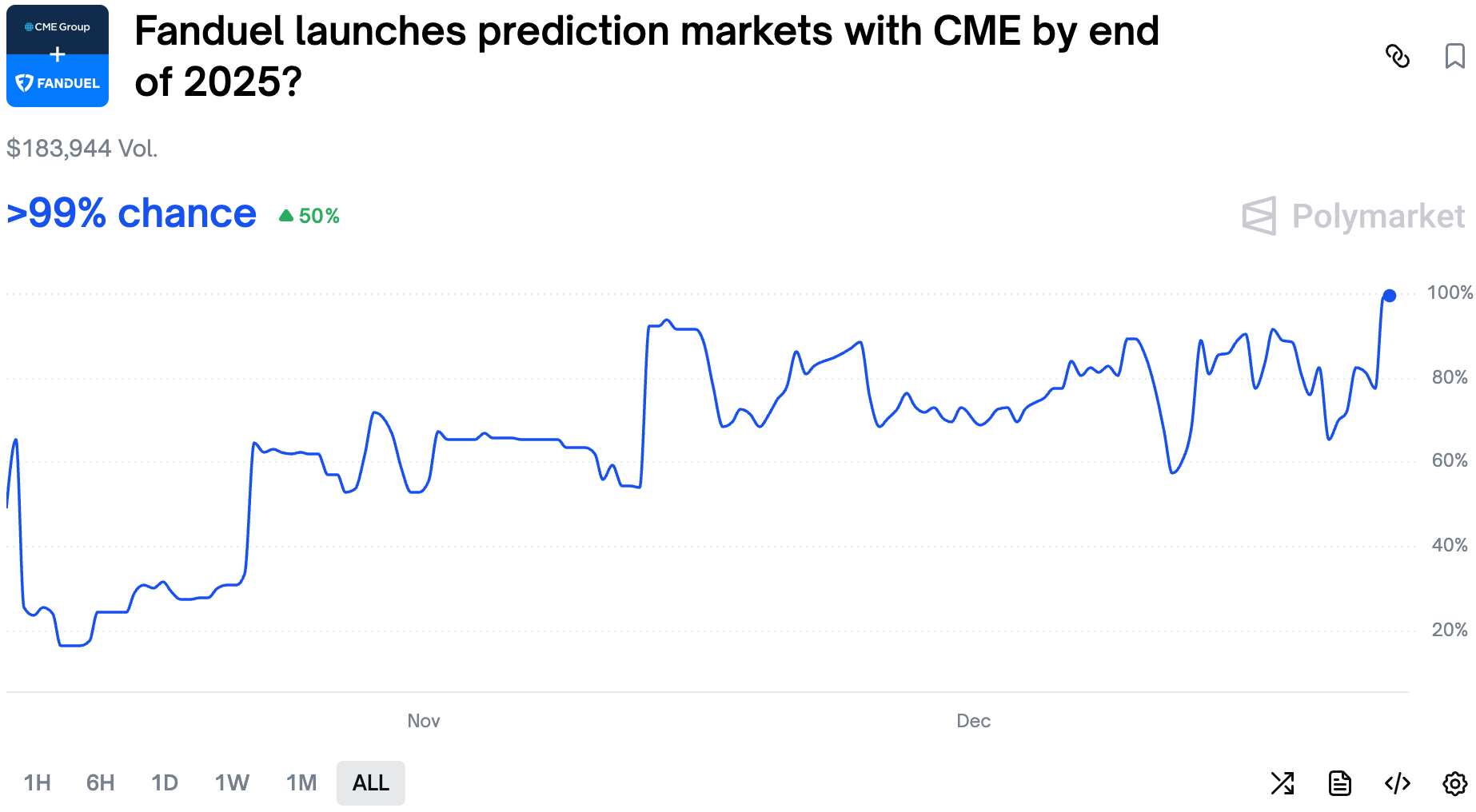

#5 New Is Here

Did you ever think CME will offer sports betting on its main page? Neither did we, but here we are.

The new Fanduel x CME prediction market platform is live, and we have one more competitor that will spend millions to attract users in 2026 and beyond. In what was a niche space only a year ago, now we have major players from the gaming and finance world making moves to capitalize on the popularity of prediction markets.

We often laugh about the "prediction market supercycle" posts, but if it's not now, then when?

Wrap up

That’s all for today - did you catch any of the moves? See you tomorrow for another Morning Brief!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.