Good morning! We hope you enjoyed the Valentine's Day weekend (we surely did!), but now we are back to global affairs across politics, technology, finance and culture.

Today's edition is light on politics, but heavy on big market moves as we await tomorrow's meetings in Geneva relating to Ukraine war and negotiations with Iran.

Stay ahead of the game with out forward-looking morning brief!

Top Movers

#1 Meaningless Thriller

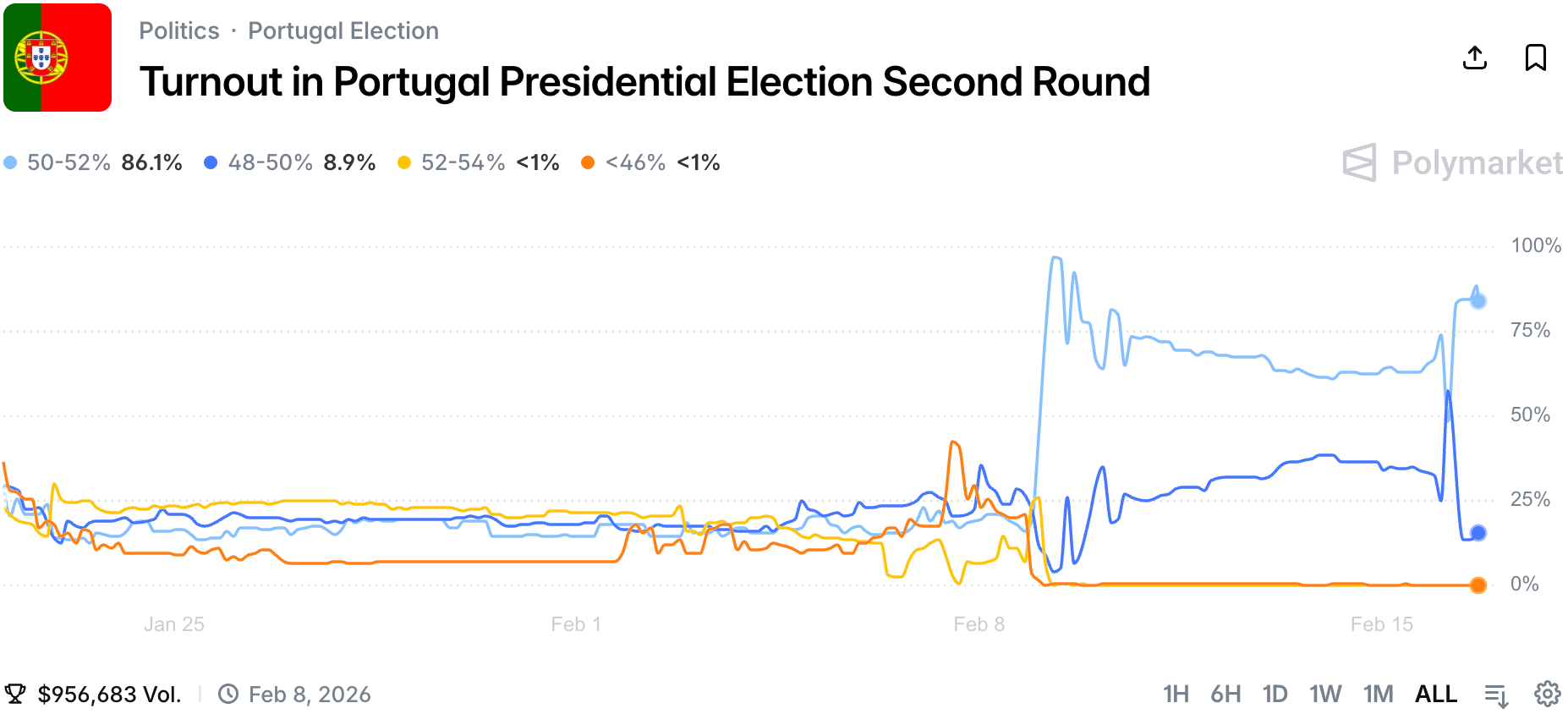

We kick-off the week with a massive swing on Portugal election turnout, where just a few votes changed everything.

There was a delayed vote due to some regions experiencing flooding during the initial voting day for the second round. But in a democracy everyone must have a chance to vote, so they did. In the meantime Polymarket traders were trying to assess how many people would actually vote as the election was decided anyway.

Turnes out it was a daunting task as the official number hoovers just around 50%.

#2 Free Money?

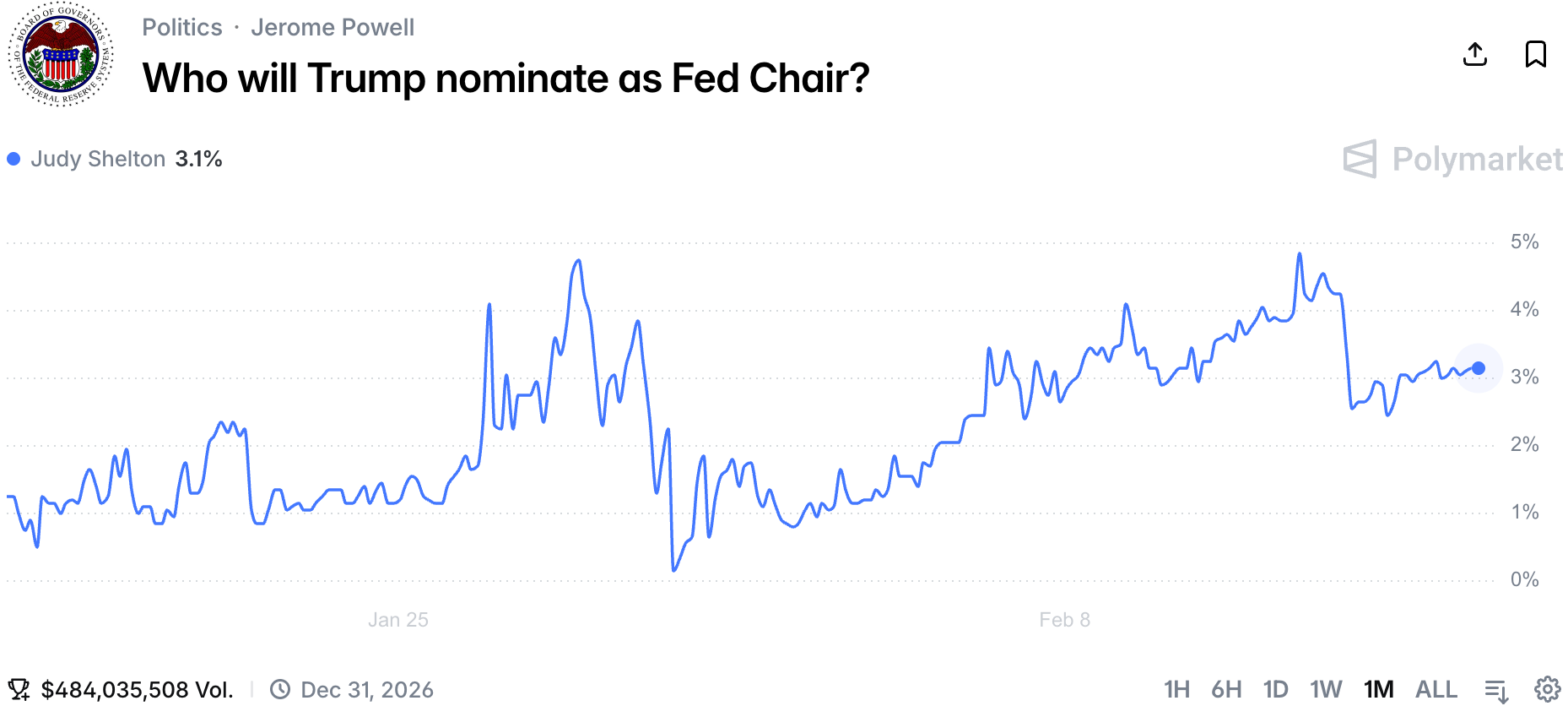

As the start of the week is light on drama, it is time to highlight one of the most ridiculous markets ever.

After Kevin Warsh was announced as Trump's nominee, for some reason a lot of money started to buy Yes on Judy Shelton to be nominated. The reality is that Kevin Warsh will be nominated eventually, but we might wait a month or so for it to happen. In the meantime, there is an event that is just short of money giveaway on the market (NFA as always).

#3 The Warner Bros. Saga Continues

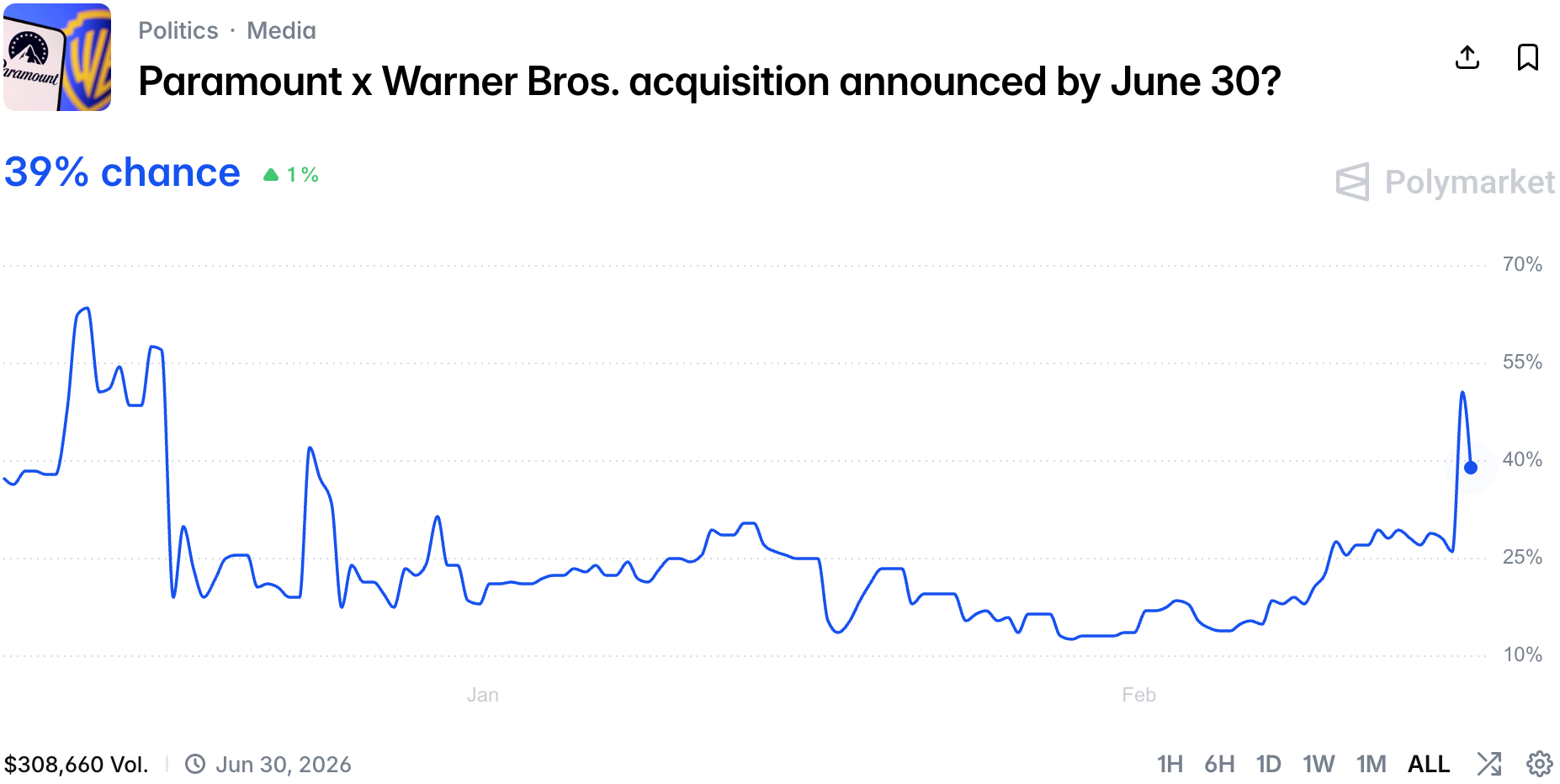

The market on Paramount acquiring Warner Bros. jumped sharply as Paramount added another sweetner to the offer.

Paramount promised to cover Netflix's termination fee of $2.8 billion for exiting negotiations. It also wants to pay $1.5 billion in fees on the new refinancing package Warner Bros. is exploring as well as add a $650 million bonus per every quarter no deal is reached.

It's quite a bid and the market noticed.

#4 Is It The Day For Grok 4.20?

The market once again chose to trust Elon Musk, as he promised to launch Grok 4.20 this week.

Elon is notorious for not keeping to his own deadlines, but sooner or later he has to launch. The competition has been shortening the release cycle and Grok feels like old tech again. The increase in price is not only due to Elon's comment, the comment was just an admission that xAI needs to move fast.

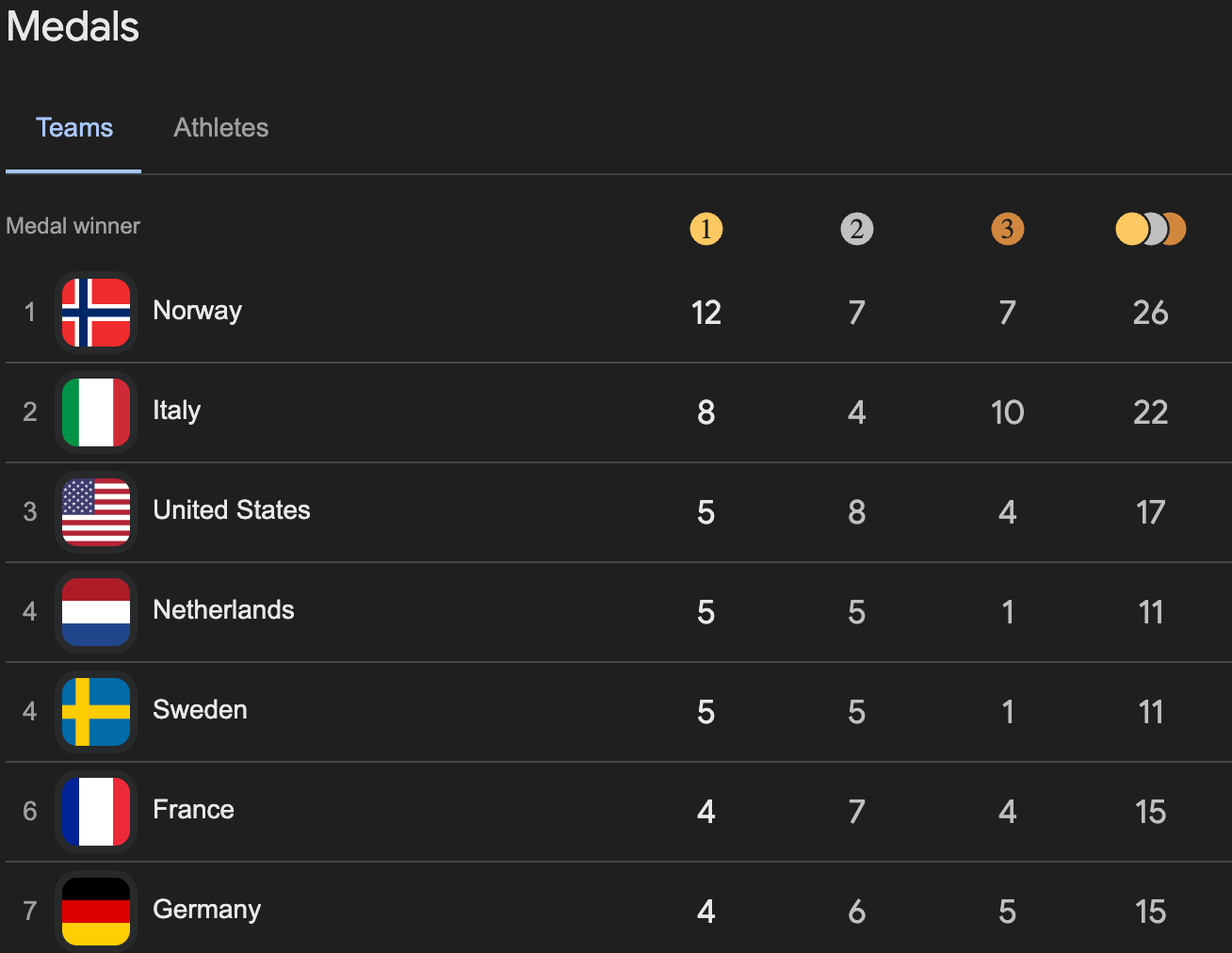

#5 Winter Olympics: Italy Marching Forward

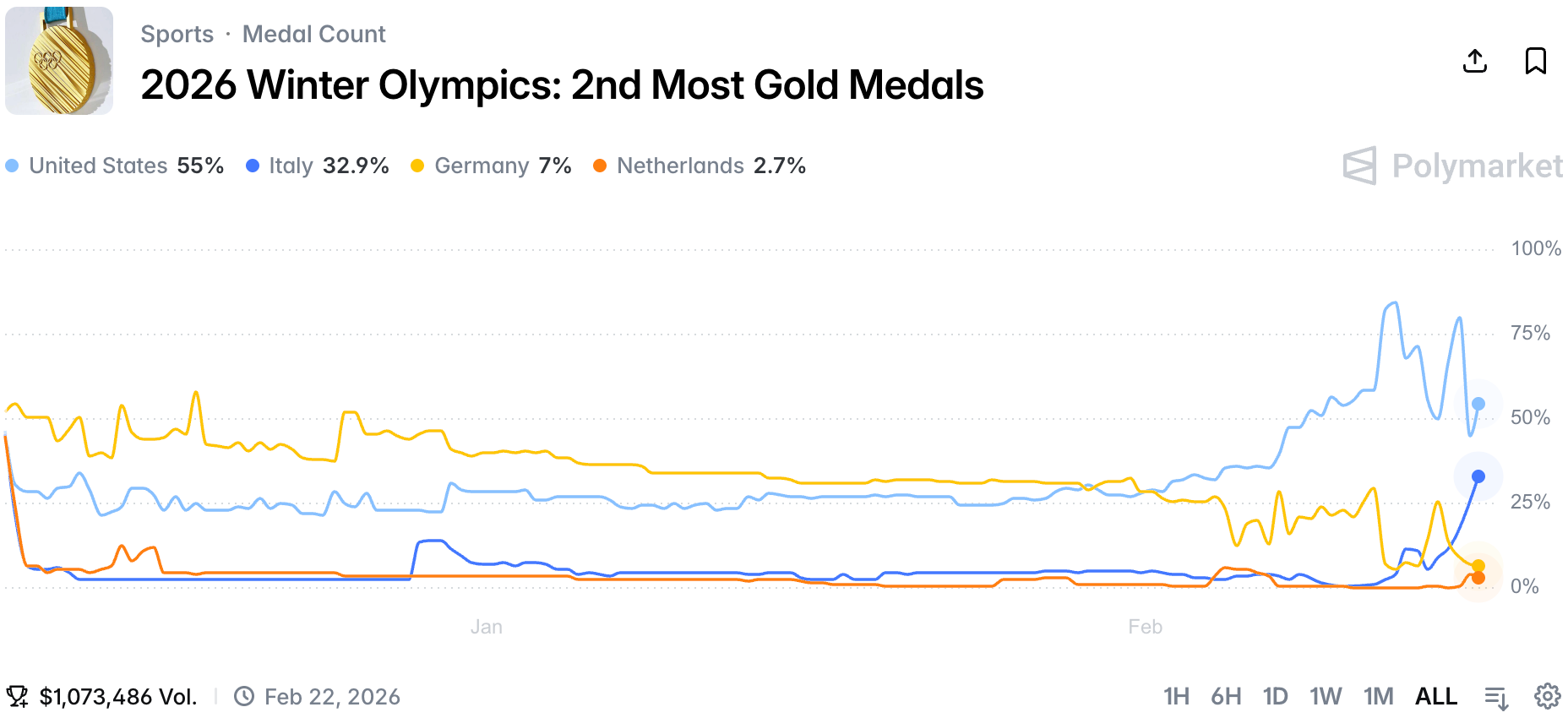

Lastly, the market has been agressively repricing Italy's chances to get the 2nd most gold medals, after a stellar performance from the country.

While Norway is securing its 3rd win in the row, Italy is emerging as a strong contender for the second place, trying to beat the US. Can they make it? There are still days till the Olympics are over, but the US team is no joke.

Wrap up

That’s all for today - did you catch any of the moves? See you tomorrow for another Morning Brief!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.