Good morning! So far it has been a fairly quiet week with no meaningful progress in the global affairs. Ukraine talks are still ongoing, while the US continues its massive airlift to the Middle East after another round of talks that was described as constructive.

That being said, we have a nice selection of sharp moves from the last 24 hours, from geopolitics to sports.

Stay ahead of the game with out forward-looking morning brief!

Top Movers

#1 Unintended Consequences

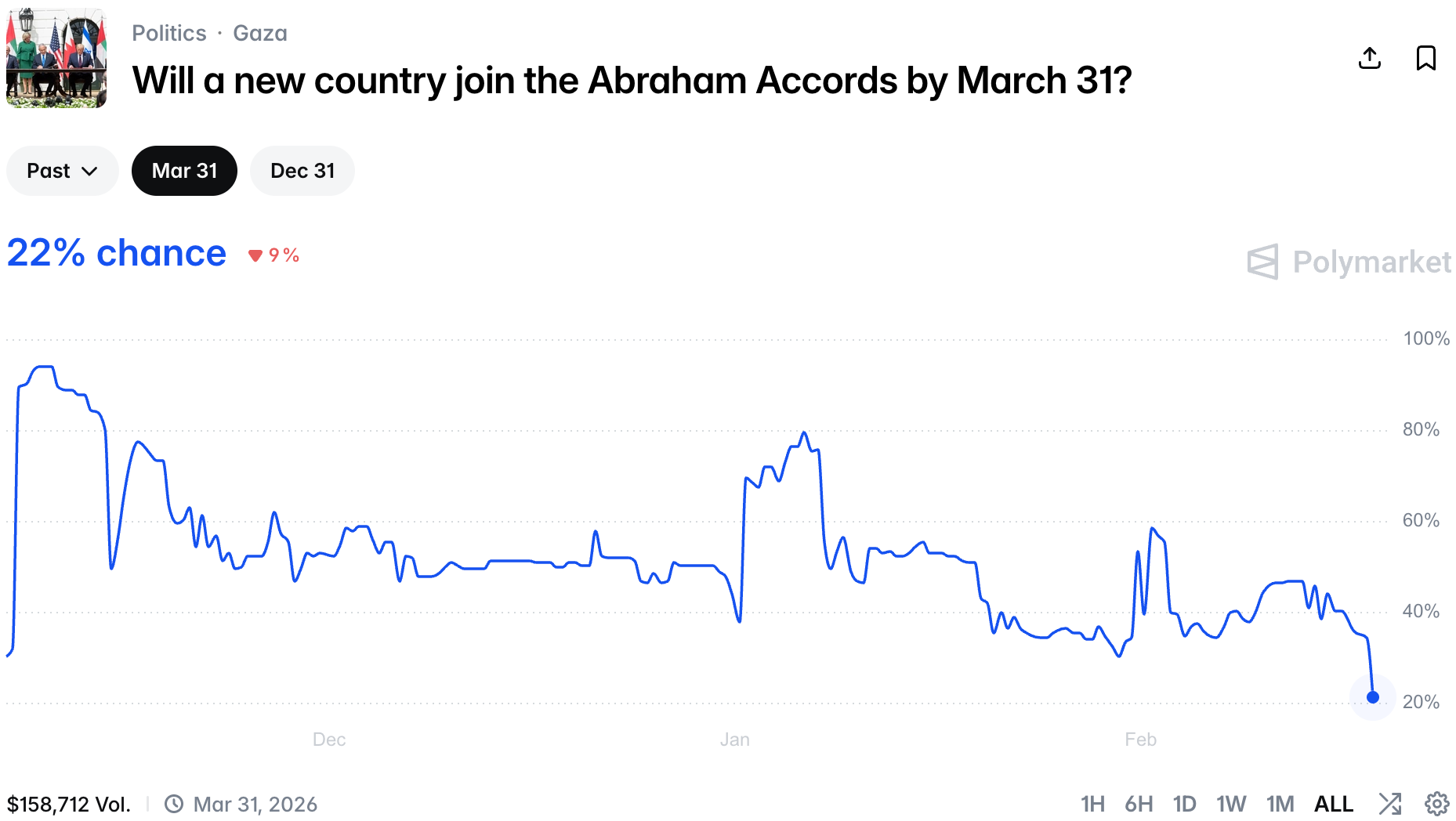

The Abraham Accords market has been in a steady decline ever since the first signs of protest in Iran, but only now the Yes price took such a violent hit.

Despite there being 2 countries ready to sign the Accords (Kazakhstan and Somaliland), the reality is that there will be no signing ceremony for either of these 2 countries, especially when there is a possible war with Iran coming soon. Strange that it took so long for the market to recognize this reality.

#2 Cheap Shots

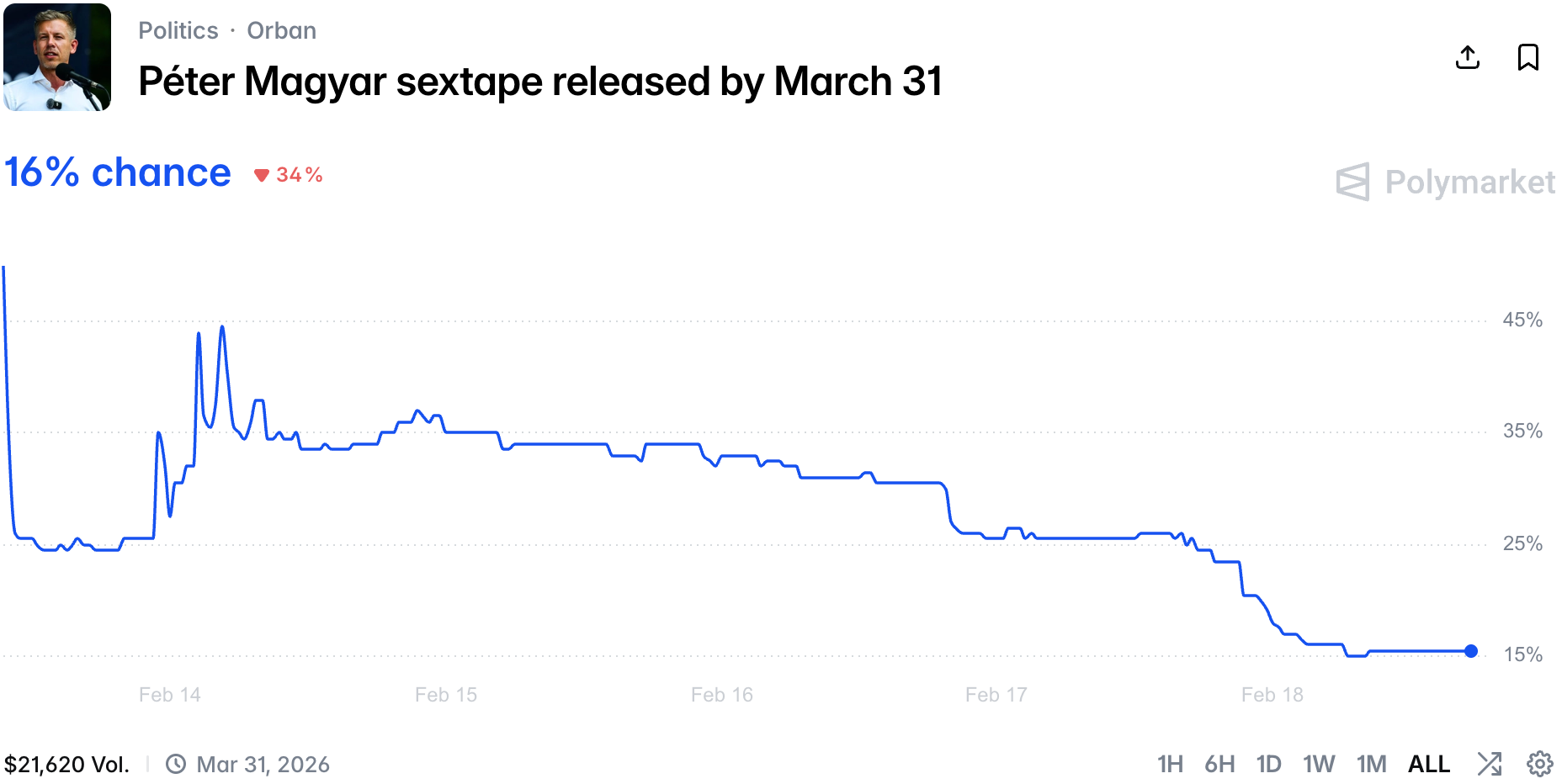

Peter Magyar appeared in all the major papers after he revealed that a sextape starring him might soon be released.

The opposition leader in Hungary claims that Orban's government did a honey-trap operation on him back in 2024 in an effort to discredit him when needed. The dramatic video suggested the release was imminent, however 6 days later, it seems his last minute hailmary worked.

Or it was a clever way to get himself globally recognized. We'll see.

#3 How Soon We Forget

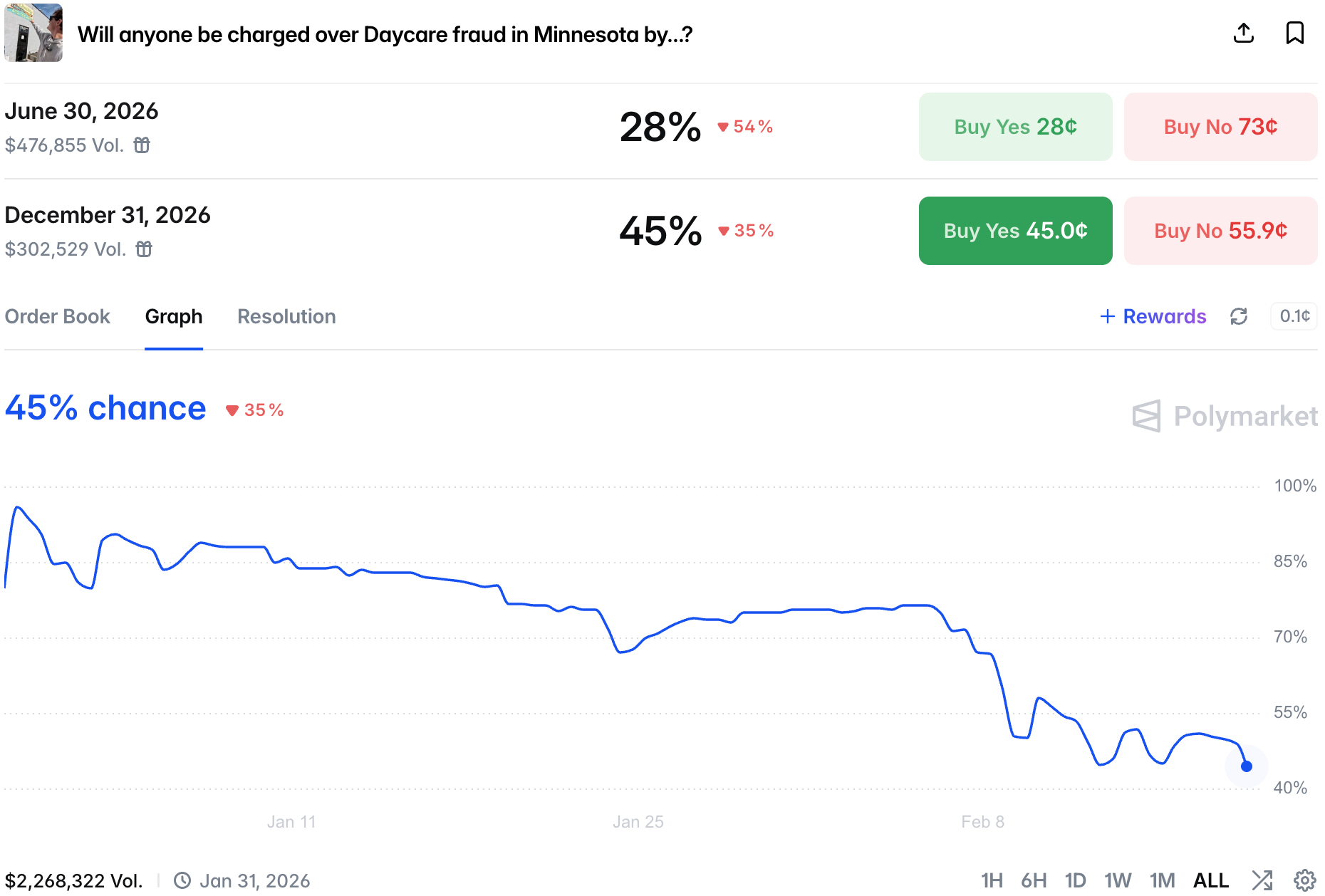

It feels like ages since we heard about the daycare fraud scandal in Minnesota and traders seem to be discouraged about progress.

But as it often happens in such cases, months of investigation are needed before any indictment can be issued; while one inefficiency of prediction markets are long-dated markets that require traders to lock money for a significant period.

#4 AI Wars Continue

Just a day after Grok 4.20 launched, the Yes price of Gemini 3 successor launch by the end of the quarter spiked.

There are no news to push the price, but considering how short the release cycles are right now and that OpenAI, Anthropic and xAI, all released updates in February, Google needs to keep up and also release a new, better version.

Especially since Chinese models are right behind American ones.

#5 Handicap Markets

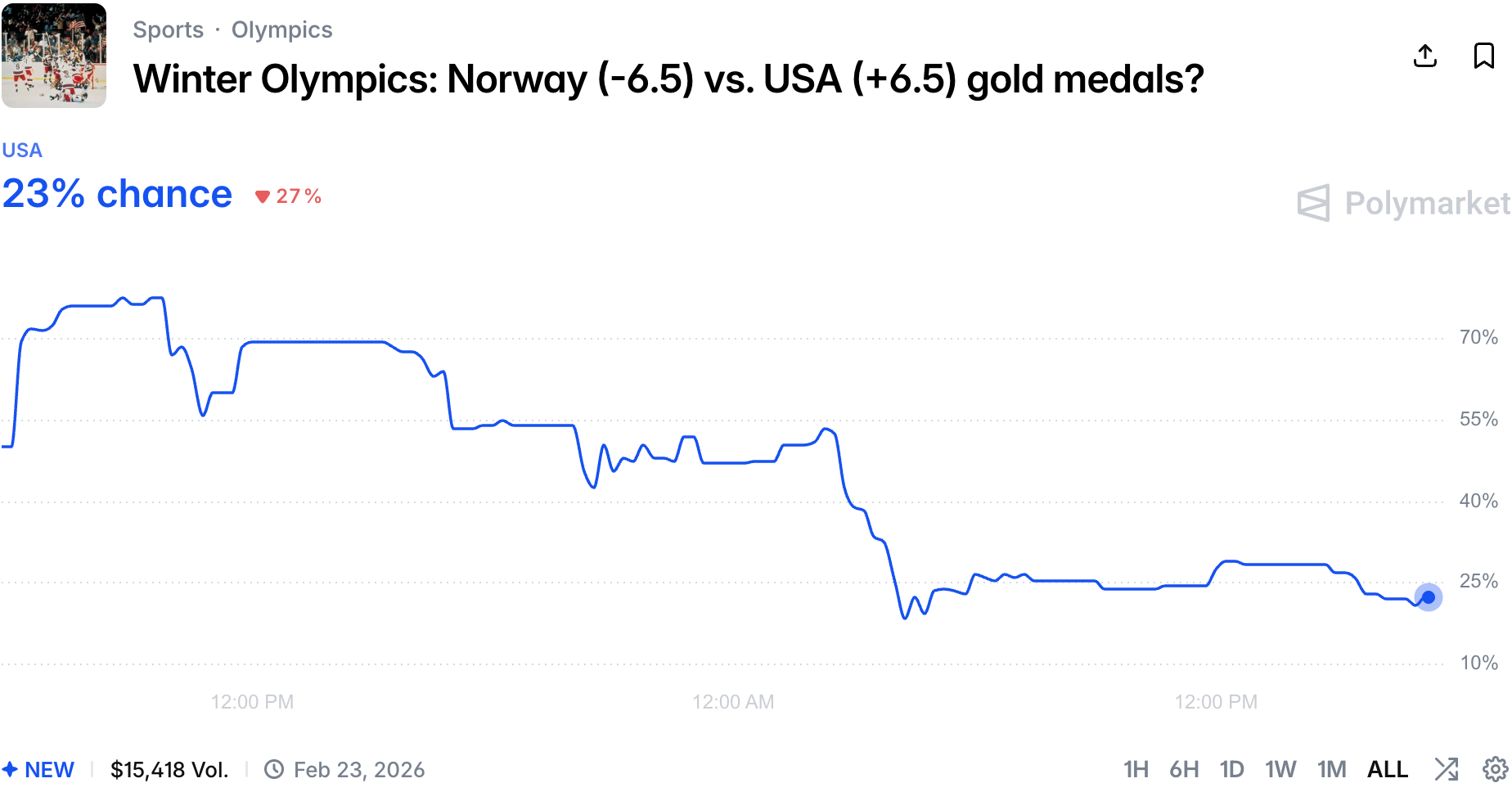

We have a new type of market on the Winter Olympics, and while it shows the Norwegian lead is safe, it showcases a growing number of derivative markets.

In an effort to expand the offering we are seeing different niche markets (like GPU rental prices) and derivative markets (eg. Nothing Ever Happens) - handicap, while pretty much exclusive to sports, is a new addition.

And while we are not very keen on sports markets, it is great to see the space develop.

Wrap up

That’s all for today - did you catch any of the moves? See you tomorrow for another Morning Brief!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.