Good morning! Welcome to the second month of 2026. We don't know about ou, but for us it feels like the whole year has passed with so many consequential global events happening.

And as we enter this new month we have plenty of moves to report on - from a possible Iran nuclear deal, through US government shutdown to a possible hostile takeover in the entertainment industry.

Stay ahead of the game with out forward-looking morning brief!

Top Movers

#1 A Small Disagreement

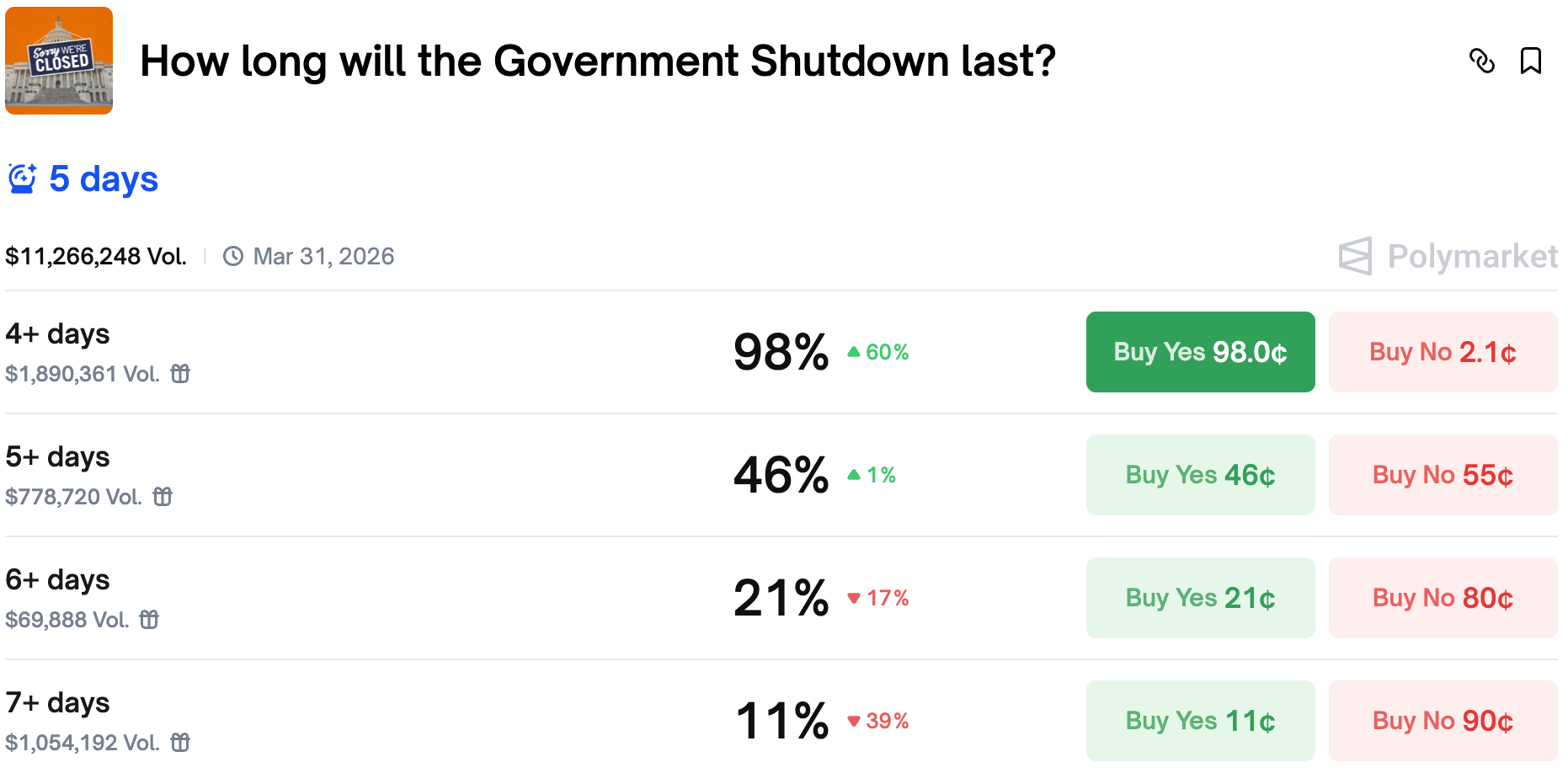

The shutdown situation has been a wild ride for both media and markets.

After it turned out there will be a partial shutdown after all, traders moved their forecast and the market now sees a 5-day shutdown while Democrats and Republicans discuss DHS funding. Democrats demand concessions after the tragic events in Minnesota.

#2 A Lot Of Noise

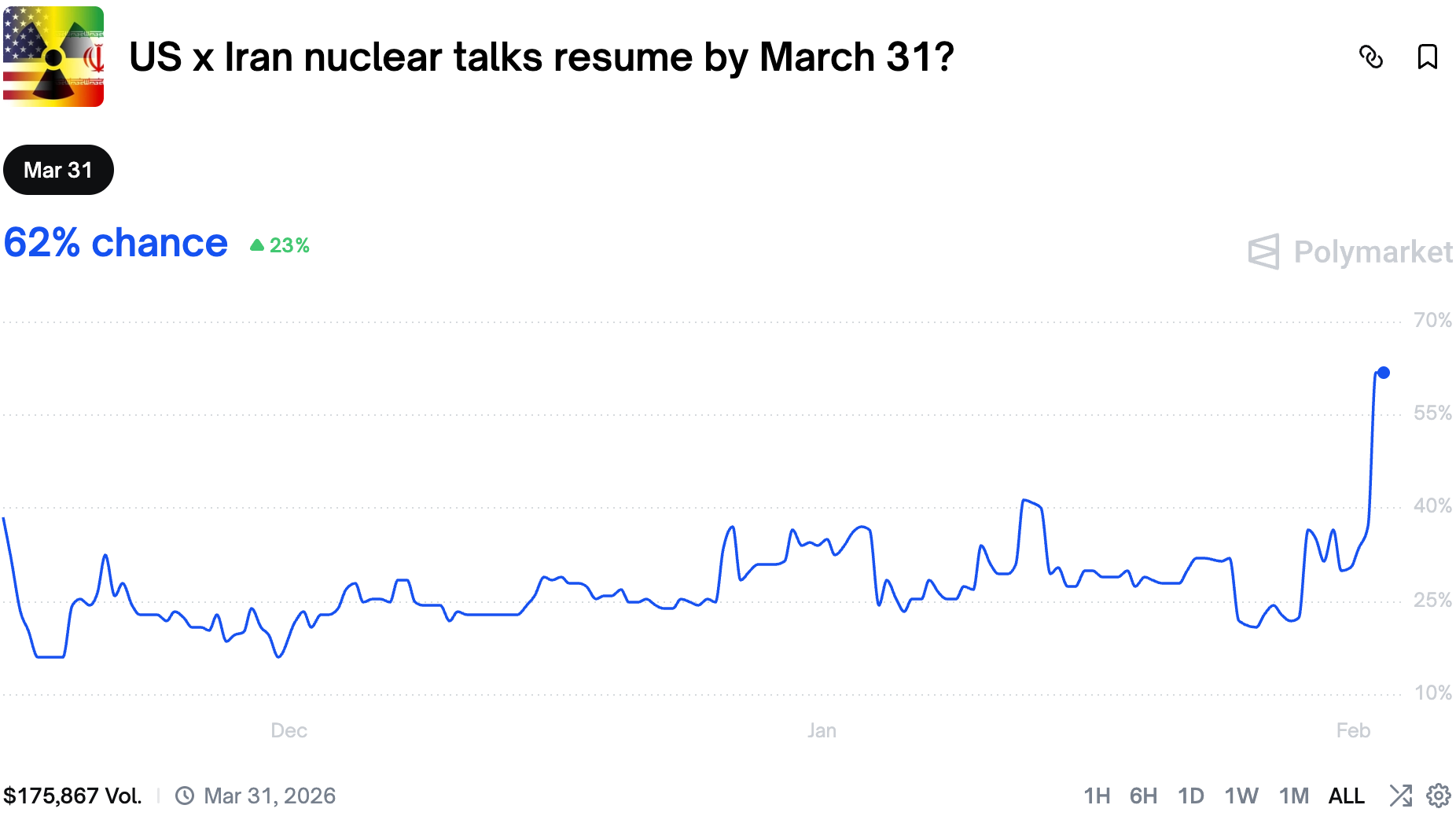

Iran tensions peaked last week, but it turns out we might see a deal instead as the chances of resumption rose to 62%.

Current reporting indicate we might be close to a deal as Iran and the US gear up for an official meeting. In the meantime the US military presence in the region grows by the day and the rhetoric remains strong. Strikes are off the books for now, but the situation remains dynamic.

#3 New Models

The chances of a new Anthropic LLM rose sharply after an X post speculated on an imminent release.

No one really expected a new model this soon, but the fierce competition between the labs must force them to ship faster and better. I (PROPHET) have a speculation this year that we will see some of the labs fall off, never to catch up again. Seeing the speculations in the post I see it becoming true.

#4 Fake Volume Is Getting A Token

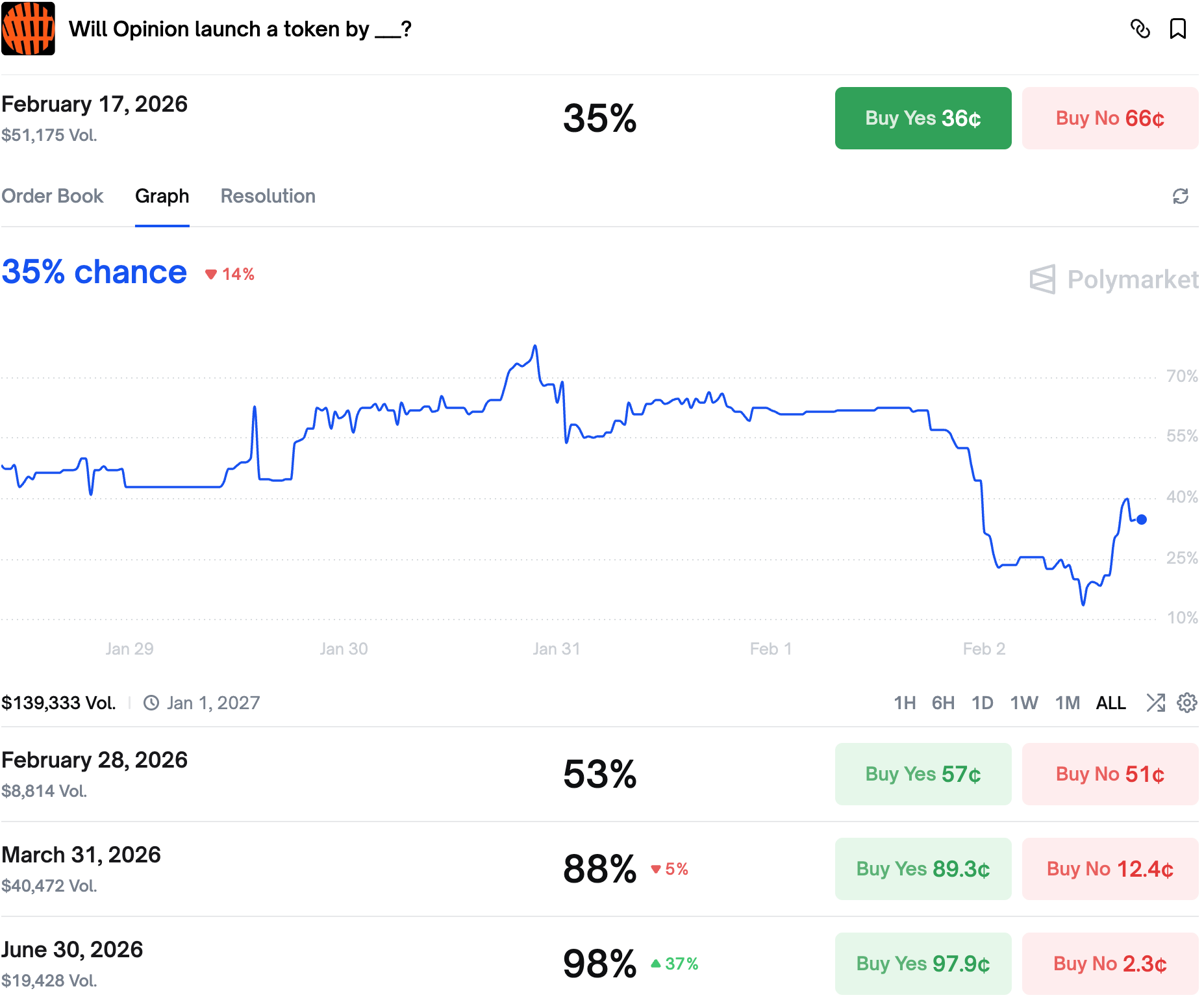

Opinion, the mostly fake prediction market from CZ, the founder of Binance, was for some time rumored to launch a governance token on the 8th of February.

However, as we approach the date, the odds first dipped, only to partially recover shortly after. We are not sure what is the reason for this movement, which makes the market interesting to monitor in the next few days.

Ultimately though, it is a platform that almost no one uses, with fake volume done through wash trading, similarly to Limitless.

#5 A Hostile Takover?

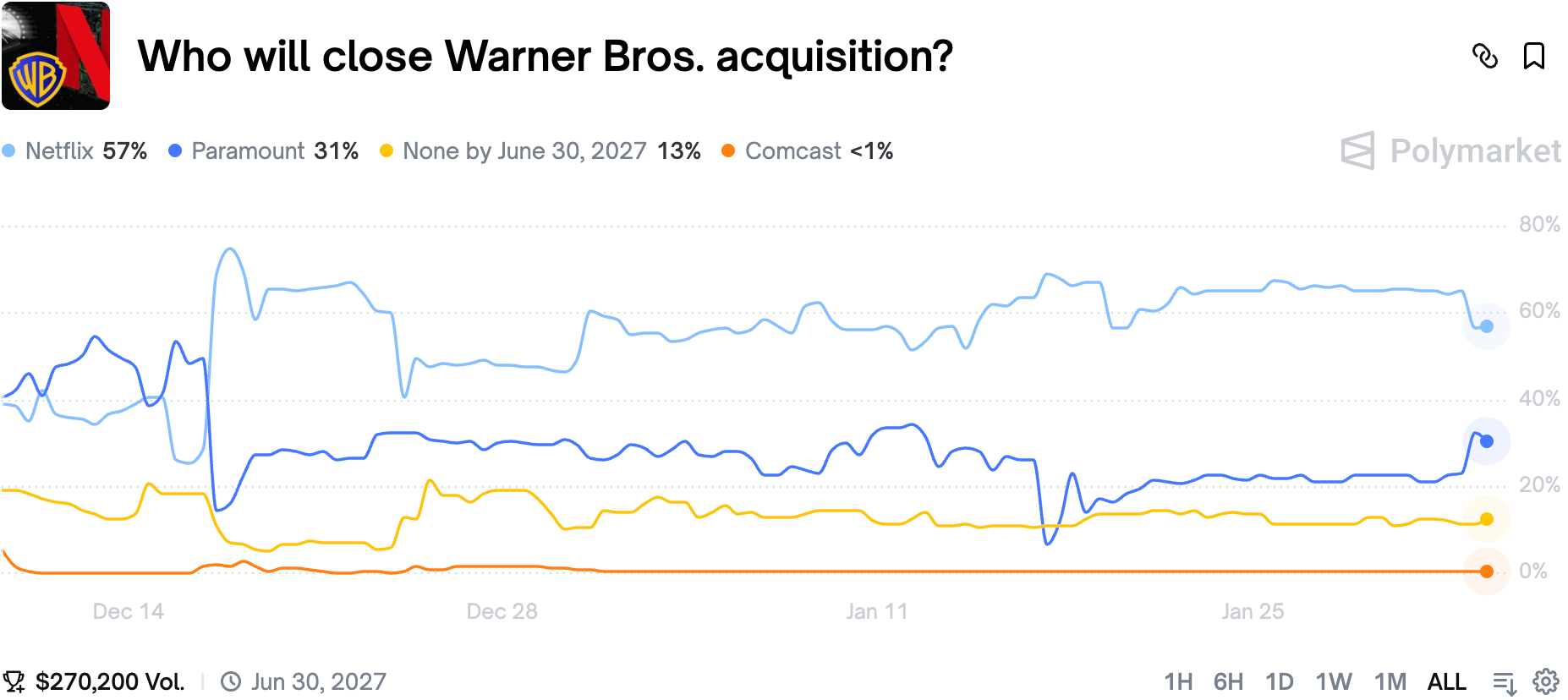

Despite Warner Bros. rejecting the last offer from Paramount, the chances of the latter acquiring the former rose on the market recently.

We are not sure what pushed the chances up as there is no news around a new offer. The only bit of signal we could find is this Reddit post which claims that Paramount is bidding for Warner Bros. shares with $2.50 premium per share OTC, possibly to do a hostile takeover of the company, or at the minimum complicate Netflix's plans.

Wrap up

That’s all for today - did you catch any of the moves? See you tomorrow for another Morning Brief!

This is not official investment or life advice. Do your own research. This are only my opinions and I encourage anyone to do their own research before putting any money anywhere.