TL;DR:

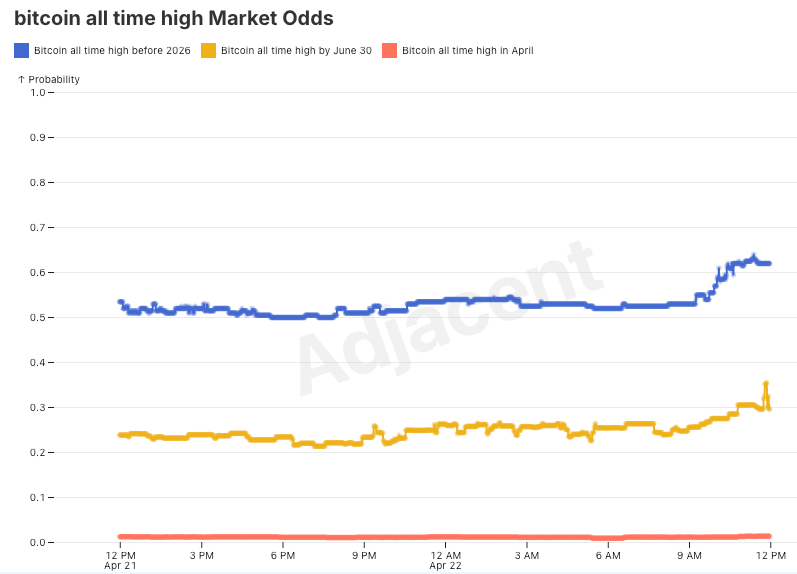

- Bitcoin is up 3.7% this week, defying a 9.1% YTD dollar drop and a $1.5T U.S. stock market wipeout, with Polymarket’s “Bitcoin all-time high by June 30?” at 26% (up 3%) and “before 2026?” at 55%.

- The 10-year Treasury yield at 4.4% fuels bond sell-offs, with Polymarket showing a 55% chance of exceeding 4.4% by Friday and 43% of hitting 4.5% in April, reflecting macro uncertainty.

- A 92% chance of no rate change at May’s Fed meeting (Polymarket) suggests persistent liquidity pressures, boosting Bitcoin’s appeal as a hedge.

- Kalshi’s “Who will Trump nominate as Fed Chair?” market gives Kevin Warsh a 44% chance, signaling potential policy shifts that could impact markets.

Market Snapshots

- Bitcoin all time high by June 30? 26% chance (Polymarket)

- Bitcoin all time high before 2026? 55% chance (Polymarket)

- 10-year Treasury yield >4.4% Friday? 55% chance (Polymarket)

- How high will 10-year Treasury yield go in April? 43% chance of 4.5% (Polymarket)

- Who will Trump nominate as Fed Chair? 44% of Kevin Warsh (Kalshi)

Event Breakdown

Bitcoin's Resilience Amid Macro Turmoil: Bitcoin is shining as a beacon of stability in a turbulent macro environment, with prediction markets reflecting growing confidence in its near-term performance. Polymarket’s “Bitcoin all time high by June 30?” ($957K volume) has climbed to 26%, up 3% in the last 24 hours, while “Bitcoin all time high before 2026?” ($155K volume) now sits at 55%, up from 50% yesterday.

These markets, tied to Bitcoin’s price trajectory, are critical barometers of sentiment amid a financial system under strain: the U.S. dollar is down 9.1% year-to-date, U.S. stocks shed $1.5 trillion in a single day, and bonds are faltering with the 10-year Treasury yield hovering at 4.4%. Meanwhile, gold hit a record $3,400, and Bitcoin itself is up 1.6% in the last 24 hours and 3.7% for the week.

The macro backdrop is grim. The Polymarket “10-year Treasury yield >4.4% Friday?” market ($63.5K volume) spiked to 79% last night before settling at 55%, signaling bond market jitters, while a 43% chance of the US10Y hitting 4.5% by April’s end (and 25% for 4.6%) underscores rising yield concerns.

Stocks are reeling, with yesterday’s $1.5T wipeout reflecting fears of tighter monetary conditions. The global M2 money supply is expanding, historically a tailwind for Bitcoin, yet Polymarket shows a 92% chance of no rate change at the Fed’s May meeting, suggesting persistent pressure on liquidity.

Against this chaos, Bitcoin’s resilience—up 3.7% weekly—stands out, with prediction markets capturing a growing belief in its potential to notch new highs.

These Bitcoin markets are vital for understanding macro trends because they aggregate real-time, crowd-sourced expectations about an asset uniquely positioned as both a hedge and a speculative play. Unlike stocks or bonds, Bitcoin’s decentralized nature and fixed supply make it a gauge of distrust in traditional financial systems. The “Bitcoin all time high by June 30?” market’s 25% odds, up 2%, reflects cautious optimism that Bitcoin could break out despite macro headwinds, potentially driven by M2 growth or dollar weakness. The “before 2026?” market’s 55% odds suggest longer-term confidence in Bitcoin as a store of value, especially as gold’s $3,400 surge signals a flight to hard assets. These markets’ volumes—$258K for April, $957K for June, $155K for 2026—indicate robust trader interest, with the longer-term market’s higher volume pointing to broader macro bets.

Will Bitcoin’s correlation with M2 hold if yields keep climbing? Could a sharper stock market correction drag Bitcoin down, or will it decouple as a safe haven? How will global risk sentiment evolve if the Fed remains hawkish? These are the questions we’ll be keeping an eye on.

Related markets & forecasts:

- How high will Bitcoin get this year? (Kalshi)

- When will Bitcoin hit $150k? (Kalshi)

- How low will Bitcoin get this year? (Kalshi)

Long-Tail Radar

Who will Trump nominate as Fed Chair? (Kalshi): The "Who will Trump nominate as Fed Chair?" market on Kalshi, currently at $7,400 in volume, is a long-tail prediction market with significant implications. Trading at 44% for Kevin Warsh (up from 23% last week), 16% for Kevin Hassett, 12% for Judy Shelton, and 11% for Larry Kudlow, this market tracks the first formal nomination for Federal Reserve Chair before January 20, 2029, per Library of Congress records. Despite its low liquidity, the market’s importance lies in its connection to U.S. monetary policy and economic stability.

The Fed Chair shapes interest rates, inflation targets, and banking regulations—decisions that ripple across global markets. Warsh, a known hawk, could push for tighter policy, potentially strengthening the dollar but risking growth. Hassett or Kudlow, aligned with Trump’s growth-first agenda, might prioritize deregulation, impacting bank liquidity (FDIC notes $500B in unrealized bank losses). Further, Shelton’s potential nomination and gold-standard advocacy could upend inflation expectations. Financial markets have priced in CPI inflation averaging about 3% over the next 12 months, above recent actual inflation rates, indicating a market anticipation of tariff-driven price increases.

As Powell’s term nears its May 2026 end, expect sharper X buzz and trader interest, especially if Trump’s tariff or fiscal policies intensify. This market’s resolution hinges on verifiable nomination data, ensuring clarity. Track it on Kalshi!

Here’s a look at related Fed Chair markets over the last 24 hours:

Questions we asked

Follow the Adjacent community on Metaculus here!

- What will the highest level of Bitcoin dominance be in 2025?

- Will China and the EU Reach a Trade or Tariff Agreement in 2025?

Ready to trade the future? Follow us on X @AdjacentNews for real-time market takes. Explore adj.news for the full scoop, or tap our API to crunch the data yourself. Chat trades and tactics with the crew on Discord—where the sharpest minds meet. Got questions? Hit up [email protected]. Adjacent’s your edge in the InfoFi game—plug in, profit, and shape what’s next.