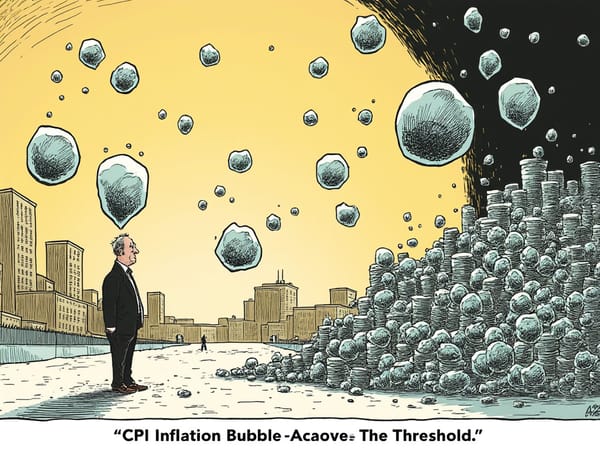

CPI Inflation Bubbles Above the Threshold: What's Next for the Economy?

The Hawkish Shift in Predictions

Market participants are taking notice of a significant uptick in probability, with predictions suggesting a steady momentum towards a higher-than-expected inflation rate. The prospect of the core CPI inflation rate topping 3.2% by the end of September 2024 has sparked heated discussions among economists and traders. The shift from a marginal projection to a more robust likelihood is evident in the trends displayed by forecasting platforms. The recent developments are underscored by a host of factors, including the waning effects of the 2022 economic downturn, ongoing supply-chain disruptions, and persistent demand for goods and services. As analysis by JPMorgan suggests, the current inflation dynamics may be poised for a second leg of growth, a notion that is causing concern among investors and policymakers alike.

The Conundrum of a Post-Pandemic Economy

Since the onset of the pandemic, many economies have navigated uncharted waters, grappling with the consequences of widespread lockdowns and fiscal stimulus packages. These responses, while necessary at the time, have come at a cost – creating pent-up demand and thereby swelling prices. As economic activity picks up, it's clear that the underlying supply chains have been unable to keep pace, driving inflation rates upward.

Monetary Policy's Crucial Role

Market Pressure and the Federal Reserve

The renewed focus on inflation has sparked a flurry of speculation about the Fed's potential response. As the central bank grapples with the dual objectives of maintaining price stability and fostering economic growth, investors are anticipating a clearer direction. Will the Fed choose to tighten monetary policy to curb inflationary pressures, or continue to ride out the raised CPI levels, potentially allowing inflation to exceed the desired threshold? This delicate balancing act will have far-reaching implications for the economy and the markets.

The Consequences of a Higher Inflation Rate

A sustained inflation rate above 3.2% would have significant repercussions for the economy, consumer behaviors, and businesses alike. While a moderate level of inflation is often seen as a sign of a growing economy, excessive inflation can erode purchasing power, compromise the value of savings, and undermine the competitiveness of businesses. Moreover, it may lead to faster-than-expected interest rate hikes, squeezing the buffer zone for consumers and businesses, further stirring the economic pot. In a bid to grapple with these complexities, the market is closely watching the Federal Reserve's pronouncements on rate movements, White House hints on economic policy, and cautionary signals from various analyses. Analysts such as those from Morningstar point out the interconnectedness of economic calendars, corporate earnings, and broader trends that impact.