Crossposted from prophetnotes.com/global-outlook-trust-your-guts

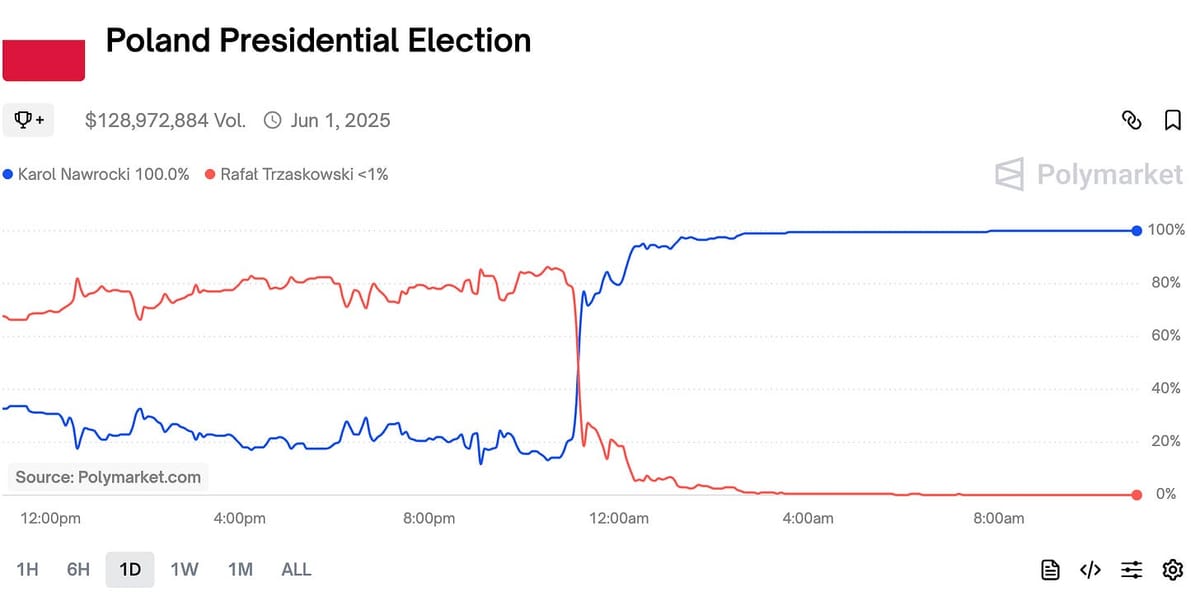

My head is still spinning after a massive roller-coaster of an election in Poland. When I put out my updated thesis with 55/45 odds in favor of Nawrocki last week, I knew the election will be close. It was in fact so close, that the first exit poll favored Trzaskowski with an extremely slim margin of 0.34%.

I wouldn’t be honest if I said I wasn’t anxious at that point. I knew that exit polls were especially inaccurate this time as 20% of respondents refused to answer them, but it hardly soothed my emotions having 25% of my bankroll on Nawrocki.

Yet only 2.5 hours later, the first late poll was published that took into account early vote count vs assumptions and proved what I calculated a week before:

Voter sentiment doesn’t change in two weeks, even under pressure from MSM hate campaign. And it may soon turn out that the Polish political drama is far from over. More on this (and other topics coming into summer) in my next article.

Now let’s zoom out of Poland and see what else was happening in the world.

Weekly Outlook

The news of the week was surely Ukrainian attack on Russian planes, but before I touch this topic, there were plenty of interesting developments in and outside US.

US Inc.

Starting on the war footing, Pete Hegseth spoke at the Shangri-La forum in Singapore where he took a pretty adversarial stance towards China. He spoke about spending more on arms, about inviting allies, old and new and about Taiwan. The US is getting ready for the possibility of Chinese aggression towards Taiwan. Hope is peace through strength, but hope is rarely enough.

Official timeline is readiness till 2027, we already saw the US moving some equipment nearer the Asian theater, we will see more of it in 2026.

Moving to domestic issues, Trump is busy on immigration and… Harvard. For one thing, the administration reportedly ordered American embassies to stop scheduling student-visa appointments in preparation for an expansion of social media vetting requirements. Additionally Trump has pushed to deport foreign students, especially Chinese.

On top of that in the continuing drama with Harvard, the administration is reportedly preparing to sever all remaining contracts with Harvard, totaling about $100 million.

And lastly on immigration, the Supreme Court allowed Trump to revoke a parole program that gave legal protection to 500,000 migrants from Cuba, Haiti, Nicaragua and Venezuela, allowing the administration to continue its fight against illegal immigration.

On top of these developments, Elon Musk announced he would step down from his governmental function. Contrary to my initial beliefs, after issues with Tesla surfaced, it was rumored for some time that Elon will go and focus on his businesses. Now it’s a reality. Elon also mentioned he will no longer focus on financing politics. In my opinion he realized that no one in politics actually wants to cut spending, after seeing the big beautiful bill.

The Americas

Up north, in the 51st state (joke) King Charles opened Canada’s parliament, officially marking the start of Carney’s government. In spite of Trump’s recent comments around the golden dome project, Canadian prime minister doubled down on his country sovereignty so we are bound to see more back and forth between the two.

Down south, Argentina raised $1 billion from foreign investors through local currency debt. It’s the first time in seven years that Argentina issued bonds to foreign investors. These specific ones offer 29.5% coupon and aim to boost country’s currency reserves. You can say whatever you want, but Milei is doing something good for the coountry.

Asia

I mentioned Shangri-La speech in the US Inc. section, but I’m confident that it didn’t sit well with China. What can I say, general tensions in the region are expected. Nothing else to report (for now). China risk index looks pretty low now though:

Middle East & Africa

It’s all the same in the Middle East. Israel is continuing its operation in Gaza and confirmed that its forces had killed Mohammed Sinwar, the chief of Hamas in Gaza and younger brother of Yahya Sinwar. While the operation is ongoing, two things are happening at once:

- more and more countries are denouncing the offensive with Germany joining the ranks recently. Reportedly Europe is considering sanctions on Israel, however the US is still silent on the matter,

- ceasefire talks are ongoing, but Hamas refuses to accept new Witkoff outline as it doesn’t include the end of the war. Tough choice for Hamas as giving away hostages equals giving away leverage and they are aiming to, at least personally, come out of the situation with a minor victory.

The US reaction on ceasefire rejection was unsurprising - Witkoff called it totally unacceptable. I believe now that what I’ve written above about Hamas leverage starts to be common knowledge. The ceasefire proposal was just a move to soften Israeli image among widening criticism. This and the aid program coordinated by Israel.

Ceasefire No odds still have plenty of room to react to the situation. I guess that some traders are just hoping and waiting for the official collapse of the talks.

Moving to Iran, we just might see some progress. Ahead of the sixth round of US-Iran talks, it is rumored that Iran will allow American members of the UN’s watchdog to inspect its nuclear sites. At the same time International Atomic Energy Agency says that Iran increased its stockpile of highly enriched uranium by half over the past three months.

It is obvious that we know close to nothing in terms of real developments during the talks, but the mere fact that they are still ongoing is a good indication of future success. Especially since the rhetoric around the deal is slowly softening. I like these odds:

Europe

In terms of the Ukraine front it was truly a massive week. Starting with international cooperation, Merz announced that the two countries would produce long-range weapons that could be used without any limitations in the war.

Additionally, on Sunday, Ukraine have destroyed at least 41 Russian planes, using drones that it smuggled far over the border. The massive attack come sin the wake of supposed Russian summer offensive, rumored to include additional 50,000 Russian troops. That being said, Russian military offensive doesn’t look too promising:

I surely won’t be the first to say that the events of last week deemed today’s peace talks useless - happening in Istanbul they lasted less than two hours and yielded close to nothing. Unless you count a loose promise of a prisoners’ exchange. But it hardly puts us closer to peace.

Keeping up with the war climate, Britain pledged to build six new arms factories under plans laid out in its 10-year Strategic Defense Review. With the cost of $2 billion, they will help Britain to procure 7,000 long range missiles.

Now back to peaceful regions - as I said in the beginning, Karol Nawrocki, the right-wing candidate, narrowly won with left-wing Trzaskowski, setting the stage up for further problems in the Polish government. Besides including the Polish topic in my next deep dive, I’ve also done a nice interview for Polymarket, available here.

Moving to more domestic stuff, there was violence in both Liverpool and Paris. Both after soccer victories, former after the Premiere League victory and latter after Champion’s League victory. There were some casualties and both countries said they were investigating the matter.

Lastly, German cabinet approved new proposals to restrict immigration, showing that Merz is applying some of AfD’s proposals. Interesting, but Bundestag still needs to approve these.

Business, Finance & Economics

The silent news of the week in finance is that OPEC+ said they would further increase production. It may come as a shocker to some, but in my opinion they are just keeping the price low enough for the US to not expand production. Challenge me on this as there is no prediction market to bet on, but soon enough you’ll see that US production is not really growing.

In the meantime American consumer spending lowered in April as tariffs took effect. Y/y growth was at 2.1% vs 2.3% in March. In addition imports dropped 20% in April, which lowered US recession odds thanks to net exports impact on GDP - is it true? We shall see:

Staying in the world of finance, CPI in France rose only 0.6% y/y pushing the ECB to further lower eurozone rates. The fall was driven mainly by lower energy and services costs.

Lastly in business, the NYT agreed to licensing deal with Amazon to train AI models using its articles. This comes shortly after NYT sued OpenAI for similar thing without approval. Interesting.

Tariffs

Coming to tariffs, we had a pretty wild week. After the United States Court of International Trade blocked Trump tariffs, a federal court reinstated them on appeal, but the case is far from over. Supposedly the Supreme Court is due to receive the case. Definitely TACO didn’t sit well with Trump.

In the meantime we heard that the tariffs talk witch China derailed with both sides accusing each other of breaking the agreement. Bessent said the talks have stalled and I can see Trump going along with it. As always, we know nothing Jon Snow, but we can only guess based on official comms.

Lastly, Trump fueled by TACO comments, doubled aluminum and steel tariffs to 50%. New rates will come into effect on Wednesday. All in dire hopes to raise domestic production.

Wrap up

And that’s all for today. While I’m taking a victory lap on Polish election, new events are brewing so stay tuned for the next deep dive on summertime and somewhere this week my article on tips & trick for Polymarket trading will come in as well.

Stay strong and see you soon!