Hi! We will be re-launching soon and this is the first of many improved market newsletters. Also check out the new and improved Adjacent News API! The Adjacent News API provides robust access to data and prediction markets across multiple platforms, along with related news and market analytics. If you are interested in using email [email protected] for a API Key.

TL;DR:

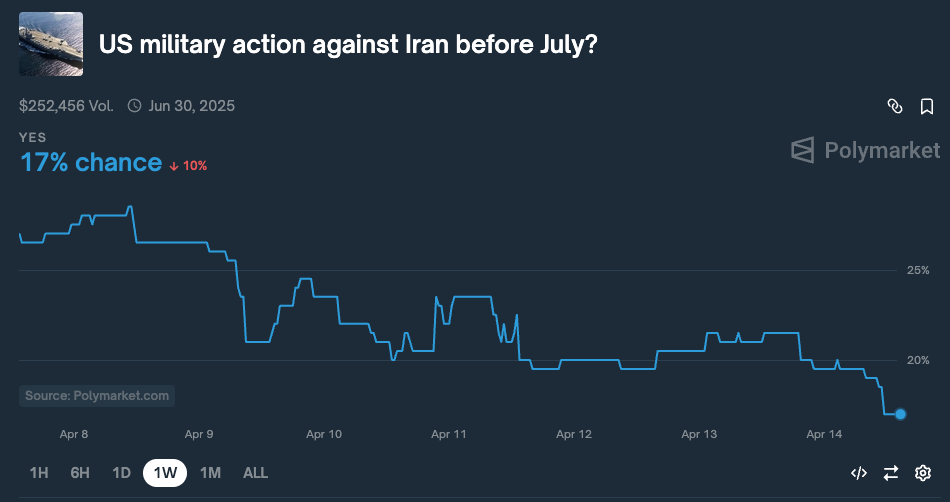

- US-Iran conflict probability decreasing: Polymarket shows 17% chance of US military action before July, down from 27% last week, following "positive" talks in Oman

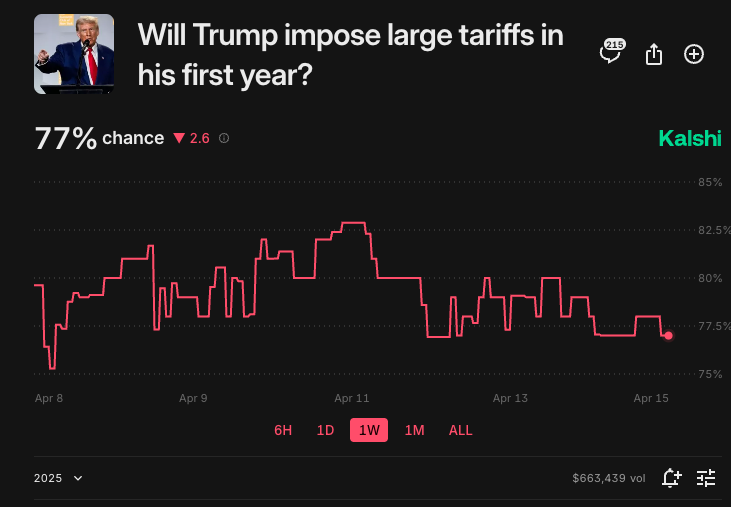

- Trump's 90-day tariff pause and exemptions for electronics shift market expectations: 200% China tariff by June down to 15%, large first-year tariffs down to 77% from 87%

- Metaculus forecasts Q4 2025 average US tariff rate at 8.6%, up from 4.5% in December, despite temporary exemptions

- US-China trade deal chances stand at 40% by June, as China's economic challenges (20% youth unemployment, property slump) create dealmaking incentives

- Negative US GDP growth in 2025 probability decreased from 59% to 48% in thinly-traded market, suggesting cautious economic optimism despite policy uncertainties

- The Adjacent community launched the following question last week, Will the yield on 10-year U.S. Treasury notes exceed 5% for at least one month in 2025? Make your forecast today!

Market Snapshots

- US military action against Iran before July? 17% chance (Polymarket)

- Will the United States and Iran sign a new agreement restricting Iran's nuclear program before 2029? 23% chance (Metaculus)

- Trump imposes 200% tariff on China before June? 15% chance (Polymarket)

- Will Trump impose large tariffs in his first year? 77% chance (Kalshi)

- What will be the average tariff on goods entering the United States for Q4 2025? Forecast 8.6% (Metaculus)

- US-China trade deal before June? 40% chance (Polymarket)

- Negative GDP growth in 2025? 48% chance (Polymarket)

Event Breakdown

The likelihood of conflict with Iran: The rhetoric between the United States, Israel, and Iran continues to heat up, but the situation remains fluid with diplomatic efforts ongoing. Several factors contribute to the perception of heightened risk. For instance, The Trump administration has taken a hardline approach, emphasizing that Iran must not acquire nuclear weapons and backing this with threats of military action, often highlighting Israel’s potential role in any strike. Iran has accelerated its uranium enrichment to near weapons-grade levels, reducing its breakout time for a potential nuclear weapon to weeks, according to some estimates. Iran’s weakened regional position—due to the collapse of the Assad regime in Syria, losses in Hezbollah’s leadership, and Israeli strikes on Iranian proxies—may make it more vulnerable but also more defiant, potentially increasing the stakes for miscalculation. In spite of all of that, movement across prediction markets leads one to believe that the probability of conflict may actually be decreasing. For instance, Polymarket’s “US military action against Iran before July?” is down to 17% from 27% a week ago. Similarly, on Metaculus’ forecasting platform, Will the United States and Iran sign a new agreement restricting Iran's nuclear program before 2029?” has slowly risen to 23% up 4% from the end of March. Recent prediction market movements in a more dovish direction are likely a result of the high-level US-Iran talks in Oman on April 12 which were described as “positive” and “constructive,” with both sides agreeing to continue discussions.

Related markets & forecasts:

- US military action against Iran in April? (Polymarket)

- Khamenei out as Supreme Leader of Iran in 2025? (Polymarket)

- US-Iran nuclear deal in 2025? (Polymarket)

- Israel military action against Iran in April? (Polymarket)

- Israel military action against Iran before July? (Polymarket)

- Will Iran possess a nuclear weapon before 2030? (Metaculus)

Trump’s Tariff Pause Shifts Trade Outlook: On April 9, 2025, Trump paused his tariff rollout for 90 days, followed by April 11 exemptions for high-value goods like chips and smartphones, retroactive to April 5. Polymarket’s “200% China tariff by June” odds fell to 15%, with volume at $35.7K, while Kalshi’s “Will Trump impose large tariffs in his first year?” dropped from 87% to 77% ($663K volume).

The Metaculus community forecasts the average tariff on goods entering the United States for Q4 rose to 8.6% from 4.5% since December. Some see this as Trump dodging smartphone price hikes for political purposes, but China’s strained economy—20% youth unemployment, property slump—hints at dealmaking room (Polymarket: 40% for US-China trade deal by June). That said, U.S. Commerce Secretary Howard Lutnick told ABC's This Week host Jonathan Karl that smartphones, computers, chips, and other consumer electronics may soon be subject to separate tariffs in a month or so, suggesting that the exemptions announced Friday evening are only temporary.

Related markets & forecasts:

- When will Trump end his tariffs against China? (Kalshi)

- What will the U.S. tariff rate on China be on Apr 30, 2025? (Kalshi)

Long-Tail Radar

Negative GDP growth in 2025? (Polymarket): A thinly-traded prediction market on negative US GDP growth in 2025 has shifted from 59% to 48% probability over the past week. This April 3rd-launched market, with just $18,300 in volume, exemplifies how long-tail markets can offer early signals of changing economic sentiment.

Traders appear increasingly optimistic despite several risk factors, weighing trade policy uncertainty, declining confidence, tight monetary policy, inflation, and potential labor constraints against positive fundamentals. The US economy's resilience is supported by strong consumer spending, low unemployment, and potential policy boosts from deregulation and tax cuts. While limited liquidity means prices can be volatile in such markets, they often capture nuanced perspectives before mainstream forecasts reflect these shifts.

Questions we asked

Follow the Adjacent community on Metaculus here!

- Will the yield on 10-year U.S. Treasury notes exceed 5% for at least one month in 2025?

- Will the market capitalization for USDT & USDC stablecoins surpass $300 billion USD by June 30, 2026?

Ready to trade the future? Follow us on X @AdjacentNews for real-time market takes. Explore adj.news for the full scoop, or tap our API to crunch the data yourself. Chat trades and tactics with the crew on Discord—where the sharpest minds meet. Got questions? Hit up [email protected]. Adjacent’s your edge in the InfoFi game—plug in, profit, and shape what’s next.