For finance guys, central bankers are like gods. Their decisions, and most importantly their words, determine the fate of their positions. A simple “yes” can move entire markets. There is this whole aura created around their stance. It’s amusing how something so simple can have such a detrimental effect.

It is possible, because since the dawn of central banking, bankers were given political independence. They are nominated by the president, but POTUS has no power over them.

However, over the years there were bankers that aligned with the government and bakers that were openly defiant. In financial terms it’s called either fiscal dominance or monetary dominance. Either can be forced to some extent, but ultimately, at least in America, the government was always weary of pushing too hard.

Up until now. Since January 20th, Trump has been putting pressure on Jerome Powell to lower rates. From calling him names (apparently Trump’s favorite tool) to actually threatening to fire him.

Powell, as a proper lord of finance, is resisting the pressure for the time being. But can he do it till the end?

Intro

I think he can. I think he must and I think he knows it. So when I’m looking at this market, my question is not about what I think will happen, because I have a fairly good idea about it.

My question is, what can happen that can derail my bet. There are essentially 3 scenarios:

- Powell resigns: either from his own accord (incl. health problems) or by being forced out.

- Trump outright fires him: this would result in the biggest legal challenge of modern times as the president cannot simply fire the Fed chair according to current interpretation of the law

- Trump fires him for cause: this would result in a legal challenge as well. However, this scenario is materially different than Scenario 2 as in this case, Trump would be moving through the approved legal path. The result would be determined by the actual challenge and how Powell responds to it.

Voluntary Resignation

When I was thinking about this scenario, I had sever ideas of what might make Powell resign. For baseline, I consider him as principled, having a legal degree and a history of working in financial industry.

Some people could say that his decision to cut 50bps in September 2024 was politically motivated, but this argument is flimsy. The overall expectation was of a 25bps cut back then, but some analyst noted that the Fed might have been late in its decision to cut. The Fed cut two more times in 2024 (both cuts post election).

Taking that into account, I have 3 basic scenarios for a “voluntary resignation”:

- Death or serious health emergency.

- Resignation due to political pressure.

- Resignation due to blackmail.

Death or Serious Health Emergency

Based on actuarial life table, Powell has a pretty low chance of dying. Being 72 years old, his probability of dying within a year is at 2.87%, which gives us roughly 1.3% chance of dying till the end of the year.

We should also take into account that Powell has better than average access to healthcare. Being on the conservative side we can put his death or serious health emergency (that is not included in the actuarial tables) at 1.3%.

While not exactly the main focus of the market, we are dealing with an old man here. 1.3% is not insignificant.

Political Pressure

The pressure is already here. To be honest it would be difficult to pressure harder. From name calling, to constant bashing in the media to outright threats of firing him - Trump has done it all. And yet Powell is still here. Additionally, no serious analyst will blame Powell for the monetary policy. I didn’t like him saying that the inflation is transitory a few years ago, but his plan worked to some extent. The inflation is down and the recession was averted for now.

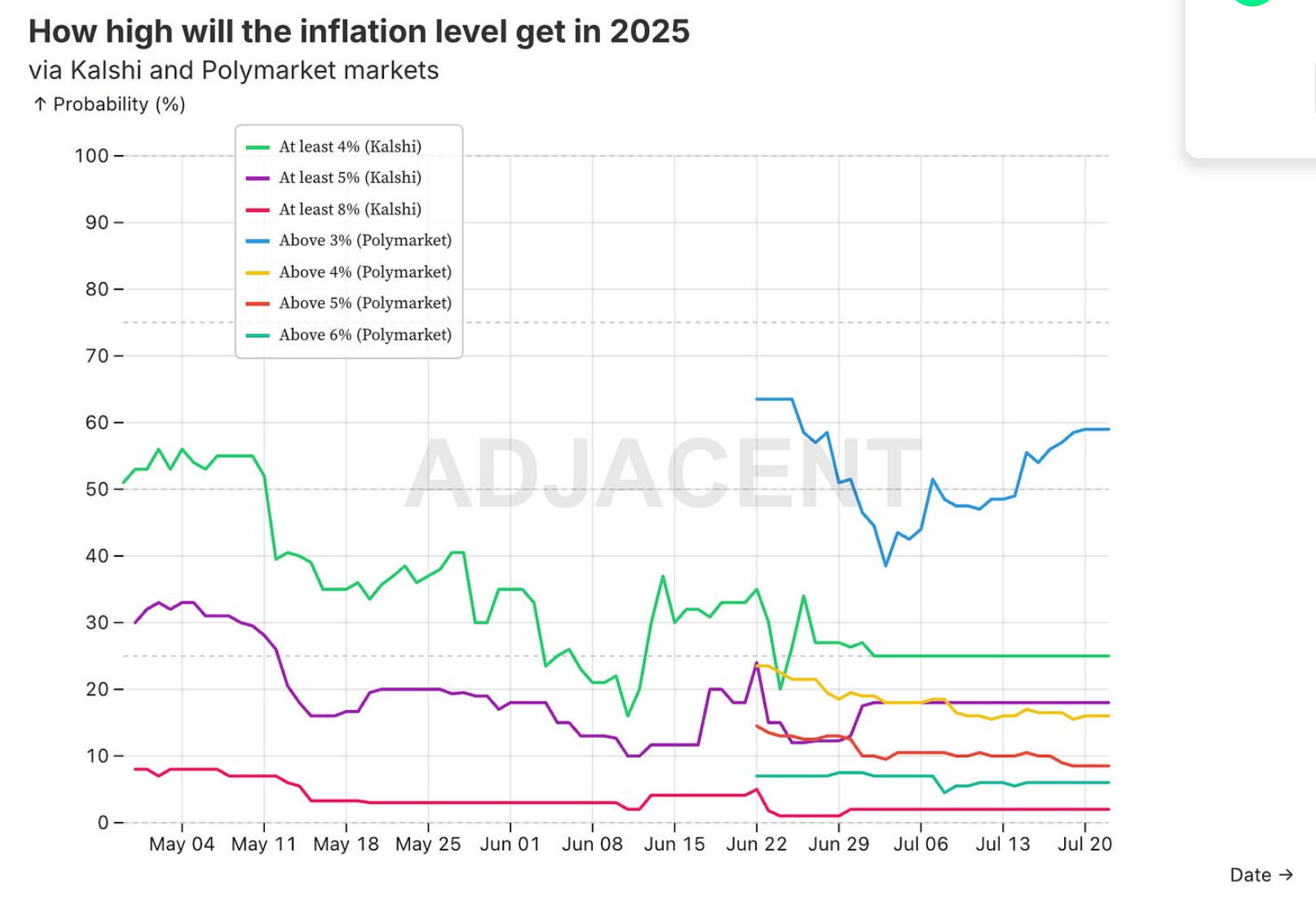

This partly fuels the expected rate cuts, along with policy uncertainty around tariffs:

I can’t blame him and neither can the market.

I don’t see not only a way to increase the pressure, but also Powell suddenly deciding that he had enough. it would have had already happened. Thus the chances of that are 0%.

Blackmail

Blackmail is a curious thing, because even if it happened, we wouldn’t really know. The official message would read “resigned due to personal reasons” or some other empty explanation.

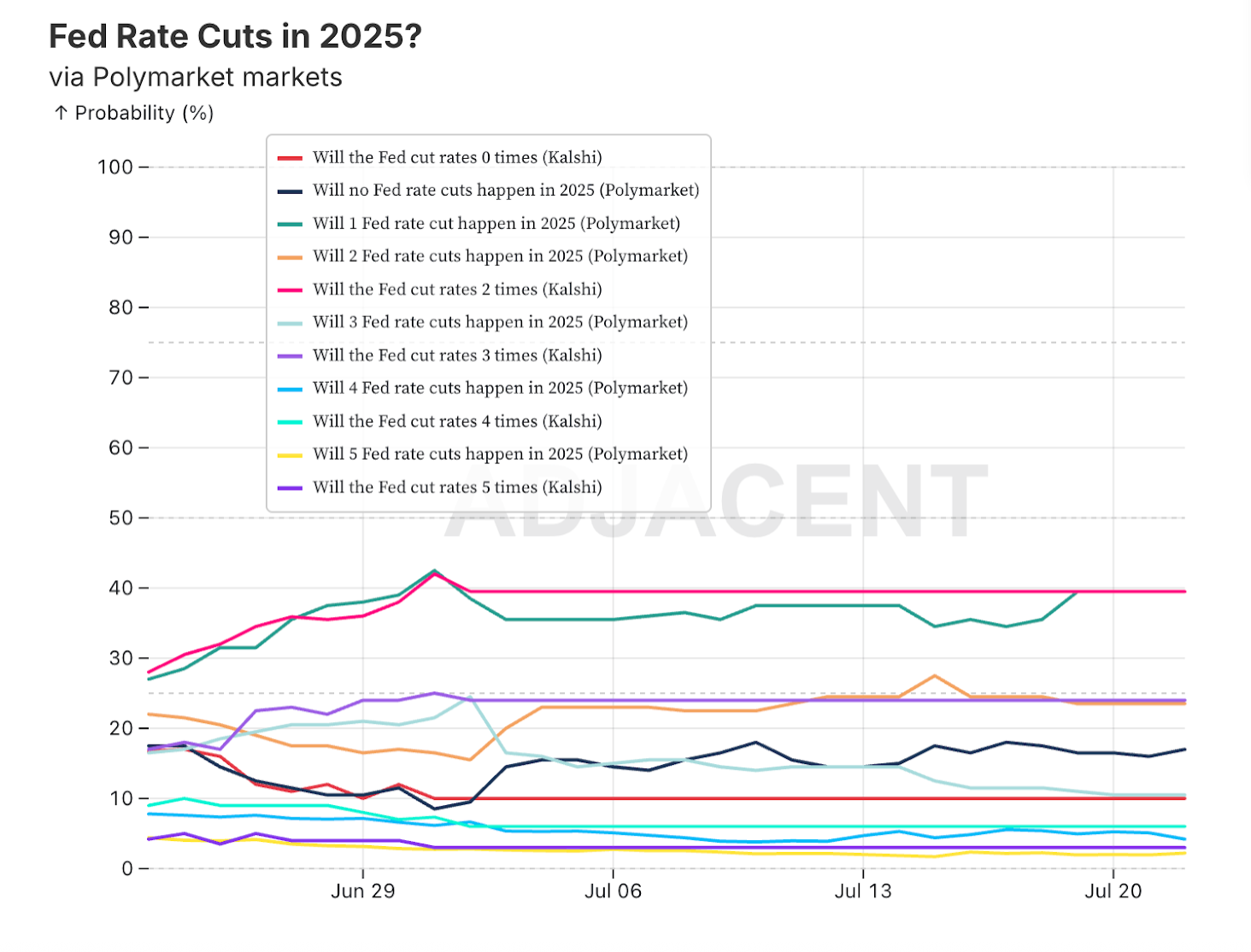

My thesis here is simple though. Trump really needs the rates to go down. His whole plan of cheap debt refinancing hinges on low interest rates. In his mind he also needs to overheat the economy so the effect of the tariffs is somewhat softened. And subsequent inflation and weakening of the dollar is not half bad as it increases the attractiveness of American exports which he wants to grow so badly.

In my opinion it is a somewhat retarded perspective on economics, but whatever. He tries at least and explores additional avenues - like the GENIUS act that aims to create demand for Treasuries by forcing stablecoin issuers to purchase them. At the same time it creates a legal framework for banks to issue their own tokens, further increasing regulated demand. Smart.

But coming back to the topic, lower interest rates are extremely important to Trump. Thus if there was any option for blackmail, he would have already used it. Yet he didn’t so chances of that happening are 0% as well.

Trump Fires Powell

Now we enter some murky waters. According to the law, the president cannot fire a person from the Board of Governors. He can only do it for cause. However it is not explicitly stated that the same applies to the Chairman of the Board of Governors. However, it is implied in the law as well as subsequent Supreme Court rulings.

In theory, Trump could try to fire Powell form the Chairman position, but leave him on the Board of Governors. However this case is not that straightforward.

Let’s say he tries that. Immediately Powell would file for an injunction that would most likely be granted. Then the administration would appeal. Even if the case is expedited, it would take at least a month before a decision is reached.

Then whoever loses the appeal (hint: it’s the administration), petitions the Supreme Court. Even if expedited, the case would take at least 2 months. Best case scenario we are looking at 3-5 months before a decision taking example from election-related cases. Worst case it drags on longer than Powell’s term which ends in May 2026.

There’s over 95% chance Trump administration would lose a case like that eventually. And throughout the months of the process, the financial markets would panic and the economy would crumble. Trump may be wild sometimes, but he’s not your average Polymarket trader aping on the longshot.

But considering it’s Trump, I will give 1% chance it happens. I’m generous.

Trump Fires Powell For Cause

In this case, Trump would go the legal way. Find some cause and fire Powell from the Board of Governors. There was some groundwork made for this as some politicians accuse him of misleading the Congress about the $2.5 billion renovation of the Federal Reserve’s Eccles Building.

However, we all know that the case is extremely weak. There is no corruption, no embezzlement, nothing that could really open the door for the firing with cause.

Realistically, if Trump decides to go this way, the scenario pans out almost exactly the same as the previous one. Powell will fight it and there is over 90% chance he wins in the end. And the financial turmoil will be there for the whole world…

Thus another 1% chance of this happening, once again being generous

Prediction Markets

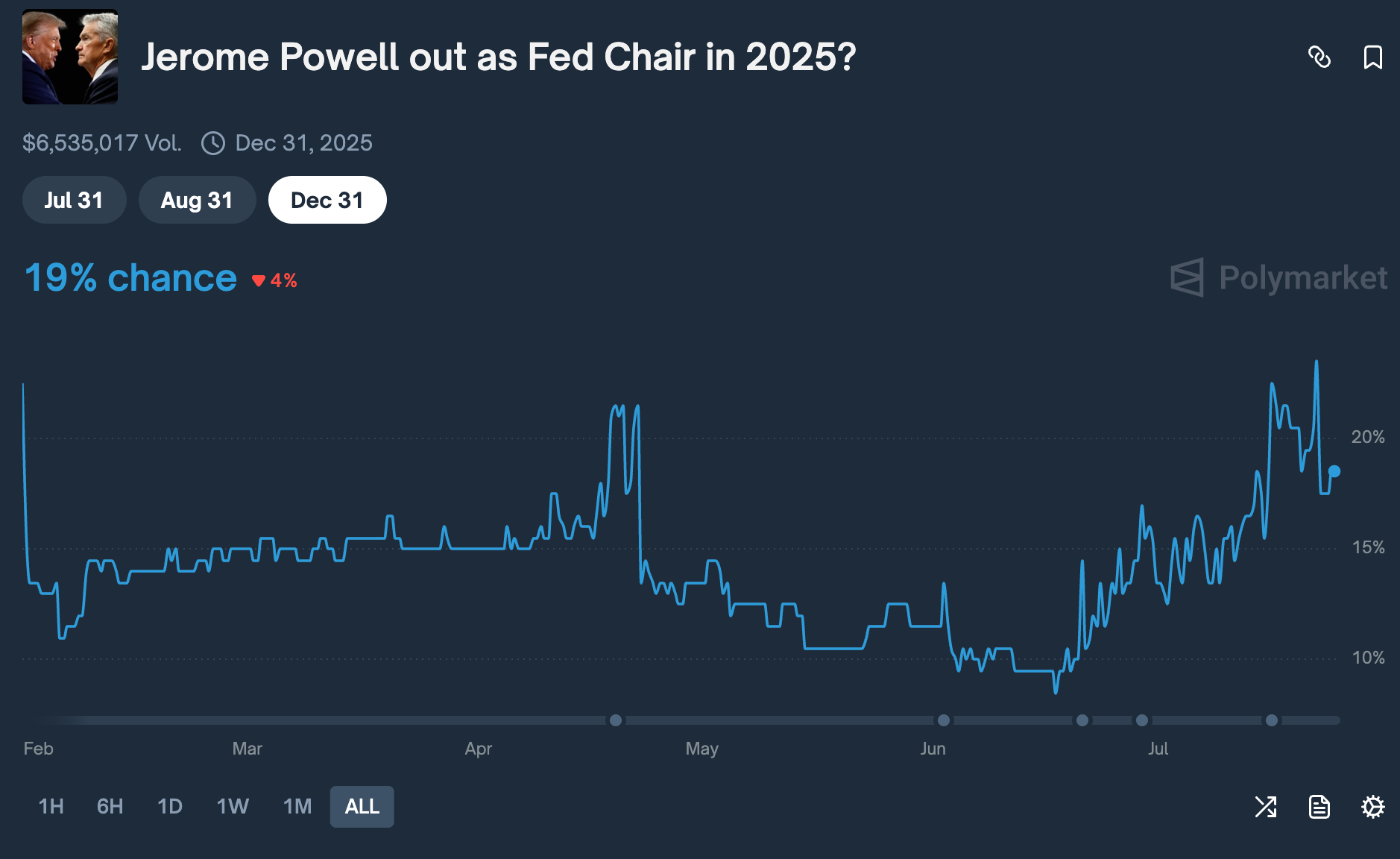

The juicy part. For now I have 2 bets on the situation. The first is the obvious one:

I have ca. 8% of my bankroll on No with average entry price of 73.8c, which I consider a massive deal seeing that my fair odds sum up to 96.7/3.3 fair price. I will be waiting for subsequent spikes, which I expect to see around the FOMC meetings, to buy more as this one is probably the best bond on the platform right now.

Additionally I hold some No here:

With another ca. 2% of my bankroll and fair prices at 98/2, it’s another massive deal funded by Trump posting.

Wrap up

And that’s all. For me the case is extremely simple, but the amount of gaslighting on social media made me compile my thesis. We probably can’t even imagine the turmoil that would happen were Powell fired. Recession is a light word then…

Stay strong and see you soon!