Welcome to another week. Last one was volatile with Iran threats flying by us on an hourly basis. But if you read this, you knew what was coming. Anyway, it was surely a good experiment to see who is a paid shill on X and who is an honest analyst - not many left!

If you value honesty, make sure to subscribe below. If you are already here, thank you and let’s see the world as it is!

Weekly Outlook

US Inc.

The US had a fair share of dramas this week. Starting with ICE and ending with Epstein files, he week was as busy as it gets.

Starting with the most consequential, the DoJ released more than 3 million additional pages of Epstein files. Still millions more were withheld. The Democrats are trying to uncover them too, but the DoJ defends itself by saying these were either too brutal or parts of ongoing investigations.

Comment: what is clear from this drop is that Jeffrey Epstein was a fixer for the elites. He was willing to provide anything and handle anything for a price and it seems he was pretty good at his job. Like Ray Donovan, but also degenerate enough to participate himself.

American Senators initially reached a deal they hoped would avert a partial government shutdown. However the House Democrats later decided to split the DHS from the agreement amid the ICE issues in Minnesota. Now we are up for negotiations as Democrats demand more “safety reforms”.

Comment: Trump went too far in Minnesota and now he will have to make some concessions.

And with the Minnesota situation, first Trump appointed his border czar, Tom Homan, to manage the operations there. And then Trump said his admin would deescalate a bit its crackdown on immigration in Minnesota. He called the killing of Alex Pretti an unfortunate event and promised an honest investigation. For now the agents that shot Alex Pretti are on leave.

Comment: I believe that last week my comments here were not precise enough, as it was pointed out to me by one of you. Alex Pretti didn’t die in violent protests - what I meant (and still mean) is that ICE deployments, followed by protests (some of them violent) and tragic situations like this one have a high potential of happening and repeating this year. It’s the midterms year and Trump needs to show he’s strong on illegal migrants as the deportations are not going as fast as promised. And since the current political division in the US is at its highest, tensions will rise to such levels easily.

The Americas

Good news for Trump admin this week from the western hemisphere as all the countries seem to bend to US will.

Claudia Sheinbaum, the president of Mexico, claimed the cancellation of an oil shipment to Cuba was a sovereign decision rather than a response to American threats. Mexico has become Cuba’s biggest source of oil since the Maduro kidnapping.

Comment: sure it was… Trump is getting his Ws, but will he be able to leverage them for domestic support?

Venezuela passed a law to open the oil sector to foreign companies. Trump now claims that Delcy Rodriguez is doing America’s bidding. Delcy also said she would propose an amnesty law covering the whole chavizmo period. She also announced the closure of notorious El Helicoide prison, where political prisoners have been tortured.

Comment: for now Delcy is hanging on to power while pushing American reforms. But it’s been barely a month since the Maduro kidnapping.

Panama’s Supreme Court ruled to revoke contracts with a subsidiary of CK Hutchinson to run 2 ports at either end of the Panama Canal. The court cited financial irregularities as the main reason.

Comment: the obvious real reason for this ruling is pressure from the Trump administration in relation to Chinese control of the crucial waterway. While there is plenty of work to be done in the western hemisphere to fully eradicate team east, good work was done recently.

Asia

A quiet week in Asia, bar a visit from Kier Starmer.

Starmer had a 4-day visit in China where he was looking to strengthen economic ties. He met with Xi Jinping. For now they announced that Brits will soon be able to travel to China visa-free. The plans for greater economic partnership start with AstraZeneca investing $15 billion in China to expand manufacturing and research.

Comment: Britain is trying to hedge between two great powers, but as it is the case with Canada, it will backfire.

Middle East & Africa

The Middle East was once again the topic of the week as tensions around Iran reached the peak.

Iran has been reportedly getting ready for strikes as regional authorities were given more power in an effort to streamline the management of the country. Iranian officials also traveled to Saudi Arabia and Turkey to press their case.

At the same time Trump was threatening Iran with a massive armada and the US with Israel were teasing strikes on a daily basis. Ultimately though we are now officially in negotiations as both sides are supposedly serious about reaching a deal.

Comment: my update on the situation is coming tomorrow, building on the very correct read of the situation in my last article 2 weeks ago.

Israel has recovered the remains of the last hostage in Gaza. The return of all bodies was a condition to begin the second phase of the ceasefire. Israel is also getting ready to open the Rafah crossing that is supposed to open today.

Comment: the plan is moving forward, I must write about Gaza one day as what will happen there in the next 5-10 years will be unprecedented.

Europe

An interesting week on the old continent with quite a few headlines that flew under the radar. Also a one very outrageous piece of news.

Zelensky criticized European allies saying that delays in air defense missiles deliveries had left Ukrainian energy infrastructure more vulnerable amid harsh winter weather. Despite Trump and Putin supposedly agreeing on halting strikes due to cold weather, there is no confirmation from the Kremlin on the agreement.

Comment: this is the winter Putin was waiting for since 2023. Extreme cold that persists for days, combined with attacks on the grid can be deadly for the population and morale. The next 2 months can be crucial regarding the war.

India and the EU signed a massive trade deal. Both will reduce tariffs on more than 95% of goods, hoping to see significant increase in trade between the two (EU counts on doubling exports by 2032). The deal will also include clauses on easing migration restrictions from India to the EU.

Comment: while a trade deal alone is probably a good idea as it secures a huge export market, the mobility agreement looks like a disaster in the making. Europe already has massive migration issues, I’m really not sure adding Indians to the mix will do it any good…

I will quote the Economist here: “Spain will offer legal residency to undocumented immigrants who have lived in the country for roughly six months, an estimated 500,000 people. Spain’s economic growth has outpaced the euro-area average in recent years, thanks in part to its relative openness to immigrants, many of whom are from Latin America. The expedited-residency decree does not need parliamentary approval.”

Comment: it is outrageous that any European publication can put a statement like this to print. Essentially an illegal operation to legalize poor illegal migrants, against the will of the people, through obscure channels vs the parliament. And justifying it by quoting good economic growth (supposedly thanks to these migrants sic!), while 25% of young Spaniards are unemployed… I wonder how will Vox react.

France follows Australia as a bill banning under-15s passed in National Assembly. Now it needs to pass the Senate. Macron wants to see the measure implemented before September.

Comment: while social media are a cesspool of propaganda, disinformation and degeneracy, they also have value, even for 15 year olds. Parents should control their children, not governments. I sincerely hope the bill fails.

Business, Finance & Economics

Some big news (and swings) in the world of finance last week. Very consequential.

Trump announced that Kevin Warsh will be his nominee to become the new chair of the Fed. He is a former Fed governor that is keen on cutting rates (but also on reducing Fed balance sheet, which is not exactly Trump’s wish).

Comment: Warsh is not an extreme pick. While keen to cut, he won’t always see eye to eye with Trump. So we can expect a lot of volatility after May as he tries to build consensus on the board.

Speaking of the Fed, it left the rate unchanged, as expected. However, Powell didn’t provide us with any guidance when it comes to next FOMC meetings.

Comment: Trump will seethe and cry, but he is powerless now. Only 4 months to go.

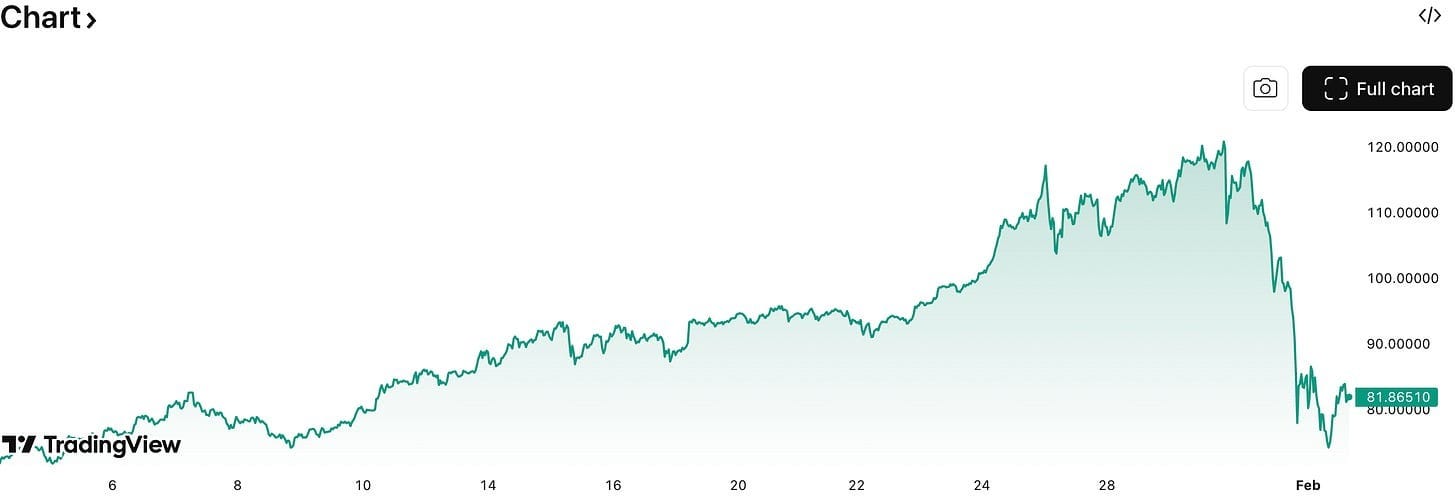

Gold and silver gave back a lot of recent gains as precious metals violently fell after Trump confirmed his Warsh pick.

Comment: there are plenty of theories on what sparked both the move up and down and I won’t LARP here as someone who knows better. But it’s highly suspicious to see a move like that on such a big asset.

German police raided Deutsche Bank’s offices in Frankfurt and Berlin on suspicion of money laundering.

Comment: just another day for the meme investment bank. As always though, it will come out of it with a slap on the wrist.

Zijin Gold, a Chinese mining giant, said it would buy Allied Gold, a Canadian rival with big operations in Africa, for around $4bn.

Comment: Trump won’t be happy about that one for sure.

Amazon said it would cut 16,000 jobs in the second round of layoffs in 3 months. The firm has not ruled out further cuts.

Comment: it is brutal in the corporate world, but we can expect to hear such news for the foreseeable future. AI is nowhere close to AGI (or even an autonomous coder), but it is good enough to significantly raise productivity.

Tesla ends production of S and X models as it scales its robot production. It also had a first year down in terms of revenue amid the Chinese competition. And supposedly there is a merger coming between some of Musk’s companies.

Comment: Elon Musk is the master of getting government contracts, he will figure something out to maintain Tesla’s share price. After all his entire wealth depends on it.

Tariffs

Trump said he would increase some tariffs on South Korea, mainly cars, lumber and pharmaceuticals, from 15% to 25% as the country struggles to meet its commitment to the US.

Comment: just another negotiation, Trump is pressuring South Korea.

Wrap up

And that’s all for the week. It’s definitely a busy year so when it comes to next content, I expect a January recap to go live by Wednesday as well as an update on Iran to follow by Friday. There is plenty of ground to cover in what is a volatile negotiation between the US and Iran. The previous piece covered the overall context and developments till an official negotiations start. Now it’s time to see where it can go.