Check out the new and improved Adjacent News API! The Adjacent News API provides robust access to data and prediction markets across multiple platforms, along with related news and market analytics. We’re empowering developers to build powerful applications that leverage market data, perform advanced search, and access insightful analytics.

TL;DR:

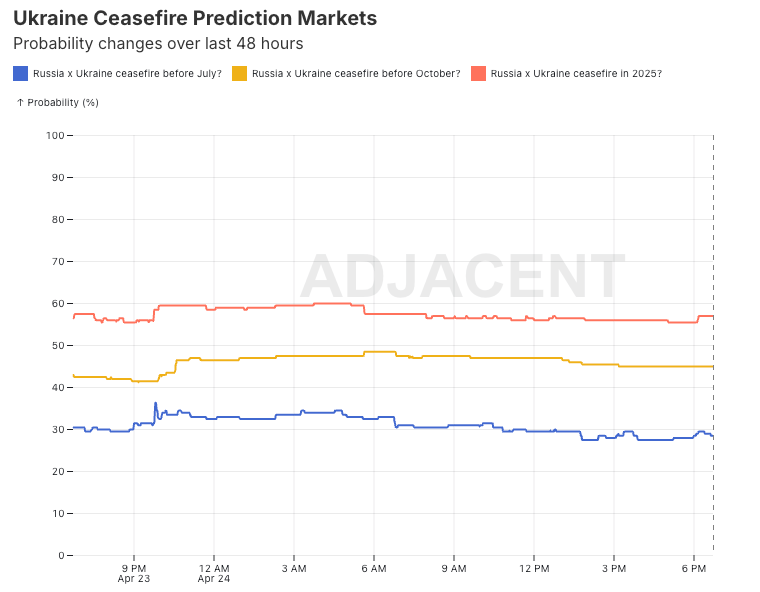

- Russia’s overnight attack, killing 9 and injuring 70, drops Polymarket’s 2025 Russia-Ukraine ceasefire odds to 56% from 64%.

- July 2025 ceasefire odds fall to 28% (from 41%), October to 45% (from 54%), with $8.7M in trading volume signaling trader doubt.

- Ukraine recognizing Russian territory in 2025 at 19% (down from 21%); U.S. recognizing Crimea at 45% (down from 51%).

- Kalshi’s “US credit rating downgrade this year?” market at 43%, with $8,947 volume, reflects trade war and debt ceiling fears amid tariff-driven market turmoil.

Market Snapshots

- Russia x Ukraine ceasefire in 2025? 56% chance (Polymarket)

- Russia x Ukraine ceasefire before July? 28% chance (Polymarket)

- Russia x Ukraine ceasefire before October? 25% chance (Polymarket)

- US credit rating downgrade this year? 43% chance (Kalshi)

Event Breakdown

Kyiv Barrage Dims Ceasefire Hopes: A potential ceasefire between Russia and Ukraine by December 31, 2025, remains a pivotal focus for prediction markets, with Polymarket's "Russia-Ukraine ceasefire in 2025?" market currently at a 56% chance, down from 64% following a devastating Russian missile attack on Kyiv. This escalation, one of the deadliest in months, killed at least nine and injured over 70 in the capital, while other cities like Kharkiv also faced strikes. The assault, involving 70 missiles and up to 150 drones, has dimmed hopes for near-term peace, reflected in market odds shifts.

President Trump condemned the attack, urging Russian President Vladimir Putin to "STOP" on Truth Social, citing the war's toll of "5,000 soldiers a week." He criticized Ukrainian President Volodymyr Zelensky for rejecting a U.S. proposal to cede claims on Crimea, noting it was "lost years ago." Zelensky, in turn, referenced the 2018 U.S. "Crimea declaration" rejecting Russia's annexation, highlighting tensions with the Trump administration's push for a deal. Vice President JD Vance, while in India, advocated for a freeze in fighting to "stop the killing," a move that would favor Russia given its control over significant eastern Ukrainian territory—a key reason for Zelensky’s resistance.

Prediction markets capture this uncertainty. The likelihood of a ceasefire by July 2025 has fallen to 29% from 41% in 48 hours, while October 2025 odds dropped to 45% from 54%. Related markets also reflect pessimism: "Ukraine recognizes Russian sovereignty over Ukrainian territory in 2025?" is at 19% (down from 21%), and "U.S. recognizes Russian sovereignty over Crimea in 2025?" sits at 45% (down from 51%). These shifts, with trading volumes of nearly $8.7M for the 2025 ceasefire market, signal trader skepticism amid escalating violence and diplomatic gridlock.

The interplay of U.S. policy, territorial disputes, and battlefield dynamics will shape ceasefire prospects. A Russian advantage in eastern Ukraine raises stakes for Zelensky, while Trump's push for a swift deal faces resistance from Kyiv's insistence on territorial integrity. Markets suggest cautious optimism for a longer-term resolution by year-end but highlight near-term hurdles. Key questions remain: Can U.S. diplomacy bridge the Crimea impasse? Will Russia’s battlefield gains force Ukraine’s hand, or deepen the stalemate? Track these odds on

Polymarket for real-time insights into this high-stakes geopolitical drama.

Related markets & forecasts:

- Russia x Ukraine ceasefire before July? (Polymarket)

- Russia x Ukraine ceasefire before October? (Polymarket)

- Ukraine recognizes Russian sovereignty over Ukrainian territory in 2025? (Polymarket)

- U.S. recognizes Russian sovereignty over Crimea in 2025? (Polymarket)

- Zelenskyy out as Ukraine president before July? (Polymarket)

- Will Volodymyr Zelenskyy resign? (Kalshi)

- Will Ukraine hold a presidential election this year? (Kalshi)

- Will Temporary Protected Status for Ukraine end this year?

Long-Tail Radar

US credit rating downgrade this year? (Kalshi): Kalshi’s “US credit rating downgrade this year?” market, with a lean $8,947 in volume ($61,019 total) and $4,556 in open interest, is a low-liquidity market that captures simmering macro anxieties. This market trades on whether any of the big three credit rating agencies—Standard & Poor’s, Moody’s, or Fitch—will downgrade the US credit rating from its current AA+ (S&P, Fitch) or Aaa (Moody’s) by December 31, 2025.

In the chart below, you’ll notice the spread between bid price (blue) and ask price (orange) widened significantly on the 21st, when the Dow fell 972 points (2.48%), the broader S&P 500 fell 2.36%, and the Nasdaq slid 2.55%. The spread has since closed as markets have recovered over the last few days.

Why is this market intriguing? Its low liquidity belies its sensitivity to escalating trade wars and fiscal pressures. Trump’s 2025 tariffs have sparked a stock market wipeout in the trillions and fears of a US recession (IMF’s 1.8% growth forecast, down from 2.7%). These tariffs inflate costs, potentially swelling deficits as GDP growth slows, a red flag for rating agencies already wary of the US’s 120% debt-to-GDP ratio. S&P’s April 2025 warning of a possible downgrade, citing “gargantuan debt levels” and political dysfunction, fuels this market’s relevance, as does buzz about rising US debt default insurance costs (70 bps). A debt ceiling standoff, looming in January 2025, could further erode confidence, echoing Fitch’s 2023 downgrade after similar brinkmanship.

The implications are profound. A “Yes” outcome—a downgrade—could spike Treasury yields (currently 4.3%), raising borrowing costs for consumers and businesses, and amplify inflation (CPI at 3%). It might also weaken the dollar, boosting hard assets like Bitcoin, as seen in its recent gains. A “No” outcome signals fiscal resilience, possibly via tariff exemptions or spending cuts, calming markets. For probabilistic thinkers and hedgers, this market distills trade war fallout, debt sustainability, and political gridlock into a single bet. Track it on Kalshi.

Questions we asked

Follow the Adjacent community on Metaculus here!

- Who will Trump nominate as next Fed Chair?

- Will the U.S. Treasury Issue BitBonds by December 31, 2028?

Ready to trade the future? Follow us on X @AdjacentNews for real-time market takes. Explore adj.news for the full scoop, or tap our API to crunch the data yourself. Chat trades and tactics with the crew on Discord—where the sharpest minds meet. Got questions? Hit up [email protected]. Adjacent’s your edge in the InfoFi game—plug in, profit, and shape what’s next.