I wrote a piece explaining that China, Russia, Iran and North Korea are in the alliance that aims to challenge the US and western hegemony. Back then, the idea was still heterodox if not even conspiratorial.

Despite some analysts seeing it a lot earlier (earliest account I found was in 2014!), the mainstream rejected the idea that US hegemony can be challenged. Up until now.

It’s no longer a conspiracy, a wild prediction - it’s out there in the open. And those who didn’t see it coming, won’t help you understand it. But those who did can help you see what’s coming next.

Intro

Today we will go over a brief history of China, the US, and how we ended up where we are today. It’s a complex story, but essential to understand where we are going. It’s a story of amazing progress and gross negligence.

It’s a story that is far from having a defined ending. And it’s a story that won’t end anytime soon.

So pour yourself a cup of arabica coffee from Ethiopia with locally produced milk, along with a dark chocolate snack made from cocoa beans from Ivory Coast that were processed in Switzerland and enjoy - all that came to you fueled by Arabian oil, on a Chinese ship, made from Australian steel. Can you see where this is going?

The West Had It Good

The end of the Cold War was a truly magical moment for the west. After decades of technological and economic struggle, several wars, constant espionage activities and a constant scare of a nuclear war luring around the corner, it won.

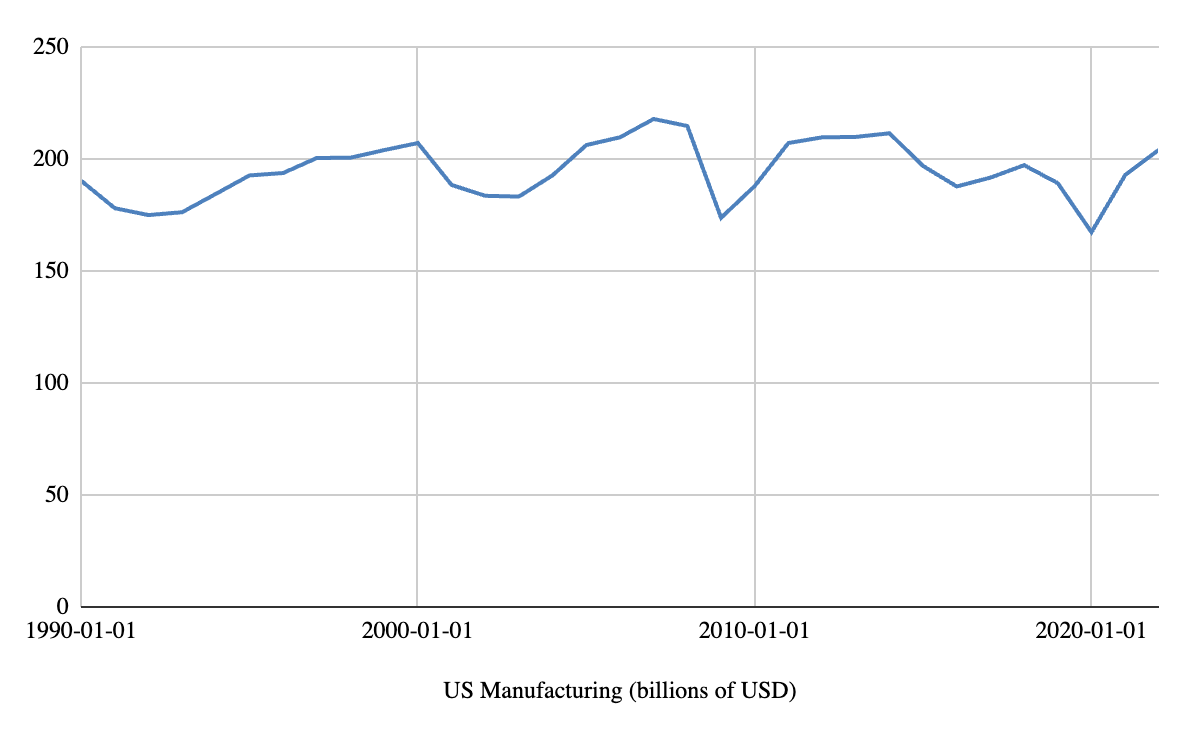

The Soviet Union was no more. And the US had it all. It won the competition for global hegemony. It was leading in new technologies - from military to chips manufacturing. Fueled by decades of military spending, it was a manufacturing powerhouse (I might be exaggerating a bit, but you understand the point).

The global institutions flourished along with technological progress. But at the same time a sort of complacency hit.

The Post Cold War Order

The US has spent decades building out the global order. It used its vast navy to have direct influence around the world. And it created a network of international institutions that provided a clear set of rules for any country that wanted to accept US hegemony:

- NATO,

- UN,

- IMF,

- World Bank,

- WTO,

- WHO,

- and many more.

These were of course all de facto controlled by the US. And their aim was to create a global system of economies, supply chains, politics, etc.; aka globalization. All under US influence, and all made in the US picture - democracies with free market economy, using USD for international trade.

However, like all political systems, it relied on power. Naturally, the more powerful you were as a country, the more benefits you were able to reap from it. The US was set to gain the most as the provider of security and reserve currency. The US was also the biggest economy in the system, so it was already positioned that way.

Other countries in the system also battled for positions - there were core allies (eg. Britain, Germany, France, Italy, Japan), important allies (eg. South Korea) and lesser allies (eg. Eastern Europe after the fall of USSR). Then there were manufacturing sweat shops (eg. South East Asia and China) and complete shitholes used for specific farming and mining (eg. Africa). Plus quite a few completely irrelevant countries.

Each had less and less benefit from participating in the system for a simple reason - for someone to have an outsized benefit, someone else needs to have a loss.

Don’t get me wrong here - you can’t have an economic miracle in a day, or a year. And some countries did advance. But this advancement had a price - it was the American (and core allies) companies that had full access to the new market, that could prevent domestic entities from growing and in practice monopolize industries. It was Americans (and core allies) who reaped the most benefits through stock ownership and cheaper production that they consumed.

The Western Mistake

Any sustainable growth requires control over resources. Food, metals, rare earth elements, oil, gas, etc. Then processing. Then building and logistics. And so on.

Throughout the years though, the west did more and more outsourcing. First it was simple manufacturing. Then as development progressed, the more complex production started moving as well. Why? Because it was cheaper to pay a Chinese 1/10 of American salary and then transport the goods.

Add to it environmental issues. For example rare earth extraction and processing is causing significant pollution in the vicinity. Why should the western lands get dirty when Chinese can do it and be happy?

However by doing so, the west started losing control over more and more parts of the supply chain. Not only the less significant parts like plastic production, but critical ones.

Some of the resources and processes are needed to develop eg. weapons or heavy equipment. When you cede control over these to other countries you are giving them leverage - an actual option to challenge the hegemony. And some countries used it to their advantage (or so they think).

The Chinese Situation

China is unique, as it has both the means and a reason to challenge the US. Reason is a pretty complex matter, but we can sum it up to three main issues:

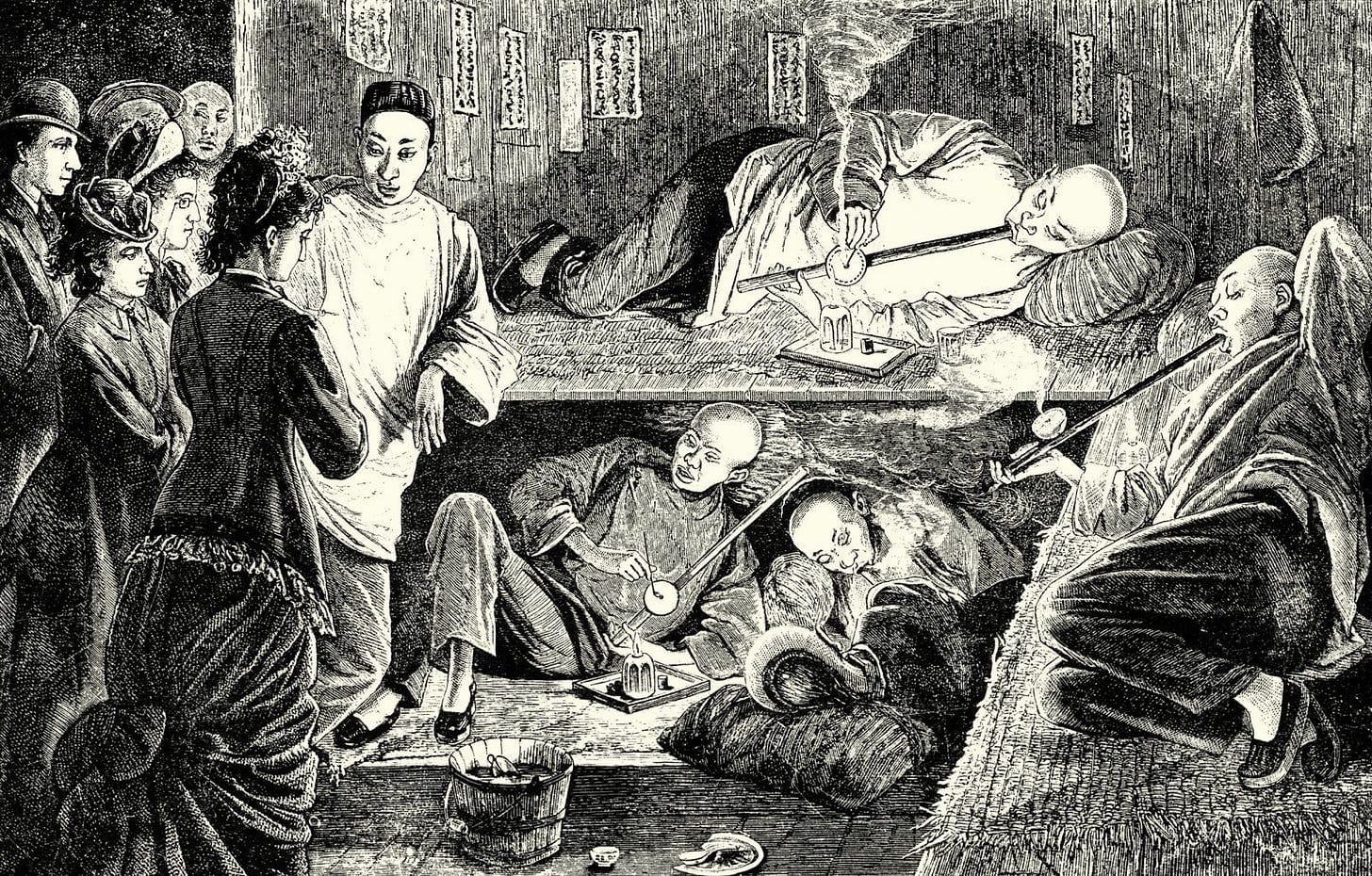

- The Century of Humiliation

- The national superiority

- Culture

The first one is a period between the start of the Opium Wars and the end of the WWII, where China essentially got humiliated and lost a lot of territory. Combined with the feeling of national pride, as Chinese culture is thousands of years old, it creates resilience and will to beat the US. Add to it the founding myth of China and you have the perfect combination.

Essentially it is a revenge.

Means

When it comes to means, the matter is even more complex. While the PLA (People’s Liberation Army, the Chinese Army) is huge in terms of number of soldiers and quite formidable when it comes to equipment (including nukes), it is realistically no match for the US military.

It has no fighting experience and its equipment is less advanced. While it is ranked 3rd in the global firepower index, we see how the second rank power is faring against Ukraine with NATO support. So while something like Taiwan invasion might be alive and well in Chinese minds, it is not a realistic thing to happen in the next couple of years. Additionally, a direct confrontation between the two is difficult, as any side that is losing significantly would just use nukes.

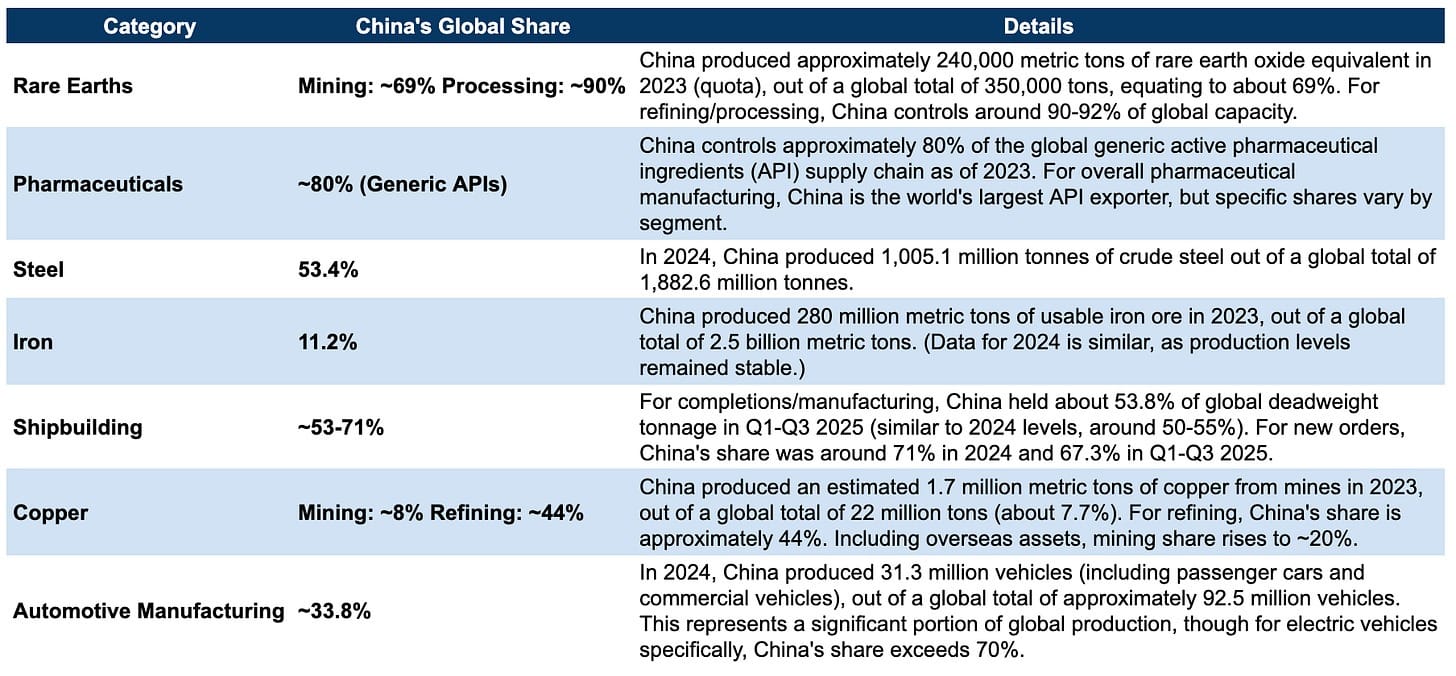

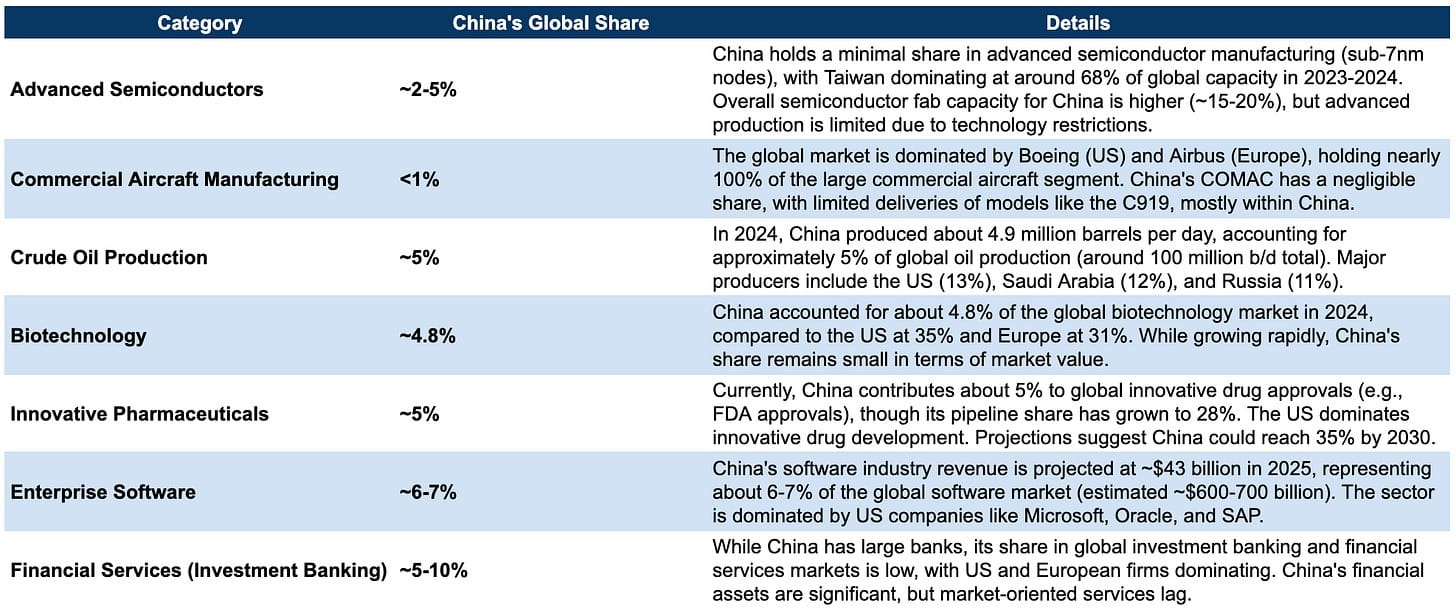

Chinese means lie strictly in its industrial might:

Some examples

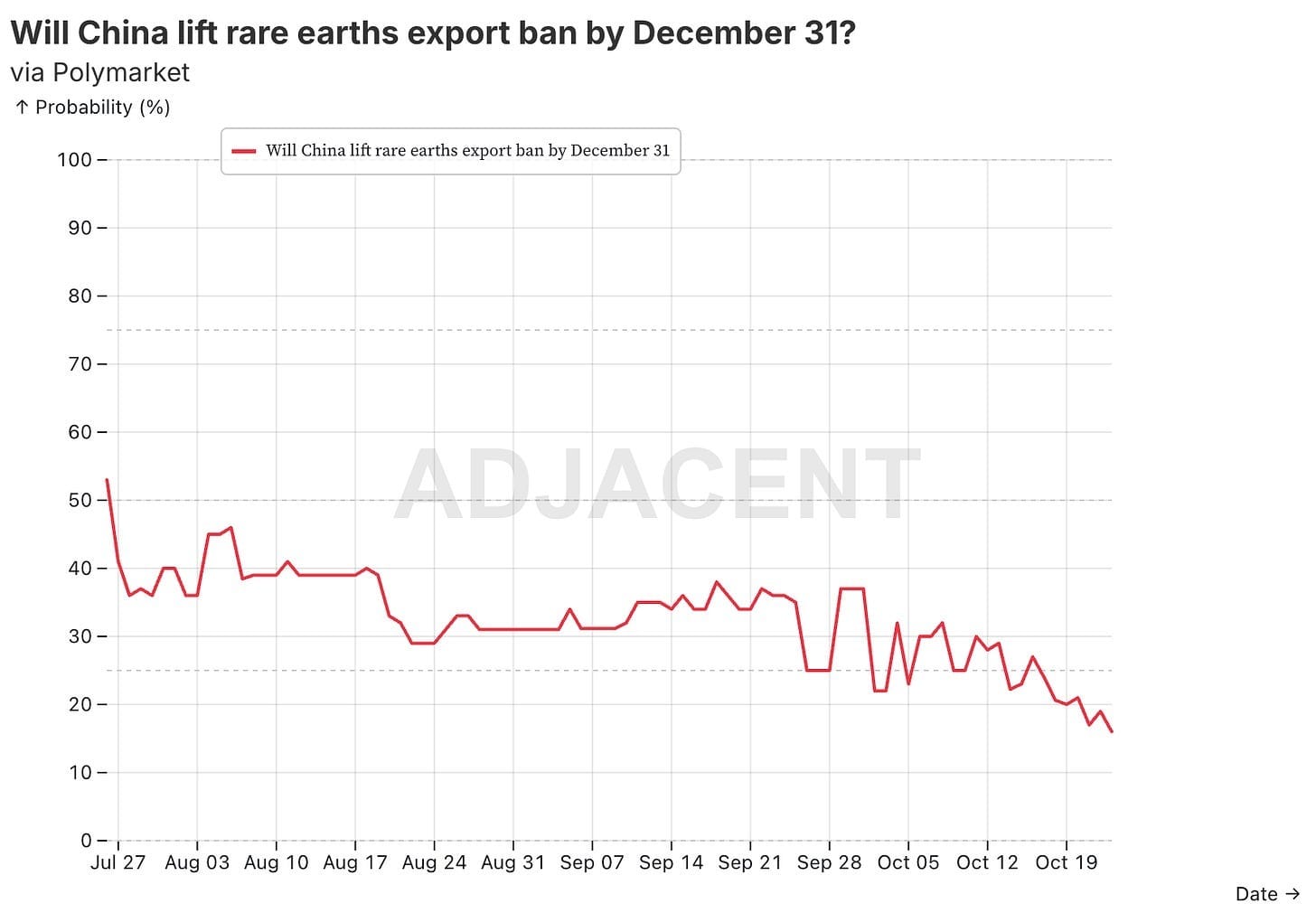

China is outright dominating many industries (like rare earth or pharmaceuticals) and is on the path to dominate others soon (like automotive). And it is ready to leverage it and try to destroy the western dominance. Like here for example:

The Supply Chain War

What is happening now is a supply chain war. China is leveraging its industrial might to disrupt the global supply chains and in effect destroy western economies. It is in fact quite similar to the Cold War between the US and USSR. Both global powers knew that a direct confrontation would be futile, so they competed economically, through espionage and proxy wars, through a network of global allies and by diplomacy. And it ended in the Soviet Union imploding economically, without a single American soldier in Moscow.

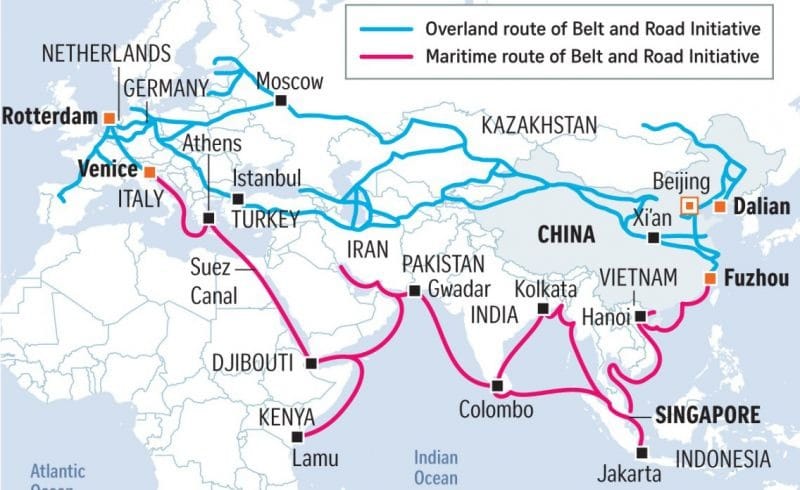

Now the same thing is happening. In fact it’s been happening for years! As I mentioned in the beginning, the first signs were visible between 2013 and 2015 with the announcements of the Belt and Road Initiative and Made in China 2025 initiative.

BRI

The aim of the BRI is to develop a network of dependent countries through infrastructure loans. And trust me, these loans are predatory. Having done some business in Africa, a lot of these big projects were being taken over by China when given country had issues with repaying the loan.

The effect was that China either built or even owns a critical infrastructure project in a country. It created leverage that China uses to control the “partners”. Even when the infra is not taken over by the Chinese, it anyway is primarily used to handle Chinese exports.

China has been building global demand for its good for 12 years now, along with vastly increased political influence, through infrastructure that handles it. A role that traditionally was reserved for the US through eg. IMF loans. It’s a direct challenge!

Made in China 2025

The second initiative was domestic - in 2015 China said it wants to graduate from being a manufacturing sweatshop to producing technologically advanced, high value add stuff. How did they aim to do that? Well, by stealing intellectual property and using its manufacturing experience and scale.

High value add manufacturing was also the domain of the US and core allies. From Apple to Samsung, from BMW to Ferrari to Tesla, from Bosch to Phillips, from Google to Amazon and so on.

To want to be on the forefront there meant to challenge the US, to win the market share from the global hegemon. Yet somehow, the US was oblivious to all of that, up until recently.

Anything Else?

Actually, yes. China is not acting alone, it is acting with Russia, Iran and North Korea. North Korea is a bit of an afterthought, a tool to scare South Korea and a source of manpower (as to Russia).

Iran was aiming to control the Middle East (ports, the Red Sea), but it has been neutralized for the time being. It is now mainly a source of oil for China.

Russia is access to Europe. Projects like Nord Stream and Nord Stream 2 were meant to make Europe fully dependent on Russian gas. The war in Ukraine was meant to end quickly with Europeans exchanging energy security for Ukraine. But it didn’t happen. Russia is also military expertise, oil, gas, other natural resources.

So we have the Ukraine war, essentially a proxy war between the US and China with Russia, where neither side can afford to lose. We had the Gaza war and adjacent, now over due to rare earth embargo as the US must focus on Ukraine - I will have the video on it later, but essentially with scarce resources and the job in the Middle East finished, the US needed to put everything it has into Ukraine (and others in the future, more below).

Is the US Finished?

No. Far from it! Remember, the last Cold War lasted almost 45 years. It takes a lot of time to topple a superpower. And the US, along with team west has still a lot of aces up their sleeves. Starting with the obvious:

Some counterexamples

As China has industries it dominates, it also has industries it lacks in severely. The west can leverage them to curb Chinese embargo.

Despite BRI, the west still controls major trade routes (Suez Canal, Panama Canal). And despite widespread barter among team east, disconnecting from the global financial system is still going to inflict a lot of pain on China (more than on others as every weapon in the Supply Chain War is a double edged sword).

And if things really go south, the US military will intervene. As we move ahead in this Supply Chain War, we will see more proxy wars. For some reason the US was unwilling to put boots on the ground, but it will change.

So while we have anything between 10 and 35 years till the war is over, judging by the last one and the ones before it, let’s look at some developments that should happen.

Predictions

Africa

This is something many sleep on right now, but Africa will be a major focal point in the next 10 years.

It is abundant in all kinds of resources - metals, minerals. And there are already moves being made there. Russians control majority of military juntas south of Sahara (which can move south and on the west Africa). The Chinese control a lot of mines there, eg. gold mines in Mali.

In the meantime, Europe continues to lose control over this part of Africa. It was a great mistake, for which both Europe and the US will need to pay eventually.

I expect to see proxy wars in Africa. They will largely be framed as revolutions, civil wars, etc. We will see both team east and team west support their preferred side, largely through mercenaries. And we will see business deals around resources.

Despite doing some business in Africa, I am still educating myself about the region so expect more articles in the future about this continent and its affairs. It’s a vast region to cover.

South America

Same can be said about South America. Although not as critical resource rich as Africa (but with plenty of eg. copper or oil), it has a land access to the US, posing either great threat or good opportunity, depending on which side controls it.

The US is already getting ready for military action in Venezuela (which is essentially a Chinese land now) and we might just see it this year. I’m still weighing on the timelines, but I will be a buyer of Yes in small quantities for the longer timelines while I research the issue. Gut feeling tells me it can start pretty shortly after the shutdown is over.

Another aspect of the South America focus is Argentina. It’s a point of contention now between China and the US. On the one hand it has a US aligned leader in Milei. On the other hand it is selling soybeans to China. And ultimately it now has the Treasury swap line saving its currency, probably with strings attached (no more sales to China?).

And lastly Brazil. Now aligned with China, It will be another point of contention once Venezuela and Argentina are more stable. Especially since it will also sell soybeans to China.

Taiwan and the Indo-Pacific

As the proxy wars around the world might heat up, I see less chance of a direct confrontation in Taiwan. The US is moving the chip production outside of the island, to the US. Internally, the party that is more aligned with China is gaining popularity. And it might just be that Taiwan will be slowly integrated into China, but no longer as a vital point in a bloody war, but as an afterthought, with no blood shed. I might be a buyer on the No side here if I see any spikes:

When it comes to Indo-Pacific, we might see more action around the Philippines, as well as a proxy war in the form of new Korean war, but I don’t think it will happen anytime soon.

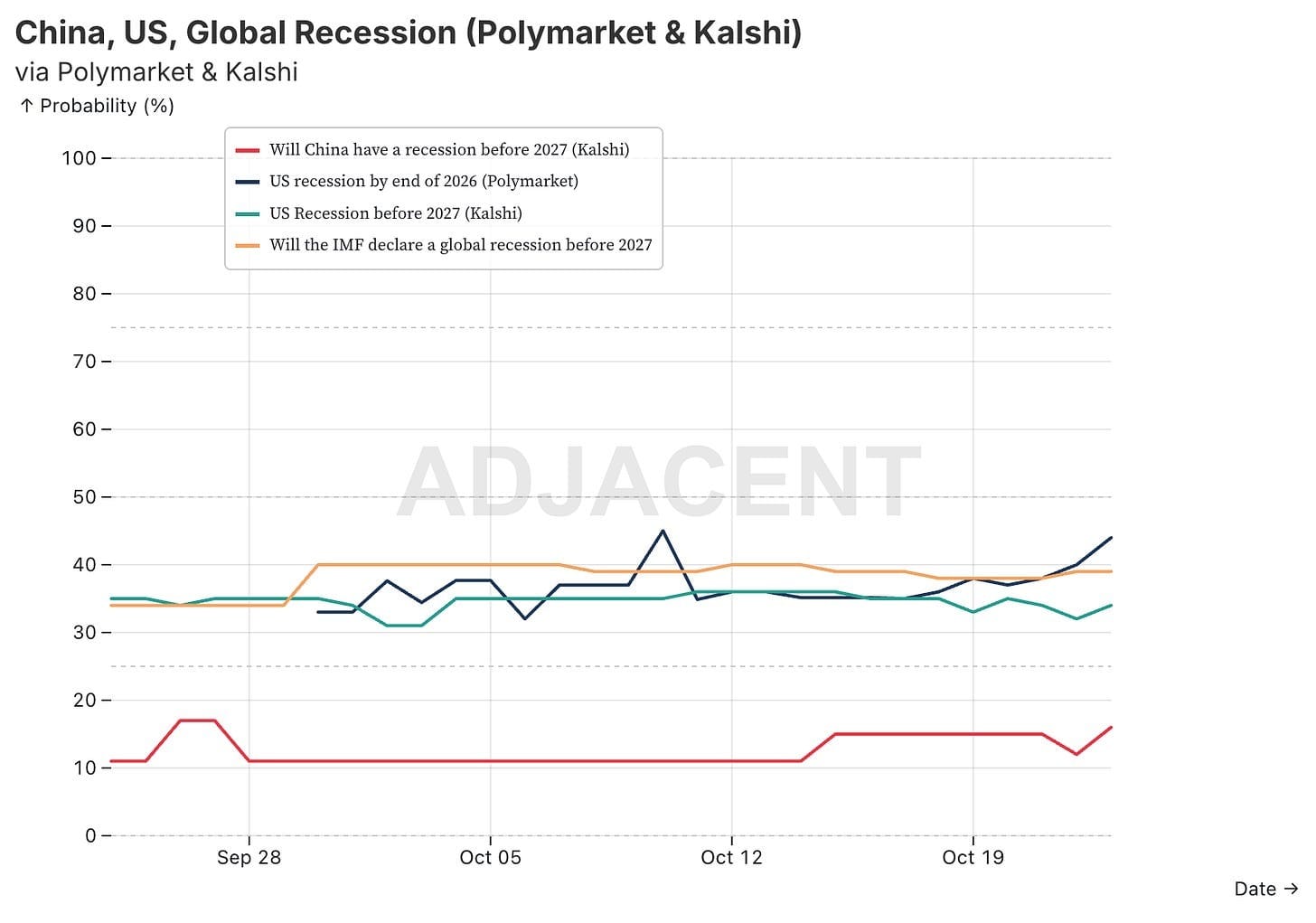

Inflation

The Fed is useless about inflation as the Supply Chain War is responsible for general scarcity. Now it prioritizes the labor market, trying to salvage at least one of its goals. Thus I see inflation being a constant problem in the next 5, even 10 years. It won’t be always visible in the data (as data is probably considered a national security issue since it is a Supply Chain war, ie. is often fake), but it will be felt by everyone, both team west and team east. Having that in mind, I might play Fed markets in the future with the updated framework.

Also about fake data, trades may not realize it, but they do feel it right:

Even if we have a recession, you won’t hear about it from official sources, neither US or China.

Other?

There are probably many other developments coming and I will expand on them in due time.

Prediction Markets

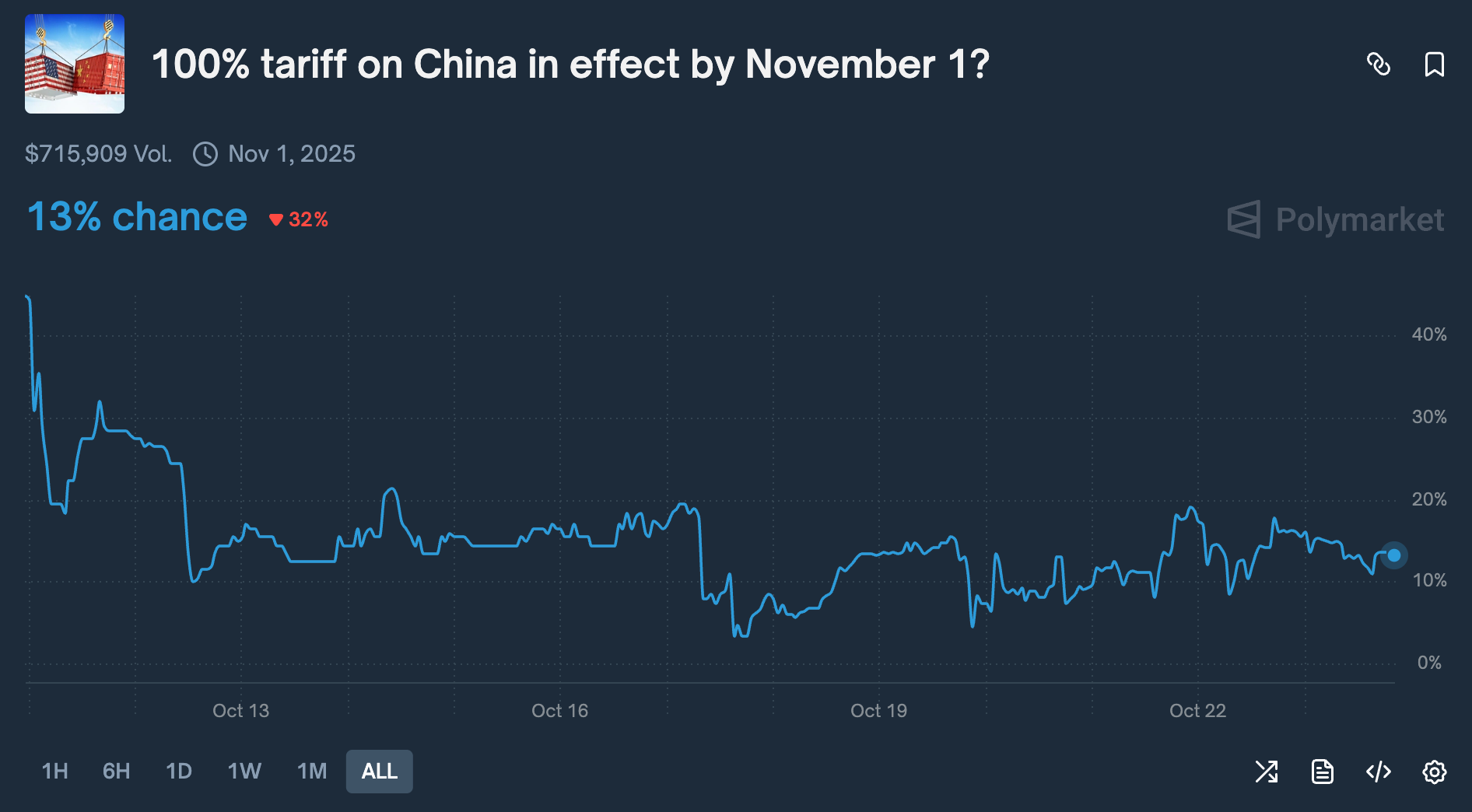

I also have other bets that tie well with this article. Outside of grander scale predictions, for the very short term I have bought Yes here:

I’m not sure why people believe in TACO so much, we had over 100% on China already. And with the rare earth embargo, I do think that China is not looking to settle soon. In fact it is escalating.

I wouldn’t call it a coin toss, but 25/75 odds seem more fair.

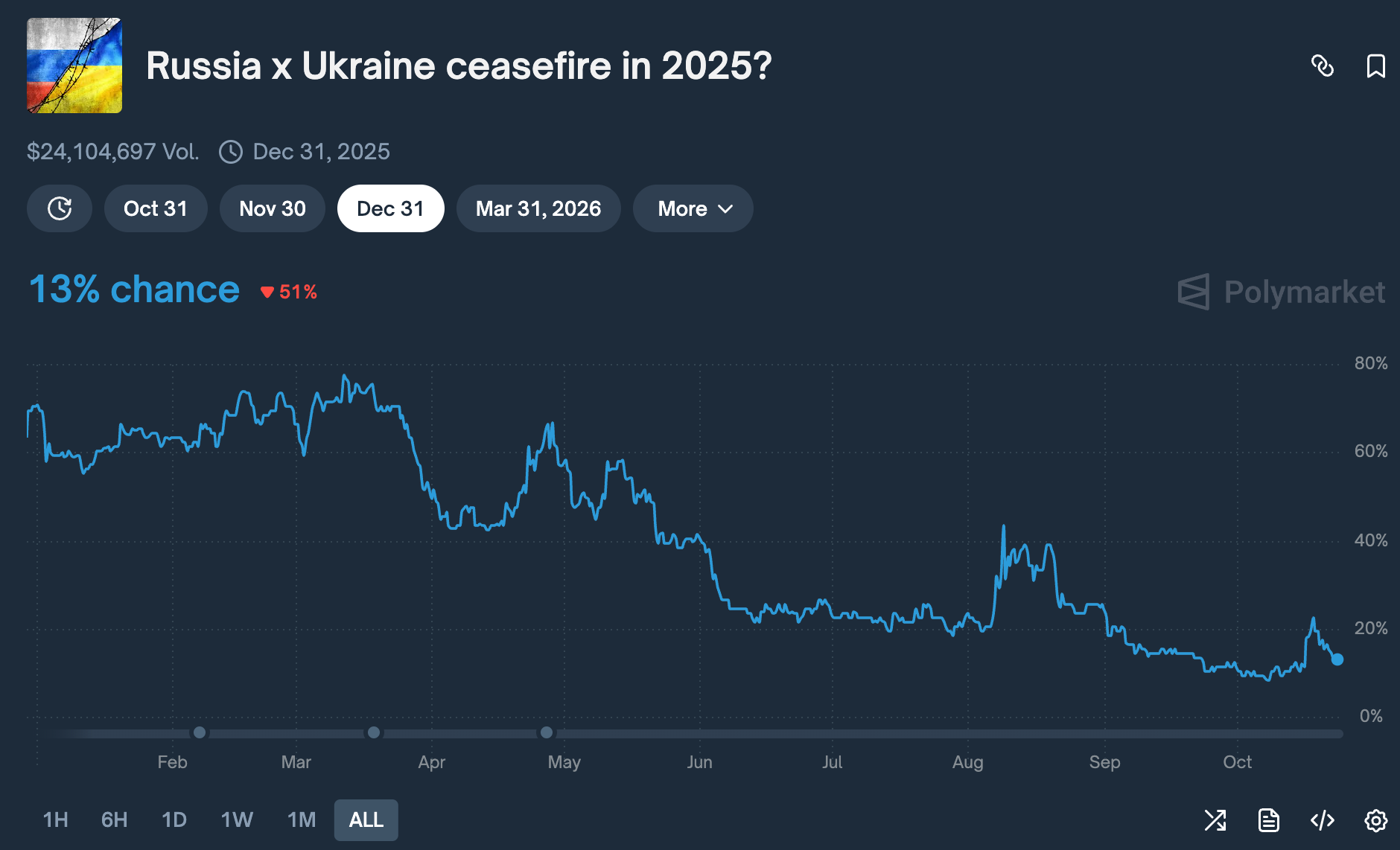

I also have a (very) small position on No here as my orders weren’t filled, but I do aim to increase it if the price swings back a bit. This war is only getting started, not finished (especially since in retaliation for the embargo, Nexperia was nationalized):

Lastly, the Ukraine war is still far from over and No at least till the end of year is pure value at almost any price:

Wrap up

While light on prediction markets, I do believe that having a proper long-term framework is essential for trading geopolitics. I hope this intro to the Supply Chain War will help you in trading markets and understanding different developments on the global stage.

As for my future endeavors, I will be now focused on Venezuela and Africa. I’m fully back in business now and I do see increased global volatility coming.

Stay strong and see you soon!