Check out our new US Political Future Index (UPFI), a comprehensive measure of anticipated Republican versus Democratic political control across major US electoral offices. Interested in learning more?

TL;DR:

- Trump and Xi meet tomorrow in Busan - first in-person talks since Trump's return to office, with markets highly sensitive to outcomes

- Trade deal optimism surging - 70% chance of US-China tariff agreement by end of October, 94% by November 10th

- Markets pricing in a rally - S&P odds for 7,000+ jumped from 40% to 85% in one week; Nasdaq-100 bullishness up to 84% of reaching record highs of 24,500

- Rare earths remain key sticking point - China's export ban still unresolved, but recent positive signals (soybean purchases, fentanyl cooperation) suggest thawing tensions

- Signs point to market rally - Both leaders face pressure to show progress; futures may rip overnight as talks begin

📈 Market Snapshots

US - China Trade

- Will Trump meet with Xi Jinping by October 31? (Polymarket)

- US x China tariff agreement by November 10? (Polymarket)

- Will Trump agree to a tariff agreement with China in October? (Polymarket)

- Will China lift rare earths export ban by December 31? (Polymarket)

- What will the U.S. tariff rate on China be on January 1, 2026? (Kalshi)

Stock Market

- S&P close price end of 2025? (Kalshi)

- Nasdaq-100 price end of 2025? (Kalshi)

- How high will the S&P get this year? (Kalshi)

Trump's Approval

- The President's RCP approval rating on Friday? (Kalshi)

- Will Trump's approval rating increase this week? (Kalshi)

🌎 Event Breakdown

Decoding market signals as Trump and Xi prepare for crucial trade negotiations: Tomorrow’s the big day. Trump and Xi are set to meet in Busan, South Korea. This is the first in-person meeting between the leaders since Trump’s return to office in January.

Talks will center upon tariffs and trade balances, rare earths, fentanyl trafficking, TikTok, and tech exports, specifically Nvidia chips.

Here are some of the top overnight headlines:

- Trump expects to lower fentanyl-linked tariffs on China

- Trump announced a trade breakthrough with South Korea, perhaps increasing leverage going into talks with Xi

- China has purchased 180,000 tons of US soybeans - the first major order in months - signaling progress and a potential easing in trade tensions

Over the last few weeks we’ve discussed the approaching trade war tipping point and the implications for markets. Now let’s tie it altogether.

Outcomes from tomorrow’s talks will unequivocally impact the stock market. This is abundantly clear from what transpired on Liberation Day in addition to Xi’s recent rare earths export ban and Trump’s 100% tariff threat response. Now the question is will markets puke or will they rally tomorrow?

US-China Trade

Prediction markets have become increasingly optimistic a deal will get done in the coming weeks.

There’s now a 70% chance (and climbing) that the US and China reach a tariff agreement before the end of the month.

It’s even more likely (94% chance) an agreement is reached by November 10th.

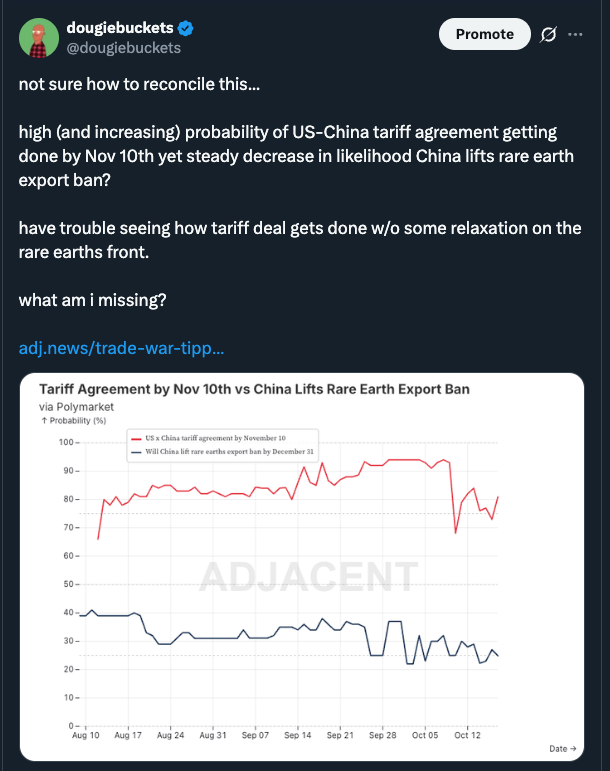

These are certainly positive signs for markets. However, a critical point of tension right now centers upon China’s rare earths export ban. Two weeks ago we had difficulty reconciling how a tariff agreement could get done without some relaxation on the rare earths export ban.

Well, it finally seems as though those odds are finally increasing.

These are all positive signs for markets, but one has to wonder if an agreement is reached what will the tariff rate ultimately be? Markets are still anticipating a tariff rate between 30% and 40% as they were two weeks ago.

That said, there has been a slight 4% uptick in the probability of rates coming in lower between 20%-30% (24%). In either scenario, prediction markets anticipate much lower than the 100% threat Trump made two and a half weeks ago.

Again, this is all seemingly good news for markets. Let’s drill into what prediction markets are saying on that front.

Will the Stock Market Puke or Rip?

Last week we did a deep dive into stock market forecasts and the bullish indicators present amidst historic economic and geopolitical uncertainty. Since then the bullishness has only continued.

In the last few days we’ve seen an increase in the likelihood of the S&P closing at record highs between 7,000-7,200 (27%) and 7,200-7,399 (19%).

Odds centered upon “How high will the S&P get this year” have also increased in recent days. Odds now for “7,000 or above” sit at 85% (up from 40% a week ago) while odds for “7,500 or above” are now at 24% (up from 4% a week ago). Those are big jumps for markets with decent volume (~$116K total).

The bullishness doesn’t stop there. The Nasdaq-100 is increasingly trending towards record highs above 24,500 (currently at 84%, up from 67% a week ago).

That’s a significant increase in bullishness from our writings a week ago which aligns with the softening of rhetoric between the world’s global superpowers.

Trump’s Approval Rating

The state of the economy always plays a significant role in politics and election outcomes.

Is there anything to be gleaned from markets concerning Trump’s approval rating when it comes to tomorrow’s trade talks and their potential impact on the stock market?

Trump’s current approval rating according to Real Clear Politics is 45.1%.

Over the last 24-48 hours it is looking more likely his approval rating will decrease to between 44.6%-45% (now up to 45% from 28% a week ago). At the same time, his odds of maintaining an approval rating between 45.1% and 45.5% have decreased to 47% from 53% just two days ago).

It is ultimately looking increasingly likely that Trump’s approval rating will decrease this week.

What should we make of this?

There’s optimism around a US-China trade deal getting done that will reduce economic and geopolitical uncertainty and in turn help propel markets. In spite of that, Trump’s approval rating is likely to trend downwards.

This divergence is interesting. These markets are not directly correlated of course, but it leads one to believe Trump’s domestic policy efforts may currently be dragging down his approval in spite of optimism on the global trade front.

So, back to our original question, will the market rip or puke tomorrow?

Signs Point to Stock Market Rally

Tomorrow is an important day for traders and investors. We will learn more about the future of the US-China trade relationship which will have far reaching impacts on the global economy.

As of now, all signs point to a thawing in tensions as means to pragmatically strike a deal. Both leaders recognize the stakes are incredibly high. It is important for them to return to their respective countries and report back to their citizens that progress is being made.

It is not the time for gamesmanship or last ditch efforts to increase leverage. There is pressure on both Trump and Xi to show the world steps forward are being taken. Each leader faces far more downside if the current trade impasse persists.

Markets seem to be sniffing this out in the short-term. Bullish sentiment has ramped up over the last few days as the Trump-Xi meeting approaches, intimating the market too believes strides will be made during tomorrow’s talks.

At this point we’re in “wait and see” mode, but don’t be shocked if futures rip overnight as the talks kick off at 11a Korea Standard Time.

Related markets & forecasts:

- Will Trump make a new free trade agreement with China? (Kalshi)

- Will the S&P finish positive this year? (Kalshi)

- How low will the S&P get this year? (Kalshi)

- Which countries will the US enact a trade deal with this year?

- Which countries will impose tariffs on the US this year?

- Will Trump launch tariffs on copper?

- Trump approval rating on December 31? (Polymarket)

- The President's RCP approval rating on Jan 1, 2026? (Kalshi)

❓Questions we asked

Follow the Adjacent community on Metaculus here!

- Who will Trump nominate as next Fed Chair?

- What will be the largest source of global primary energy consumption in 2030?

- Will the yield on 10-year U.S. Treasury notes exceed 5% for at least one month in 2025?

- U.S. real GDP growth in 2025?

- Will China and the EU Reach a Trade or Tariff Agreement in 2025?

Follow us on X @AdjacentNews for real-time market takes. Explore adj.news for the full scoop, or tap our API to crunch the data yourself.